Australian Dollar Slides On RBA Interest Rate Call and Weak Chinese Data

- Written by: Gary Howes

The Australian Dollar was sharply lower after the Reserve Bank of Australia (RBA) opted to keep its base interest rate unchanged at 4.10% and communicated it was not committed to raising interest rates again.

Like all major global currencies the Australian Dollar is highly sensitive to central bank interest rate expectations and the lowering of expectations for further rate hikes will have played a role in the Aussie's declines on Tuesday.

The Pound to Australian Dollar exchange rate (GBPAUD) rose by 0.80% on the day to 1.9708 in the wake of the decision, but the move was also aided by an underwhelming Chinese economic survey that confirmed Australia's key export partner continued to struggle in August.

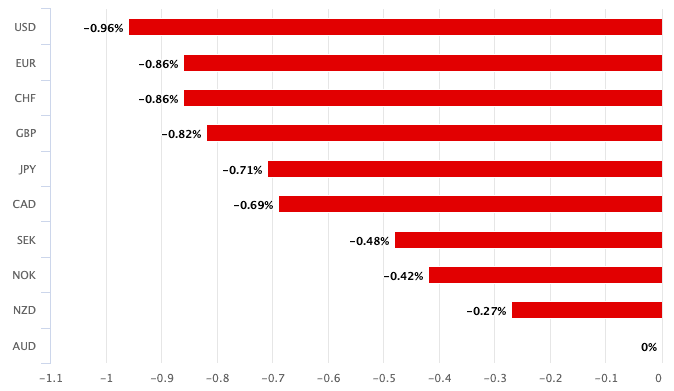

Above: AUD performance relative to G10 peers on September 05.

At the time of writing, the Australian Dollar-U.S. Dollar exchange rate is lower by 0.80% on the day as China's Caixin services PMI survey read at 51.6 in August, an undershoot of the 53.6 expected and a material slowdown on July's 54.1.

The data confirms the Chinese economy remains caught in a lengthening slowdown, despite recent efforts by authorities to resuscitate it.

"At 51.8, it came in below all (seven) analyst forecasts, dropping more than 2pts from July and even more from the heady highs of March-May. As a result, AUD is bottom of the pile, down 0.5% with an in-line RBA doing little to change that," says Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

The importance of China to Australia's economic performance was acknowledged by RBA Governor Philip Lowe when he said in a statement, "there is increased uncertainty around the outlook for the Chinese economy due to ongoing stresses in the property market."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"The Australian economy is experiencing a period of below-trend growth and this is expected to continue for a while," added Lowe, striking a sombre assessment that will have furthered boosted confidence amongst market participants that the RBA is likely finished its rate hiking cycle.

On the all-important matter of inflation, it appears the RBA is relatively content with the level of interest rates. The statement noted, "to date, medium-term inflation expectations have been consistent with the inflation target and it is important that this remains the case."

The RBA expects inflation to fall back to the 2-3% target by 2025.

"Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks," said Lowe.

"At the margin, the language on inflation coming down sounded a little more confident than in August," says RBC's Lignos, "the RBA is likely to keep hoping they don't need to hike again."

RBC Capital estimates that AUD volumes in the interbank market were running at 40% above normal through the Asian session amidst interest in the Chinese data and RBA decision.

"There is a challenging backdrop for the AUD (and also the NZD) given maturing hiking cycles, a lack of clear carry advantage versus peers compared with the historical norm, and China's economic woes," says Themistoklis Fiotakis, a currency analyst at Barclays.

'Carry' refers to the dynamic whereby global capital flows from areas of lower interest rates to areas of higher interest rates, something Australia has long benefited from. But the current cycle sees the RBA commanding an interest rate that is far from exceptional, thereby denying the Aussie Dollar a 'carry' advantage.

Iron Ore Prices Could Offer Support

Those watching the Aussie Dollar's latest bout of weakness should nevertheless be aware iron ore prices - a longtime marker of AUD performance - are in the ascendency, a development that could limit its weakness.

"The iron ore rally continues as confidence mounts over Beijing’s property support," says John Meyer, an analyst at SP Angel, the specialist broker and advisory.

Iron ore prices have extended gains to $114/t and $117/t on the Singapore market and Meyer says the move to April highs reflects confidence in the steelmaking sector in China following a sustained period of pessimism.

This was reinforced by Country Garden avoiding default, Chinese cities scrapping mortgage restrictions and Shenyang loosening measures to bolster property buying and development.

However, Meyer warns despite the measures aimed at boosting the economy, the "property sector is not out of the woods yet".

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes