Pound Forecast to Continue Rallying v US Dollar Over Coming Week

The Pound to Dollar exchange rate (GBP/USD) remains in a short-term uptrend which we expect to continue.

To be fair, much of the momentum in this pair is coming from the Dollar side of the story, the US currency remains the poor-boy of the G10 currency complex in 2017 and the fundamental story will largely rest on how much further weakness the currency will suffer.

"The USD continues to grind lower ahead of the Fed meeting this week. The market is now calling the Fed’s bluff over its ability to deliver additional rate hikes in the medium-term," notes Mazen Issa, an analyst with TD Securities.

Our technical studies suggest further gains ahead for GBP/USD, although there is tough resistance right above the current market level in the form of the R1 monthly pivot at 1.13175 which needs to be overcome first.

Monthly pivots are levels calculated using the previous month's data and are used by traders to assess the trend and often to trade counter to the trend, they therefore present an obstacle.

Assuming R1 can be breached, the pair will probably extend higher.

A move above the 1.3200 level would confirm such an extension, with a target thereafter at 1.3300.

Momentum is not particularly bullish as recorded by MACD in the lower pane.

For example, MACD is currently lower than it was in late May but the market is higher, showing a growing divergence between the market and its momentum, however, this loss of momentum alone is not enough to dissuade us from our bullish bias.

1.2880 is a key level below the market where a firm floor of support is situated which would probably hold up the exchange rate if it were to fall to there.

1.2880 is where both the 50-day moving average and the monthly pivot is situated, both of which alone are tough obstacles to break, but combined provide a formidable floor for the exchange rate.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data Ahead for the Pound

GDP is expected to continue trundle along at sub-par levels around the 1.5-2.0% mark which we have grown accustomed to in 2017.

The first set of estimates for growth in the second quarter are released on Wednesday July 26 at 9.30 BST, and are likely to be the most significant release for the Pound in the week ahead.

They are currently expected to show a slightly slower 1.7% rise in GDP in Q2 compared to a 2.0% rise at the same time last year (in Q2 in 2016).

Such a result will pull growth down to the lower boundary of the current GDP growth rate range.

Quarter-on-quarter, growth in Q2 is likely to be 0.3% higher than it was in Q1, when it was only 0.2%.

The other release of note is Mortgage Approvals in June, from the British Banking Association (BBA).

These are also out at 9.30 on Wednesday July 23.

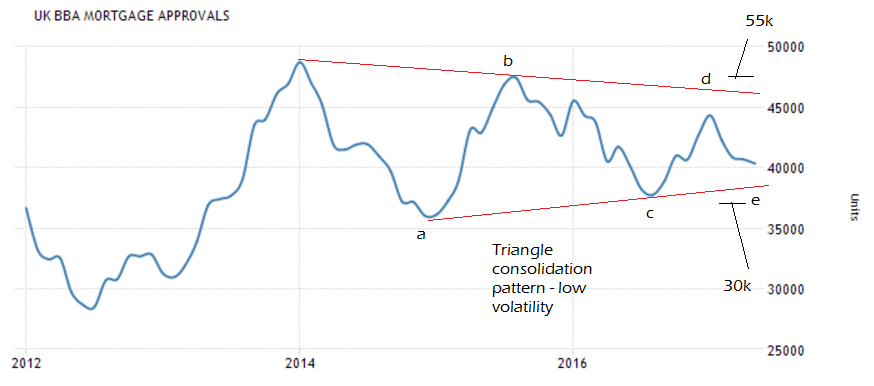

Mortgage approvals have been oscillating in a subdued range for years since the great recession as illustrated in the graph below:

They have, however, formed an interesting triangle pattern over the last few years which provides clues of what might happen next.

Triangles almost always precede periods of high volatility, and although we can’t tell which way the volatility will extend, it is highly probable there will be either a large swift spike higher or lower in the data.

The triangle has probably almost finished as it has formed 5 component waves - a,b,c,d,e - which is the minimum number to prove completion.

For confirmation, we would be looking for a move above 47,500 in an upside break; or below 37,000 in a downside break.

Using the height of the triangle at its widest as a guide we forecast a post-break volatile spike of about 8,000 -12,000 approvals higher or lower, so assuming the previously mentioned levels are breached, the upside target is 55k level and the downside 30k.

Given housing is such a key leading indicator for the economy this may be a key early warning for the general health of the economy going forward and thus the Pound.

A spike lower in approvals would probably drag down Sterling and vice versa for a spike higher.

Data, Events for the Dollar

The main event in the week ahead is the meeting of US Federal Reserve on Wednesday, July 23 at 19.00 BST.

They are not currently expected to increase rates at the meeting, however, the they will release a statement outlining their current stance.

Recent US data has been poorer-than-expected, leading to concerns about whether the Fed really will raise interest rates ‘one more time’ this year as they are currently expected to.

“U.S. policymakers are still talking about raising interest rates one more time this year, but nearly every piece of U.S. data released this past week casts doubt on the need for additional tightening,” said Forex guru Kathy Lien of BK Asset Management.

Another key release for the Dollar is the first estimate of Q2 GDP, out at 13.30 on Friday, July 28.

The market is pricing in a 2.5% quarterly year-on-year rate and 2.6% quarter-on-quarter rate.

“A print at least in the mid-2% range would provide some relief that US growth has returned to an above-trend pace after a disappointing Q1. But a pace closer to 2% would likely be taken negatively by markets, as weaker than expected growth amid low inflation can be expected to lower the Fed's conviction in its policy rate path,” said Canadian investment bank TD Securities.

The Employment Cost Index is also out in the coming week and is a key gauge of earnings and therefore potential inflationary pressures, and Fed policy.

The Index is scheduled for release at 13.30 on Friday, July 28.

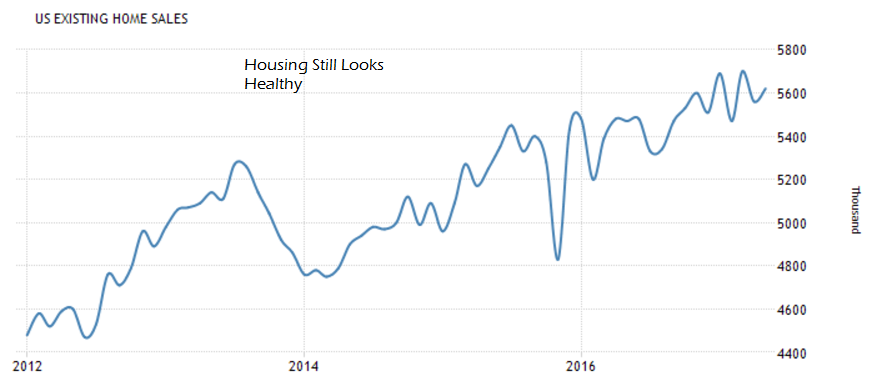

There is a lot of housing data out although there are no signs that its long-term upward trend in growth will slow, as illustrated on the chart below:

Other key data includes PMIs, durable goods orders, the final reading of Michigan consumer sentiment and consumer confidence; advance estimates of goods trade balance and wholesale inventories; Chicago Fed national activity index, Richmond Fed manufacturing index, and Kansas Fed manufacturing index.