Dollar Advances Against G10 Rivals As Traders Bet On Trump Tax Plan Approval

The US Dollar rose Friday after US lawmakers approved a multi-trillion Dollar budget which gives Republicans the opportunity to rewrite the tax code, without a single Democrat vote.

President Donald Trump called it, "the first step towards massive tax cuts," whilst Democrats have labelled it "Robin Hood in reverse," due to claims it favours higher earners over the middle and lower income brackets.

The impact on FX has been considerable with the Dollar index rising to highs of 93.44 on Friday morning and most other Dollar pairs gaining throughout the session.

The bill's passing also drove a rise in US Treasury yields, which are key drivers of the Dollar, prompting the 10-year yield to edge higher to 2.3680%."

"The greenback has held ground thanks to optimism about a Trump tax reform," says Swissquote's Market Analyst Arnaud Masset. "This is not a done deal, but signs are that he will keep this campaign promise."

Boris Schlossberg, a Director at BK Asset Managment, is a little more cautious on the significance of the budget bill.

"Investor enthusiasm may be premature as actual tax reform could turn out to be an agonizingly frustrating process," he says.

Schlossberg's views are backed up by a detailed analysis of the proposed reforms by Bank of America Merril Lynch's (BofAML) Global Economist Ethan S Harris, who says the tax reforms will have to be slimmed down considerably to have any hope of passing into law.

"History teaches us that tax reform is tough and time-consuming," Harris writes. "In their current incoherent state, the proposals still leave a lot of areas of contention unanswered including, tough questions around the deficit, income distribution, state distribution or the myriad of details that go into a complete bill."

Harris says that to have any chance of becoming law the tax cuts and reforms will have to be slimmed down a lot. One major issue lawmakers may have with passing the bill is its impact on the deficit because the Republican party want the cuts to be "revenue neutral".

Repatriated Foreign Earnings - Impact on FX

Whilst tax cuts might increase growth and push up interest rate expectations, supporting the Dollar, the main impact on FX will probably come from a different source.

Repatriations of foreign earnings by corporates are expected to come about as part of a wider reform of the tax code - perhaps in the form of a tax holiday on overseas earnings, an amnesty or a lower special corporate rate.

"As markets look for overseas profit repatriations from US tax reform, we are watchful for a potentially sizable FX impact," says BAML Strategist, John Shin.

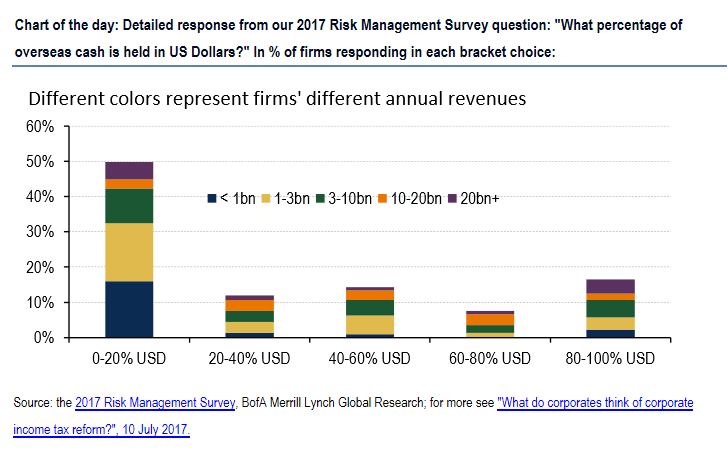

According to BAML's 2017 Risk Managment Survey, a much larger portion of overseas earnings could be denominated in non-Dollar currencies than previously thought, suggesting the repatriation effect on the Dollar could be much greater than previously anticipated.

"50% of the respondents reported that their overseas cash was 0-20% in USD," says Shin, before estimating that about 40% of the overseas assets held by US companies are denominated in foreign currencies.

In current Dollar terms, he calculates companies may have between $1 trillion and $2.5 trillion of assets held overseas, while a repatriation tax-holiday could result in between $250 billion and $400 billion flowing back to the US. That may be only a small proportion of the total but it is still a large enough number to have a sizeable impact on foreign exchange markets.

"Ultimately, we do think that a base case for a repatriation act would be a positive impact for the USD on net," concludes Shin.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.