Dollar on the Backfoot as Jobless Claims Point to "Substantial" Increase in U.S. Unemployment Ahead

- Written by: Gary Howes

Image © Adobe Images

The Dollar lagged major peers as investors bet banking sector woes have passed and U.S. labour market data pointed to an increase in joblessness ahead.

Bets for further rate hikes at the Federal Reserve were diminished after weekly U.S. jobless claims read at 198K, slightly above consensus estimates of 195K and up from last week’s reading of 191K.

The increase in those seeking out-of-work benefits suggests the U.S. labour market might be turning, which would give the Federal Reserve reason to pause its hiking cycle, in turn depriving the Dollar of yield support.

"The U.S. dollar carved out fresh session lows after weaker than expected data bolstered the argument that the Fed may be done raising interest rates," says Joe Manimbo, Senior Currency Analyst at Convera.

The Pound to Dollar exchange rate looked on course to complete its strongest monthly advance since November 2022 in the wake of the data as it tipped 1.2382.

The Euro to Dollar exchange rate meanwhile looked set to record a monthly advance in excess of 3.0% as it went as high as 1.0929.

The rise in jobless claims suggests the U.S. labour market might finally be cooling in reaction to higher interest rates as a result of Federal Reserve hikes and the recent tightening in lending conditions following the country's banking crisis.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Should upcoming data confirm the labour market is turning investors would likely feel justified in expecting the Fed to start cutting interest rates later in the year.

Interest rate cuts are typically consistent with a weaker Dollar outlook.

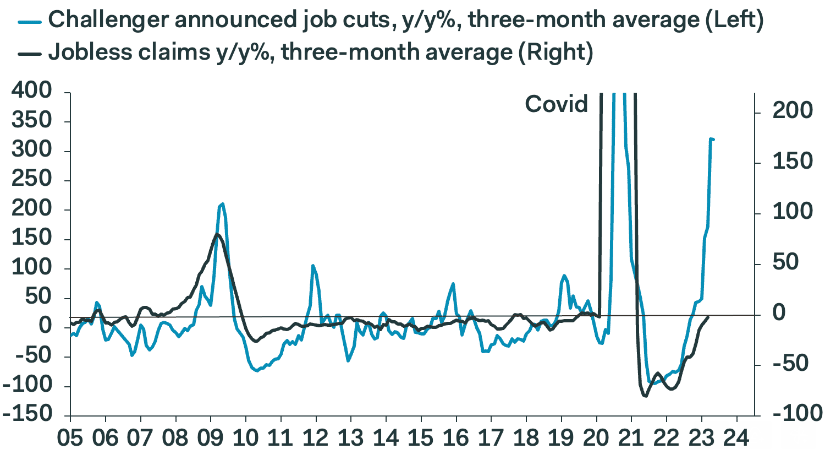

"The level of claims remains extremely low, but the cycle bottom probably is now in the past, and looking ahead, the lagged impact of the surge in layoff announcements ought to drive claims substantially higher during the second quarter," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

Shepherdson says announcements lead claims because firms tend not to make all their job cuts immediately, and also because in many states people receiving severance pay can’t make a claim until it ends.

"But the surge in announcements is huge, so the claims numbers likely will look very different by the end of the second quarter, and perhaps a good deal sooner," he says.

Image courtesy of Pantheon Macroeconomics.