The "Controversial" Case for a Weaker Dollar Under Trump

- Written by: Gary Howes

Stock image of President Donald Trump. Official White House Photo by D. Myles Cullen.

Analysts at Julius Baer make the case for a weaker dollar under a Trump sweep.

Dollar exchange rates have risen through October as the prospect of a second Trump presidency looks increasingly likely, but what if the opposite happens?

According to a new pre-election analysis from a private Swiss bank, the Dollar could end up weaker under his stewardship of the world's biggest economy.

"Out of all our asset class views, our currency view is arguably the most controversial," says David A. Meier, an analyst at Julius Baer. "We see downside USD risks, contrary to widespread views."

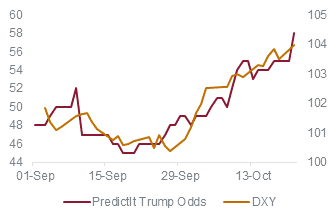

U.S. betting markets, including Polymarket, Kalshi, and PredictIt have further raised the implied probability of Trump winning to more than 60%.

Betting market odds are proving to be a reliable reflection of financial market expectations, expressed through a stronger Dollar.

"The market has finally focused on a fast-approaching U.S. election, with rising odds in prediction markets of a Trump win serving as the proximate trigger," says Themistoklis Fiotakis, an analyst at Barclays, which warns the Pound-Dollar exchange rate could fall as low as 1.23 under a second Trump term.

"We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome on a blue sweep, but the magnitude of the moves is likely larger in the former," says George Saravelos, an analyst at Deutsche Bank

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Trump has committed to hiking tariffs on imports while boosting the U.S. economy with tax cuts, which economists say is inflationary and prompts a hawkish reaction from the U.S. Federal Reserve, strengthening the USD.

Instead, "policy uncertainty has the potential to drag on the dollar, as experienced early on in Trump’s first term, when the trade dispute with China was in the making," says Meier.

"The USD’s safe-haven characteristics clearly did not help against such uncertainty, rooted in the US itself," he adds.

Julius Baer thinks the impact of further trade tariffs is uncertain, for example, higher tariffs on China, introduced by Trump in 2017, did not significantly curb the US trade deficit.

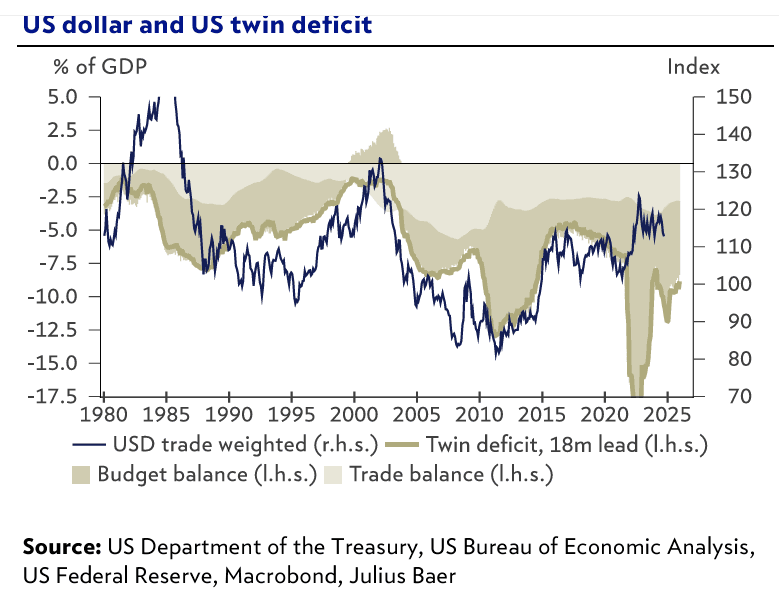

"A limited impact on the trade deficit would leave the current account deficit ample. This is one part of the US ‘twin deficit’, to which the USD is historically correlated," says Meier.

"The other part of the twin deficit, the budget deficit, is expected to widen if the tax cuts were extended, and higher tariffs would not be able to compensate for the shortfall in tax income," says Meier.

He explains that even if reflation expectations strengthened the USD going into the elections – and, in the case of a Trump sweep, beyond – a deterioration of the twin deficit in the medium term is a powerful argument against jumping on the bandwagon of USD strength in a Trump sweep scenario.