Pound-Dollar Rated a Buy: MUFG

Image © Adobe Images

- GBP/USD spot at publication: 1.3637

- Bank transfer rates (indicative guide): 1.3260-1.3355

- FX transfer specialist rates (indicative): 1.3518-1.3540

- More information on attaining specialist rates, here

Pound Sterling can crack the glass ceiling preventing it from striking new multi-month highs against the Dollar, according to analysts at investment bank MUFG.

In regular briefing to clients, MUFG says they are backing the Pound to move higher against the Dollar, courtesy of the positive momentum behind the exchange rate.

"We are recommending a long cable trade idea. The GBP currently has strong upward momentum against both the EUR and USD," says Derek Halpenny, Head of Research at MUFG.

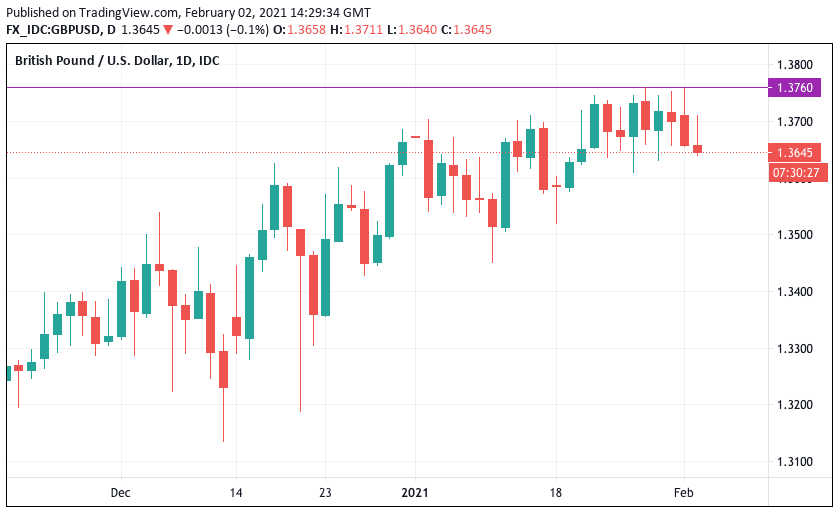

The call comes at as the Pound-to-Dollar exchange rate (GBP/USD) struggles to break above the 1.2760 region, suggesting some notable resistance:

Above: GBP/USD chart showing resistance at 1.3760.

But a break above the resistance at 1.3760 is likely to play out given the supportive forces provided by the UK's vaccine rollout programme and a new correlation with stock markets, which are currently in an uptrend.

"The GBP is benefitting from the reduction of Brexit risk and improving sentiment towards the UK related to the relatively fast roll out of vaccines. The GBP has also become more correlated to other high beta G10 currencies as it derives more support from improving risk sentiment. We expect the GBP’s bullish momentum to extend further in the near-term," says Halpenny.

There are however some potential pitfalls fro the bullish stance, notably a disappointing Bank of England event on Thursday.

"The U.K. pound was muted against the buoyant dollar but rolled to May 2020 highs against the euro. Sterling was broadly consolidating a rally that’s hoisted it to 32-month highs against the dollar ahead of a major policy update from the Bank of England Thursday," says Joe Manimbo, a foreign exchange analyst at Western Union.

Current consensus amongst economists is the Bank will opt to keep interest rates unchanged, leading some foreign exchange strategists warn an unexpected cut could dent the currency's trend of appreciation.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"On balance, we expect the BoE to decide against lowering rates next week and refrain from providing a stronger signal over the likelihood of negative rates being implemented anytime soon. If correct, it should open the door to more GBP upside and lift cable towards the 1.4000-level for the first time since 1H 2018. Leveraged Funds long GBP positions are still relatively light," says Halpenny.

Sterling's growing correlation with stock markets now that Brexit has ceased to be a primary considering is another source of potential risk and opportunity.

Well-supported equity markets are however assumed to be a feature of the investment landscape for the foreseeable future by MUFG, which should pose headwinds for the Dollar.

"The backdrop of COVID vaccination roll-outs and further fiscal and monetary policy support as dominant themes that will underpin risk sentiment. That will limit the scope for recent USD strength being extended much further," says Halpenny.