Pound to Dollar Rate Falls 1.4% on Red Sweep

- Written by: Gary Howes

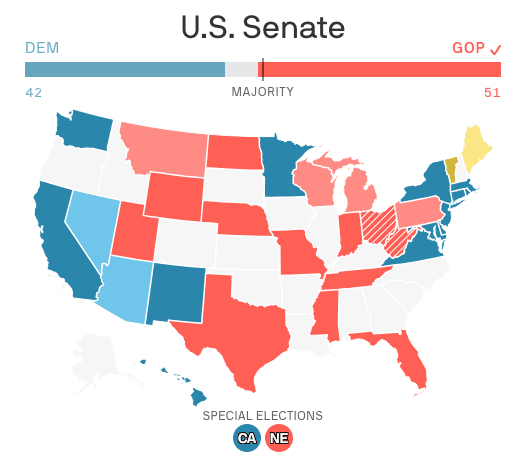

Above: The Republicans have the Senate

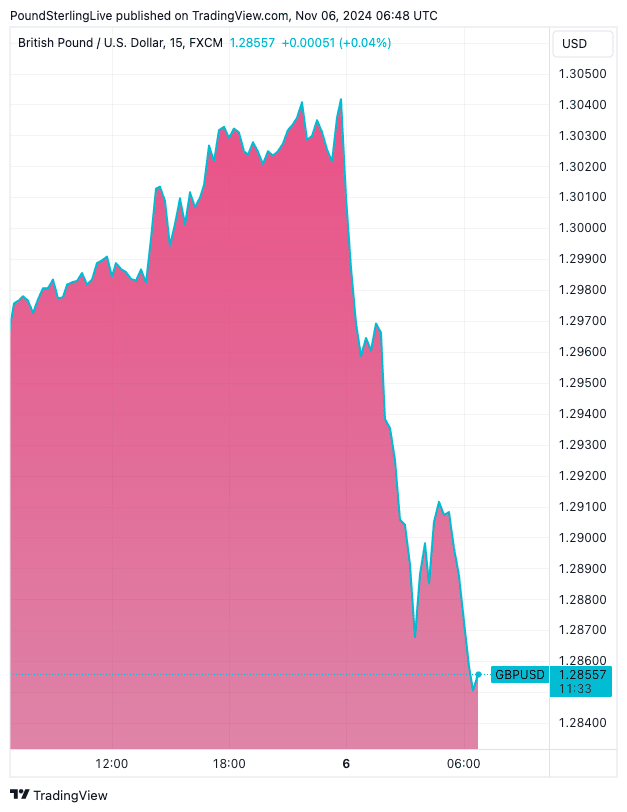

Pound Sterling fell by more than a per cent against the Dollar and could be set for further losses after Donald Trump stormed his way into the White House.

When the all-important key swing state of Pennsylvania was called for Donald Trump, his return to the White House was assured as Kamala Harris had to win this state to even have a chance of winning.

Trump's success comes as his Republican Party takes control of the Senate from the Democrats. They are expected to retain the House of Representatives easily.

This means the 'red sweep' outcome, whereby the red team controls two of the USA's three pillars of state, is fulfilled, delivering the most USD-bullish outcome for financial markets.

Trump's pro-tariff and low-tax agenda will now be unfettered by opposition.

Stocks are rising, cryptocurrencies are up, oil is down and the dollar has risen right across the spectrum. The Pound to Dollar exchange rate fell to 1.2850.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Trump's agenda of tariffs and tax cuts is inflationary, which will lower the tempo of future interest rate cuts at the Federal Reserve, which is bullish for the Dollar.

"The US dollar is trading higher against almost every currency in the world overnight on the news of the big outperformance in the polls from Donald Trump. Not only are markets positioning themselves for a comfortable Trump victory in the electoral college, but the prospect of a Republican-controlled Congress, which is key in determining the ability of the incoming president to force policy changes through the US government," says Matthew Ryan, Head of Market Strategy at Ebury.

The new president's pro-growth agenda and expected supply-side reforms to the economy (which will also involve a significant rise in the USA's debt) will also boost the 'American exceptionalism' trade, in which global investors seek to buy all things American, including its currency.

The red sweep outcome was considered by analysts to be the most bullish outcome for the Dollar, with some saying the currency could ascend by approximately 5%.

"I think in terms of outcomes tonight, I would expect GBP to be challenging 1.26 should Trump get announced," said a trader at JP Morgan.

"The currency market has realised its previously indicated tendency: it firmly believes that the Trump presidency will be USD-positive," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.