Pound vs. Dollar: A Shorting Opportunity

Retail trading instructor Hao Sun tells us he sees opportunity in betting on further falls in the GBP/USD exchange rate.

The GBP/USD might still - technically speaking - be in a medium-term uptrend but further gains are likely near-term we are told.

The call comes as GBP/USD is seen pulling back from September highs above 1.36 which have taken it back to the cusp of 1.32.

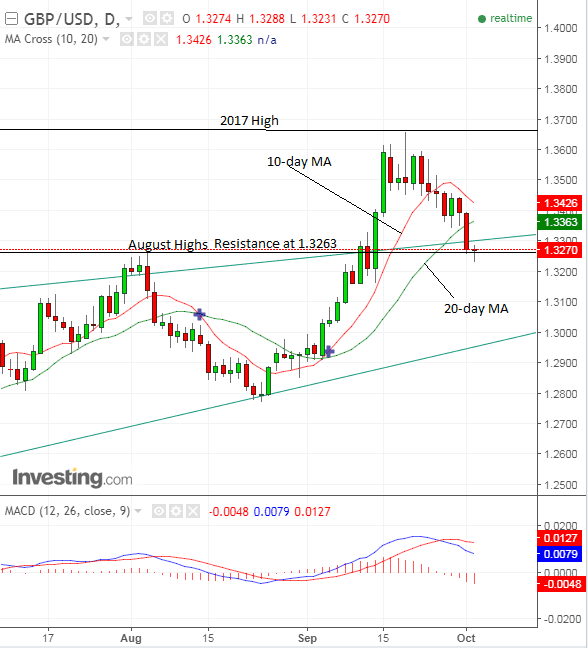

The exchange rate, "seems like it has pulled back a little bit too far, because the price has gone beyond this 10 and 20 moving average buy zone. Which tells me a much further pull-back is due," says Trade With Precision's, Trading Instructor, Hao Sun.

Normally prices rotate inside a 'buy zone' between the 10 and 20 moving averages, resuming their uptrend, however, the pull-back in GBP/USD has pierced below these levels, signaling the decline could be more forceful than analysts had previously expected, and could have further to fall.

Another sign of weakness, notes Sun, is that this is the third week in the row that the pair has fallen.

Assuming GBP/USD ends the week down, then that in itself is a bearish indicator as normally the exchange will not weaken three weeks running in the midst of an uptrend.

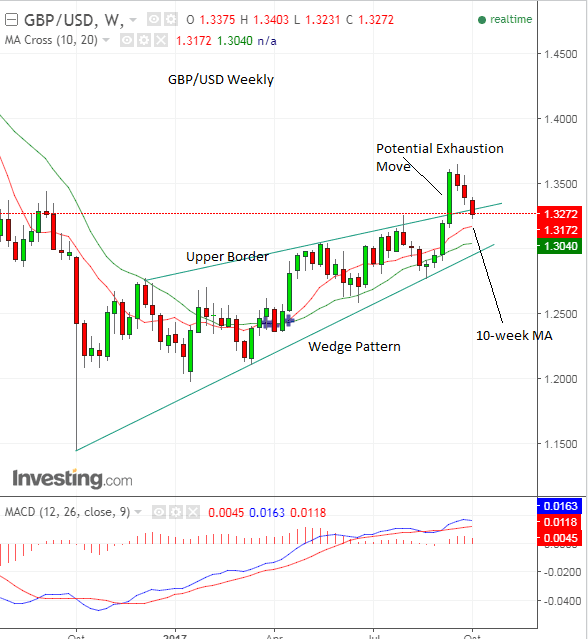

The pair broke out above the upper border of as rising wedge pattern clearly seen on the weekly chart, and this overshoot csan signal exhaustion of the uptrend.

If the pair closes back below the upper border line it will add weight of evidence to the argument the uptrend may be exhausted and augur lower prices.

On the lower timerframes such as the four hour chart the pair is in an established downtrend.

All the moving averages are in line and Hao Sun says he is "stalking a trade", by which he means he is waiting for the pair to recover a little first before contemplating shorting it - which means selling the Pound and buying the Dollar.

One possible level where the pair could be ripe to short, might be at support turned resistance at around 1.3350.

This level is also between the 50.0% and 61.8% Fibonacci retracement levels, which further suggests the exchange rate could be vulnerable to a bearish reversal there.

Fibonacci levels are based on a mathematical principle which appears to provide a framework for analysing financial markets; Fibonacci retracements often correspond with inflection points on charts.

The bearish target for any shorting trades is ultimately at the psychologically significant 1.3000 level - although anywhere between1.3000 and 1.3100 could be a possible target, as these are at around the level of the 10 week moving average, which is expected to provide support.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Analyst Joel Kruger at LMAX Exchange offers a different perspective in a note to clients.

Kruger observes the present market level is at the same level as the August highs at 1.3260, and this could be a barrier to further downside.

"The market has traded back down into some previous resistance turned support from August as it unwinds from stretched readings that propelled it to fresh 2017 highs in the 1.3600s back in September," says Kruger, who appear bullish over the medium-term.

"Overall, the outlook is now highly constructive on a medium-term basis, which means any additional setbacks are viewed as corrective as the market looks to put in the next higher low ahead of a bullish continuation," adds the analyst.

LMAX Exchange accept that dips back to the 1.3000 level as possible, in line with TWP Sun's view, however they see that as a "formidable support zone and the market is not expected to trade below the psychological barrier for any meaningful period of time."

Kruger suggests fundamental reasons for the weakness, which they think stems from a combination of weak UK Manufacturing activity data, a loss of confidence in Prime Minister May, a less hawkish Bank of England Governor and a revitalised Dollar which continues to benefit from speculation that the Federal Reserve will increase rates before the end of the year.

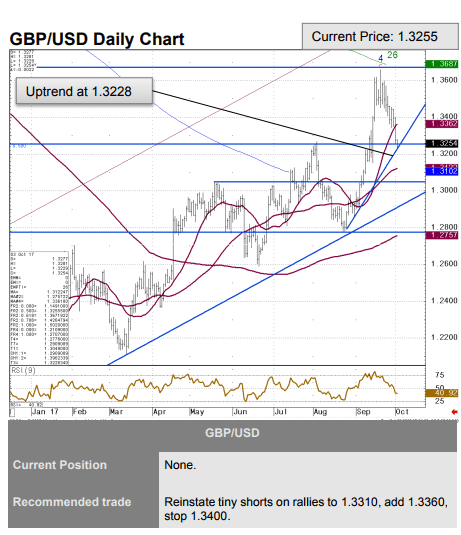

Commerzbank's, Technical Analyst, Karen Jones meanwhile sees the pair looking increasingly bearish with a view more in line with that of TWP's Sun:

Jones notes support and resistance at the current market lows from the August high at 1.3267.

If the pair breaks below the 1.3228 uptrend (line), that would we the tipping point for Jones, and "enough to negate upside efforts and signal another leg lower to the 1.2888 2016-2017 uptrend," says the Commerzbank analyst.