GBP/USD Rate Strikes Three-month Low

- Written by: Gary Howes

Image © Adobe Images

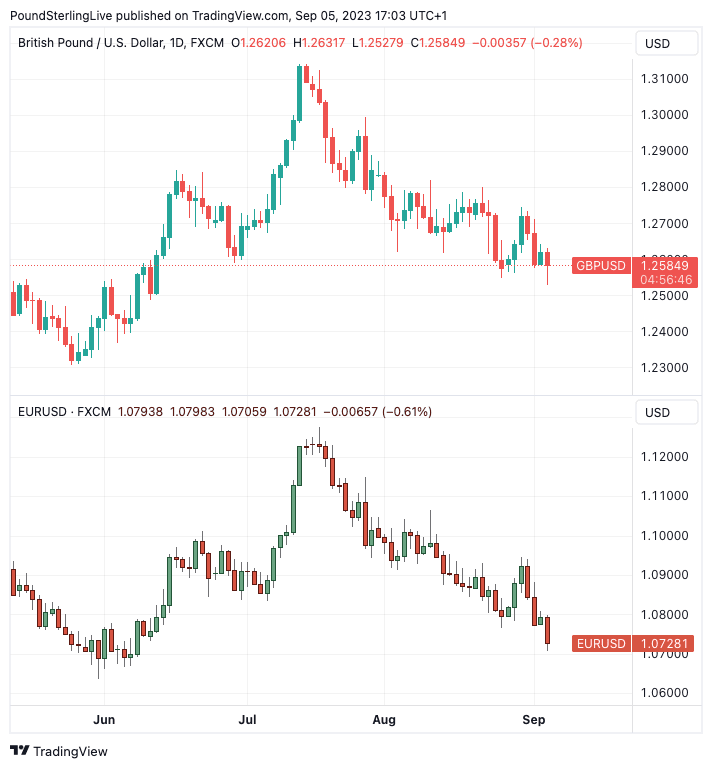

The Pound to Dollar exchange rate (GBPUSD) fell to a fresh three-month low after investors were left with very few attractive alternatives to the Dollar in the wake of underwhelming Chinese and Eurozone economic data.

GBPUSD hit its lowest level since June at 1.2528 after disappointing data in Europe and China contrasts with a better-than-expected run of U.S. data that raises expectations that the U.S. Federal Reserve can maintain interest rates at current levels for an extended period.

"The greenback is riding a seven-week winning streak, a rally partly driven by fading expectations for the U.S. central bank to cut interest rates from 22-year highs above 5% anytime soon," says Joe Manimbo, Senior Currency Analyst at Convera.

Data released Tuesday showed China's services sector grew at the slowest pace so far in 2023, while Eurozone services activity contracted more than expected in August.

"Lower-than-expected China services growth - even though still in expansionary territory - has helped push the greenback to fresh six-month highs on flight-to-quality flows," says Axel Rudolph, Senior Market Analyst at IG.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

S&P Global revised its composite PMI reading for the Eurozone to 46.7 from 48.6 announced in the preliminary release. This undershot the consensus expectation for 47 and suggests the Eurozone economy had fallen into contraction mode in August.

The data prompted a risk-off market sentiment that proved supportive of the safe-haven U.S. Dollar.

"Broad gains propelled the U.S. dollar index to three-month highs," says Manimbo. "The euro and sterling both slipped to 12-week lows against their U.S. counterpart."

Above: GBP/USD (top) and EUR/USD at daily intervals.

"Sterling tumbled more than 0.5% to below 1.26 as risk sentiment weakened and spurred a flight to safety in the greenback," he adds.

China's Caixin services PMI survey meanwhile read at 51.6 in August, an undershoot of the 53.6 expected and what amounts to a material slowdown on July's 54.1.

The data confirms the Chinese economy remains caught in a lengthening slowdown, despite recent efforts by authorities to resuscitate it.

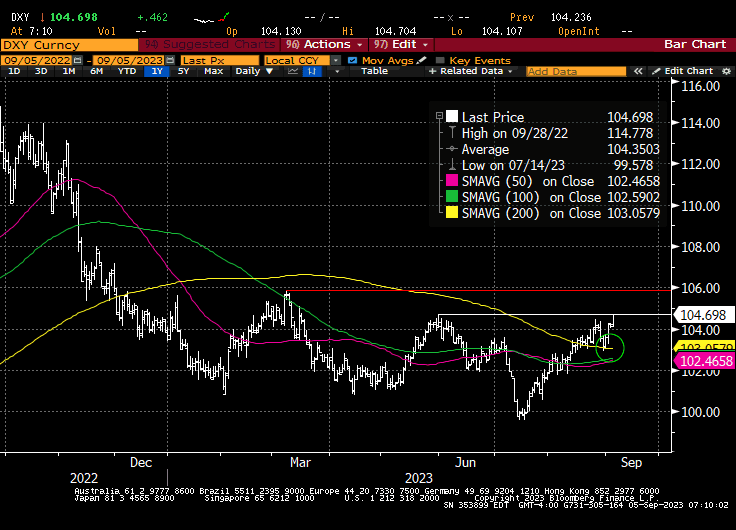

"It seems to be a string of bad news on the PMI front around the world that has led to the continued break higher in the USD vs. just about all currencies," says Brad Bechtel, Head of FX Strategy at Jefferies. "DXY and BBDXY are both having a classic, technical break higher and poised to run."

He notes both measures of Dollar performance have broken above their respective 200-day moving averages which, from a technical perspective, advocates for further strength.

Image courtesy of Jefferies LLC.

Wael Makarem, Senior Market Strategist for MENA at Exness, says the Dollar remains in an uptrend that has lasted for more than seven weeks now and could extend.

For the likes of Pound-Dollar and Euro-Dollar this is significant as it is the U.S. side of the equation that will ultimately determine how low these pairs go.

For now, the trend suggests lower, and there seems little rational argument for trying to pick a bottom and defy the trend.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks