Pound-Dollar Rallies after U.S. CPI, but this is No Trend Reversal as Inflation Tipped to Remain Sticky

- Written by: Gary Howes

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3860

- Bank transfers (indicative guide): 1.3474-1.3570

- Money transfer specialist rates (indicative): 1.3734-1.3762

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar fell following the release of U.S. inflation data that suggested a peak in inflationary pressure might be at hand, thereby taking pressure off the Federal Reserve to begin the process of tightening monetary policy.

However, having digested the numbers, a number of economists say although prices might be peaking, they look set to remains stubbornly high.

The latest numbers therefore offer no reason for the Dollar to turn tail and any post-data weakness might prove temporary.

U.S. Core CPI rose 0.3% Month-on-Month in July, lower than market expectations for 0.3% and a rapid deceleration from June's 0.9%.

CPI rose 0.5% Month-on-Month, equalling the market expectations.

"U.S. core inflation has seen the mountaintop, but remains high," says Avery Shenfeld, Chief Economist of CIBC World Markets Inc. "July featured solid gains in both food and energy prices. While core prices were cooler, the 0.3% gain, softer than in the prior four months, is still capturing broad based momentum in both goods and services."

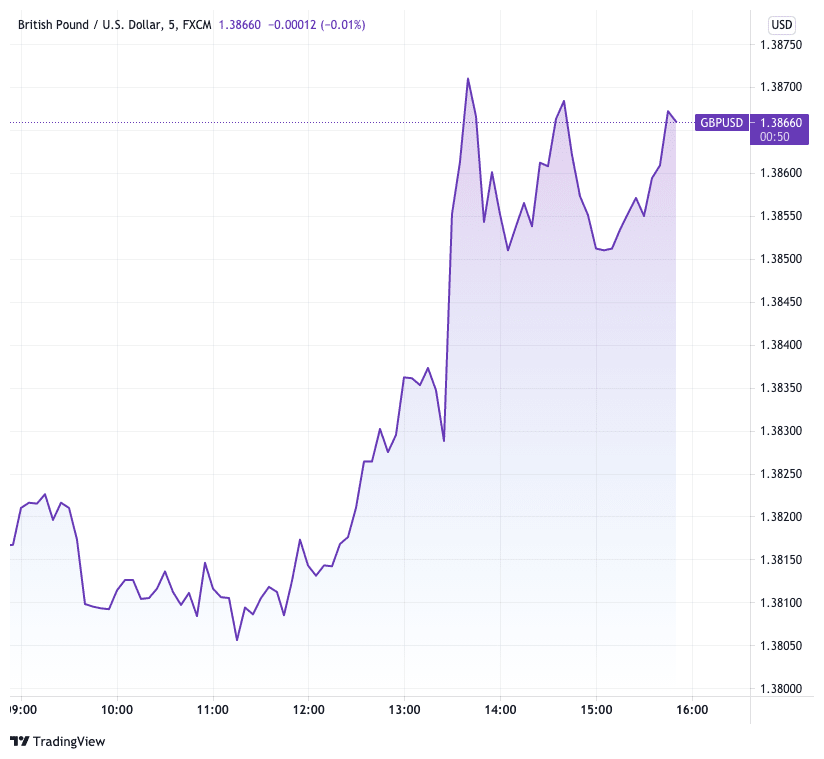

The Pound-to-Dollar exchange rate rose in the wake of the data to trade at 1.3874, having been as low as 1.3803 ahead of the release.

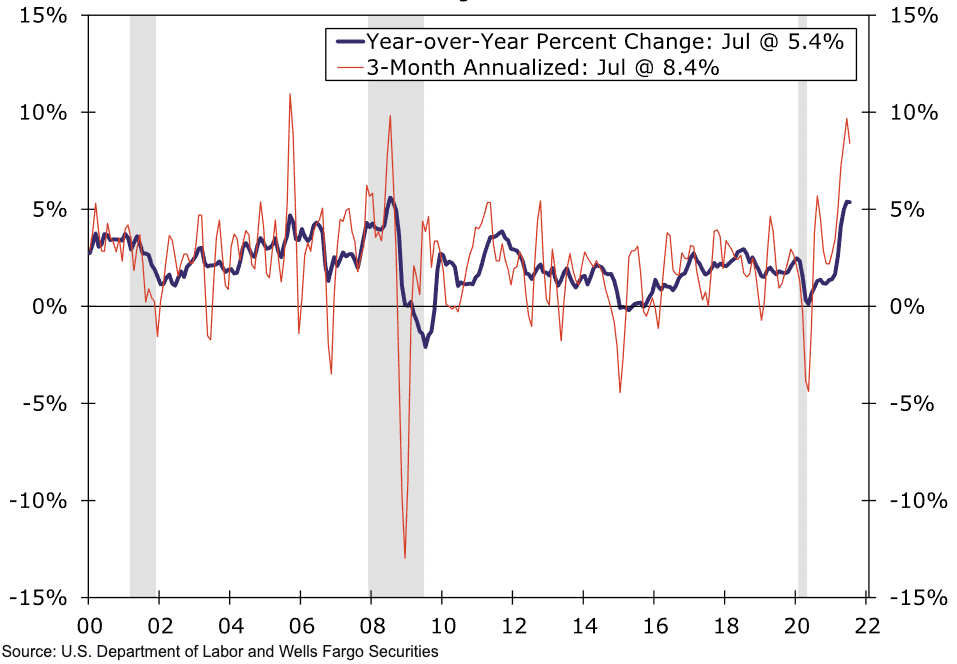

Above: U.S. Consumer Price Index, Year-over-Year % change vs. 3-month annualised rate. Image courtesy of Wells Fargo.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Dollar has been bid for much of 2021 on the view that a rapidly improving economy and rising inflation would force the U.S. Federal Reserve into ending its quantitative easing programme and commencing a series of interest rate rises.

The rise in inflation above the Fed's 2.0% target suggests this process should begin sooner rather than later, something a number of Fed officials have recently suggested.

The majority of Fed officials have however maintained price rises are likely to be transitory in nature. Instead they prefer to let prices die down and allow their generous monetary support to help boost the labour market.

The fall in the Dollar following the inflation numbers suggests the Fed's patient approach is indeed warranted.

But while the Dollar delivered a knee-jerk reaction by going lower following the data some economists expect U.S. inflation to remain stubbornly high, suggesting the numbers are by no means a trend breaker for Dollar bulls.

Economists at Wells Fargo observe there was also evidence that price pressures continue to broaden out, which should keep the heat turned up on inflation for a while.

"Price pressure continues to broaden beyond categories most acutely associated with the reopening, as businesses are finding it easier to pass costs on today than they typically could this early in an expansion," says Sarah House, Senior Economist at Wells Fargo Securities, LLC.

Indeed, core goods prices excluding used autos are up 3.6% over the past year, the fastest pace since the early 1990s.

"The fact that firms are facing higher costs in the form of physical inputs and labor, suggests even as supply constraints eventually ease wages could keep pressure on consumer prices for some time to come," says House.

In the near-term, economists at RBC Capital Markets expect price growth for goods and services that were largely unavailable over the past year to continue to accelerate, while early indicators from wholesale vehicle markets suggest used car prices are set to give back some of recent gains.

"At the same time there is still a risk that inflation pressure becomes more widely based," says Claire Fan, Economist, RBC Economics.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

RBC Capital's baseline view however remains that overall inflation will cool towards the Fed’s target in 2022, and the Fed will remain accommodative until persistent evidence of a healthy economic recovery emerges.

Michael Moran at Daiwa Capital Markets America says "food prices are stirring" having risen 0.8% in June and 0.7% in July, up from 0.4% in April and May.

"All told, while transitory influences showed signs of easing in July, there is still good reason to remain on inflation alert," says Moran.

In short, these are inflation numbers that will please those arguing both that inflation is here to stay and that it is transitory.

"Today's report is a win for Team Transitory, but Team Persistent is not walking away empty-handed," says House.