Dollar Forecast to Fall in April as Seasonal Trends Take Hold

- Research shows USD usually weakens in April

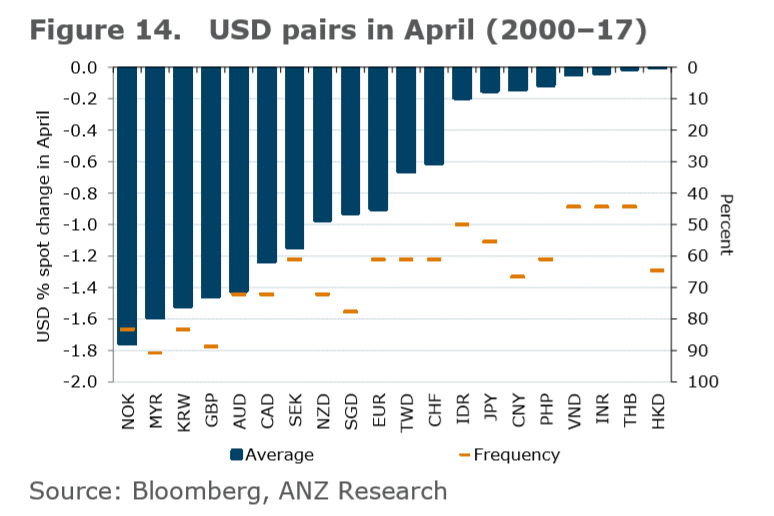

- Biggest loses against GBP, NOK, AUD, CAD, KRW and MYR

- GBP/USD could rise above 1.44 if this April is the same

© moonrise, Adobe Stock

'April is the cruelest month' wrote the poet TS Elliot, and what was true for him also seems to be true for the US Dollar, at least according to research from ANZ Bank.

The fourth month of the year is the worst month for the Dollar, which has a strong habit of weakening in April, mostly versus the Pound, the Norwegian Krone, the Australian Dollar and the Canadian Dollar.

Research conducted covering the last 18 years shows GBP/USD rose in 16 out of the last 18 Aprils, USD/NOK fell on 15, AUD/USD rose on 13 and USD/CAD fell on the same number (see chart below).

The biggest moves against USD in April were made by NOK (see chart below).

"The best returns, in terms of percentage spot moves, lie in going short USD against NOK, MYR, GBP, AUD, KRW and CAD (Figure 14)," say ANZ analysts Khoon Goh and Rini Sen.

In contrast to the Dollar's recurring weakness in April, the Pound has a marked propensity to strengthen, according to similar research from Bank of America Merril Lynch (BOFAML), who forecast GBP/USD reaching 1.4445 on the back of seasonalities.

"April seasonality is approaching again for GBP, which tends to rally no matter what the political/macro backdrop," says Kamal Sharma, FX Strategist with BOFAML in London.

The Pound seems to outperform regardless of the fundamental backdrop and happened even when there was a financial crisis, general election, and Brexit referendum.

The explanation appears to have something to do with the high proportion of multi-nationals in the UK's FTSE 100 and April's location right after the end of the tax year.

Many companies wait until after the end of the financial year to repatriate profits and dividends from foreign subsidiaries so as not to distort earnings and because it is only after the end of the year that they actually have a clear idea of how much they have.

"A combination of the end/start of the UK tax year and a heavy month of dividend payments by UK corporates are factors which we think are at play driving GBP strength during April," says Sharma.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.