GBP/USD Rate: Forecast For the Next Five Days

The Pound to Dollar rate looks like it is poised for a move higher again as US data is expected to continue its trend of deteriorating in the week ahead.

GBP/USD pulled back from the May highs and reached a trendline which has provided underpinning support.

During the pull-back it formed a three wave a-b-c correction, the terminal c-wave of which ended at the trendline.

The move, though steep is still only, technically, corrective, which means it could easily resume its ascent and return to the 1.30 summits again.

The pair has bounced, but not sufficiently yet to suggest a resumption of the previous uptrend.

Ideally, we would want to see a clear break above the 50-day for confirmation of more upside.

Such a move would have to move above the 1.2875 level to gain confirmation, with a target at 1.3000.

A break clearly below the trendline, the c-wave lows and the 200-day MA, situated 1.2569, confirmed by a move below 1.2500 would confirm a continuation lower to a target at 1.2400.

Data and Events for the US Dollar

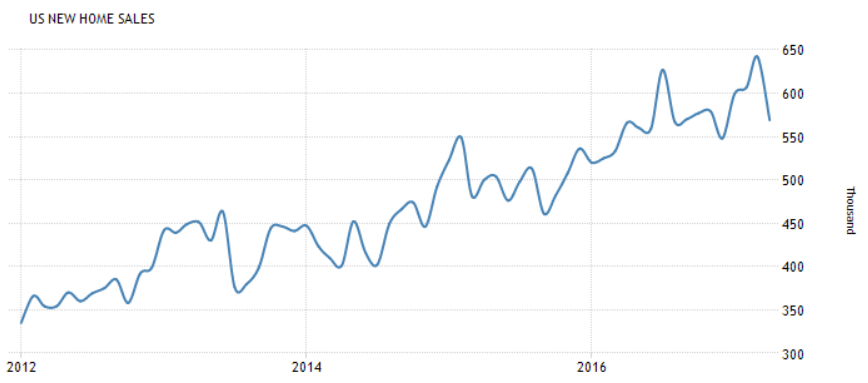

Housing data is important because, according to received investment wisdom ‘Housing Leads the Economy’.

It is all the more worrying, therefore, that recent housing data has been decidedly on the weak side.

It also means this week’s data from the National Association of Realtors will be closely watched when they release Existing Home Sales for May, on Wednesday at 15.00 BST, amid forecasts of a decline of 0.7% to 5.55 million, following a slump of 2.3% a month earlier.

On Friday, New Home Sales for May is released at 15.00. The data is expected to show an increase of 5.5% to 600,000, following a drop of 11.4% in April.

The other highlight for Dollar-traders is Federal Reserve speakers, several of whom will be making appearances in the week ahead and commenting on the outlook for future monetary policy.

Monday sees New York Fed President William Dudley and Chicago Fed President Charles Evans make public appearances.

On Tuesday, Fed Vice Chair Stanley Fischer, Boston Fed President Eric Rosengren and Dallas Fed President Rob Kaplan are scheduled to deliver comments.

Fed Governor Jay Powell is due to speak before the Senate Banking Committee on Thursday.

Finally, Friday sees St. Louis Fed President James Bullard, Cleveland Fed President Loretta Mester and Fed Governor Powell make public remarks.

Despite the Fed's relatively hawkish message at the last Fed meeting when Chair Janet Yellen highlighted the strong labour market, investors remained doubtful over the Fed's ability to raise rates as much as it would like before the end of the year due to a recent run of disappointing U.S. economic data.

Futures traders are pricing in less than a 15% chance of a hike at the Fed's September meeting according to Fed’s Funds Futures, whilst odds of more expected December increase was seen at about 35%.

The Week Ahead for the Pound: Key Events

There are no major data releases due so the main event of the week will be the start of Brexit negotiations on Monday, June 19.

Britain's Brexit minister David Davis and the European Union's chief negotiator Michel Barnier will start negotiating Britain's departure on Monday, starting a two-year divorce process due to end by March 2019.

Major issues that will be discussed, include, the size of a "divorce" bill, how the U.K. will trade with the EU once it leaves, and the status of EU nationals and Britons living in the EU.

Markets now assume British Prime Minister Theresa May's failure to secure her party a majority will lead to a softening of the government's Brexit stance with a greater priority being placed on securing a closer trading relationship with the EU.

Fighting for her political survival, May has been trying to strike a deal with the Democratic Unionist Party, but there is still little clarity on the status of the relationship, although currently it appears to be along the lines of a loose coalition.

Following Thursday's surprisingly hawkish MPC debate, where 3 members voted for a 25bps hike in rates and where the minutes took a hawkish tone, "markets will be on the lookout for any comments from BoE officials. Note that Governor Carney’s postponed Mansion House speech will be rescheduled," says Victoria Clarke at Investec.

The week will likely be dominated by politics once again, particularly so given that the economic data calendar is very quiet.

The domestic focus will be on whether the Conservative Party reaches a final deal with the DUP over a confidence and supply agreement, which would provide the government with a narrow majority in the House of Commons.

Reports this week have suggested that a deal between the two parties was close, but that due to the tragic fire at Grenfell Tower a conclusion would be delayed until next week.

Also due next week is the Queen’s Speech which has been rescheduled to Wednesday.