U.S. ISM Report is the Latest in a String of Positive Data Runs

- Written by: Gary Howes

- Yet another surprisingly strong U.S. data release

- Helps USD higher into the weekend

- Keeps GBP/USD locked below 1.20

- But ISM data has been noisy of late

- And economy still set to slow markedly

Image © Adobe Images

The Dollar rebounded ahead of the weekend after a key survey of the U.S. economy came in stronger than markets were expecting.

The U.S. ISM services PMI read at 55.1 in February, which was ahead of expectations for a slide to 54.5 from January's 55.2.

Stocks fell while U.S. bond yields and the Dollar moved higher; a now-familiar signal that investors are betting the Federal Reserve has more work to do on interest rates before the economy slows sufficiently to bring inflation lower.

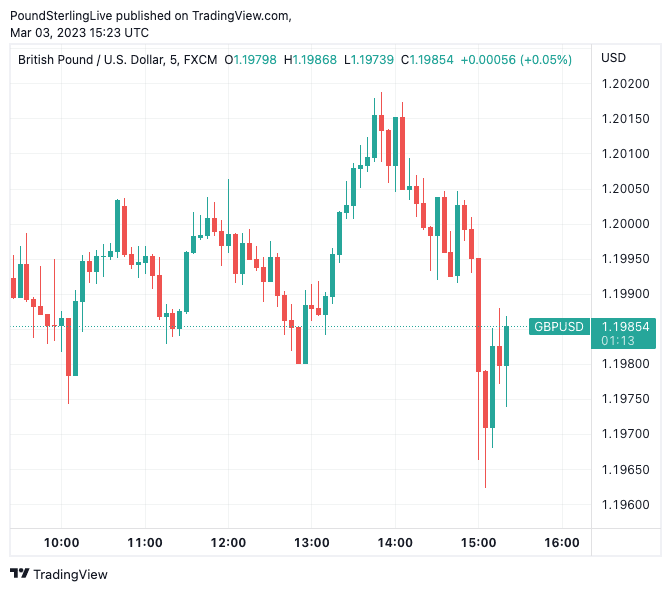

The Pound to Dollar exchange rate (GBP/USD) slipped back below 1.20 to 1.1984, taking bank transfer rates into the 1.1565-1.1745 bracket, competitive holiday and cash rates to around 1.1820 and competitive payment rates to around 1.1950.

"Markets have been caught off guard by stronger than expected US data of late," says Bipan Rai, Head of FX Strategy at CIBC Capital markets. "That’s meant an extension higher for Fed terminal, and a stronger USD."

Above: GBP/USD at 5-minute intervals showing another rejection at 1.20. Consider setting a free FX rate alert here to better time your payment requirements.

The ISM is the latest in a string of strong U.S. economic data prints that confirm the economy retains the kind of strength consistent with elevated inflation levels.

Financial markets are therefore pricing in further interest rate hikes at the Federal Reserve, which investors bet will eventually make their presence felt and trigger a more marked economic slowdown.

For now, the prospect of higher interest rate expectations raises the yield paid on U.S. bonds, which in turn maintains USD-supportive capital flows as investors seek out higher returns.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Kieran Clancy, Senior US Economist at Pantheon Macroeconomics, says the ISM series has been volatile of late, with the weather being particularly unhelpful. December was seen out with snow storms while January and February have been unseasonably mild in the U.S.

"Abstracting from the considerable noise here, the trend in ISM services has been broadly flat since the summer, in part due to a drawdown in excess savings accumulated during Covid," he says.

But looking ahead, the economy won't be immune to the Fed's recent run of rate hikes.

"Aggressive tightening is still working its way through the economy, and people have already spent a little over half of their excess savings," says Clancy.

CIBC Capital Markets says the USD could be supported in the near term by resilience in the economy and continued Fed hikes.

Nevertheless, "we still expect the Fed to undershoot the market's hiking expectations, weighing on the USD into mid-year, as attention turns to other advanced economies that are raising interest rates," says Rai.

"Beyond our 1m forecast, we have more conviction that the USD is poised to depreciate," says Simon Harvey, Head of FX Analysis at Monex.

"We think Q2 will offer a better entry point for traders since central banks across the DM space should be close to completing their hiking cycles, while the pace of global growth is likely to max out as the previous drag from monetary tightening starts to fade and China’s economic recovery hits its peak," he adds.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks