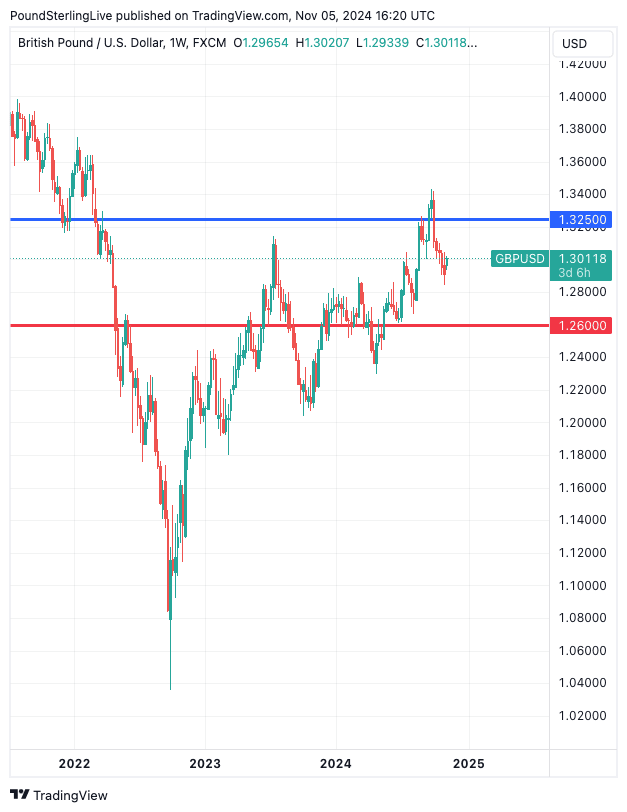

GBP/USD to 1.3250 on Trump Win Says Wall Street Trader

- Written by: Gary Howes

Image © Adobe Images

JP Morgan's FX trading desk sets out potential levels for the Pound to Dollar exchange rate (GBP/USD) on the three potential outcomes to today's U.S. election outcome.

The Wall Street bank's GBP trader says 1.2800/50 remains important support in GBP/USD, with multiple tops in H1.

Here, the 200 day moving average is also found (at 1.28125), and the low over month-end.

"But I think in terms of outcomes tonight, I would expect GBP to be challenging 1.26 should Trump get announced, while on Harris, 1.3250 resistance should come under pressure," says the trader.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

He says that, given the still large amount of long GBP positioning, and the poor Budget mix, "I would look to sell GBP alongside EUR on a Trump victory."

Those watching the GBP exchange rates should expect a larger move lower in Pound Sterling should we get a Red Sweep, "given the likely impact on Gilts from Treasuries in what is a concerning fiscal environment."

The trader will be in front of a screen from around 2AM London time, which is when the first results should start rolling in from the East Coast.

Although betting market odds heavily favoured Trump for much of October, momentum has been with Harris in recent days, with polling showing she has made gains in the late stages of the race and a paring of Trump's advantage on betting market odds reflected this.

Financial market expectations have tended to follow betting market outcomes and the net result has been a softening in the Dollar as Trump's odds diminished.

Markets see three options: a Trump win with a split Congress, a Trump win with a sweep of Congress and a Harris win with a split Congress.

"A Trump ‘clean sweep’ and a Harris win without a clean sweep remains the two most likely outcomes, in our view, and equally likely. These are the most bullish and most bearish outcomes for the dollar, respectively," says Kit Juckes, FX analyst at Société Générale.

Another consideration for markets would be an effective draw, similar to what we saw in the race between George W. Bush and Al Gore in 2000.

That race was settled in courts, which made for a protracted period of legal intrigue and market limbo.

Trump is already claiming voter fraud, a sign he is intent on sowing discord in the event the outcome is not decisive.

Markets won't like this, and we think this would favour the Dollar and weigh on risk-sensitive currencies