Two Models Say Sterling Is Not Worth It

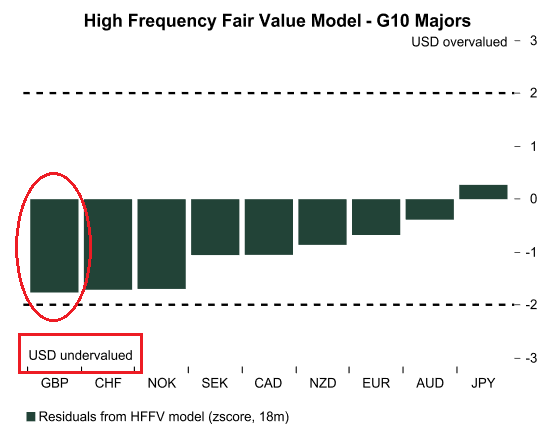

GBP/USD is one of the most overvalued currencies in the G10, according to research citing two models who says as much by Canadian lender TD Securities.

Their conclusions assume a devaluation is on the cards for the Pound, which will probably fall to a level more in-line with its fair-value estimate.

Using their proprietary High Frequency Fair Value model (HFFV) which incorporates a host of fundamental economic criteria including interest rate differentials, estimate the ‘fair-value’ TD show that GBP/USD is close to two standard deviations away from estimates.

“GBP is the most overvalued and running close to 2sd from our estimates. Positioning data shows outstanding shorts in GBP but it is clear the market may have already priced in much of the good news in GBP. We think the road ahead will be challenging, especially with the BoE’s hands tied with high inflation and a FEER-based model suggesting it remains close to 10% overvalued,” said Richard Kerry TD’s head of global strategy.

The reason TD’s Kerry says the BOE’s “hands are tied,” is because the weak pound has caused inflation to rise by increasing the cost of imports.

Now, rising inflation would normally lead the Bank of England BOE to raise interest rates which would be a good thing for the Pound.

However, because this inflation is more to do with currency weakness than increased growth the BOE are likely to be reluctant to increase rates.

Raising of interest rates when growth is sluggish can be “self-defeating” in the words of former BOE governor Mervyn King, as it also puts up the cost of borrowing.

Therefore, the outlook from a central bank/monetary policy perspective is bleak for Sterling, increasing the argument for a devaluation.

The FEER model, mentioned above by Kerry, is another way of estimating the ‘fair-value’ of the exchange rate, which according to its inventor, John Williamson of the Peterson Institute in Washington, is defined as, “the rate consistent with a steady economy at full employment and a sustainable current-account balance," according to a definition in the Economist.

According to TD’s Kerry, this too is showing GBP overvalued – by more than 10%, which again suggests the Pound will weaken to return to a level more in line with its fair-value.