Pound-Dollar Rate: Bostic Ramps up the 'Taper Talk', Keeps USD Bid

- Written by: Gary Howes

- USD underpinned by new Fed speak

- Bostic says taper could occur in Sept.

- Barkin a little more coy on jobs progress

- Rosengren sees taper by year-end

Above: File image of Raphael Bostic. Image: Center for American Progress, reproduced under CC conditions.

- GBP/USD reference rates at publication:

- Spot: 1.3860

- Bank transfers (indicative guide): 1.3474-1.3570

- Money transfer specialist rates (indicative): 1.3734-1.3762

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Dollar demand is intact with no less than three Federal Reserve members having already this week said the time to start reducing the Fed's asset purchase programme is fast approaching.

Federal Reserve Bank of Atlanta President Raphael Bostic said he was in favour of "going relatively fast" on scaling down the Fed's asset purchase programme, a process referred to as tapering.

"The economy is in a much different place today," Bostic said in a webinar held Monday, providing the latest signal on what is arguably the most crucial issue for global financial markets at present.

Fed officials began debating when and how they should taper asset purchases at their July meeting, with a series of speeches and commentaries from Federal Open Market Committee (FOMC) members this August providing a clearer picture as to how and when tapering might occur.

For the Dollar 'taper talk' is supportive given it implies the date of the Fed's first interest rate rise is drawing closer.

The Dollar has been bought in 2021 as investors anticipate higher interest rates in the U.S. in coming years as the Fed reverses the extraordinary support it provided the U.S. economy during the Covid crisis.

"We are well on the road to substantial progress toward our goal,” Bostic said.

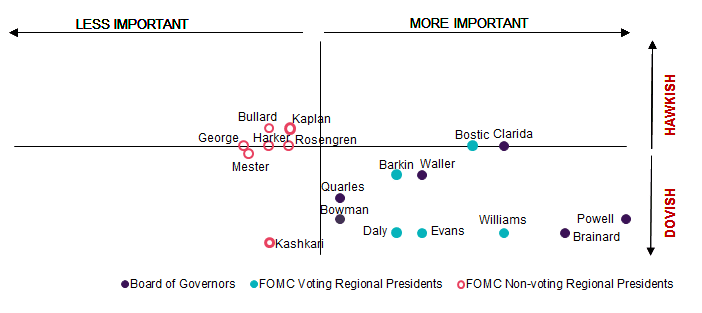

Image courtesy of NatWest Markets.

Bostic noted Friday's bumper jobs report - that saw 943K jobs created in July - as "definitely quite encouraging in that regard. My sense is if we are able to continue this for the next month or two I think we would have made the ‘substantial progress’ toward the goal and should be thinking about what our new policy position should be."

"The Dollar builds gains after FOMC voter Bostic urges tapering as soon as September," says Kenneth Broux, Senior European Economist at Societe Generale Corporate & Investment Banking.

The Pound-to-Dollar exchange rate has faded from late-July highs at 1.3983 through the course of July and is presently quoted at 1.3864.

The Euro-to-Dollar exchange rate has meanwhile offered a clearer expression of Dollar strength, going to 1.1729 and threatening to test the April 2021 lows at 1.1704 in the process.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed is currently buying $120BN of assets per month - consisting of $80BT government securities and $40BN of mortgage backed debt - and has pledged to keep up that pace "until substantial further progress" has been made toward its goals of maximum employment and 2.0% inflation.

Expectations for a Fed taper were boosted Friday by better-than-expected U.S. jobs data that revealed 943K jobs were created in July; exactly the kind of blowout numbers Fed officials want to see before reducing the scale of their support.

"Right now I’m thinking in the October-to-December range, but if the number comes back big or maybe even a little bigger, I’d be open to moving it forward," Bostic said referencing upcoming jobs reports. "If the number really explodes, I think we would have to consider that."

The Dollar is tipped by foreign exchange analysts to remain in demand in an environment of strong U.S. data and 'hawkish' Fed speak.

"The US dollar remains supported by the increasing prospect of monetary tightening in the near future," says George Vessey, an analyst at Western Union Business Solutions.

"The US dollar has benefited, dragging EUR/USD to over 4-month lows and GBP/USD over 1.5 cents lower than last week’s high," says Vessey.

Richmond Federal Reserve President Thomas Barkin also spoke Monday and said he sees progress in the economy toward the central bank’s goals, particularly on inflation.

“I think it is fair to say on the price side we made substantial progress, maybe more than substantial progress," Barkin said at an event in Roanoke, Virginia, but he added "I believe there is still more room to run in the labor market."

The caution expressed on the jobs market does however set him as less 'hawkish' than Bostic.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Boston Federal Reserve Bank President Eric Rosengren said during an interview with the Associated Press on Monday that the Fed should announce in September that it will start reducing its $120BN in monthly purchases of Treasury and mortgage bonds before year-end.

The comments by Bostic, Barkin and Rosengren come days after Fed Vice Chairman Richard Clarida said that the economy was on course to merit the withdrawal of monetary stimulus.

Clarida said that if the growth outlook remains strong, he favours a tapering announcement by the end of the year, a view also pushed by San Francisco Federal Reserve President Mary Daly.

"The jawboning we are seeing from Fed speakers already this week indicates that Jay Powell is ready to make the leap," says Neil Wilson, Chief Market Analyst at Markets.com.

Fed Chairman Jerome Powell is expected by some economists to provide details of the Fed's tapering plan by the end of the month when he delivers a keynote address to the Jackson Hole Symposium of central bankers.

If this is not the case then in all likelihood the FOMC’s September meeting will see a taper announced.