U.S. Dollar Flattered by Fresh 'Risk off' Demand

- Dollar outperforms at start of new week

- But 'safe haven' demand is only real source of support

- Expect lingering USD support to remain over coming days

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3059

- Bank transfer rate (indicative guide): 1.2702-1.2793

- FX specialist providers (indicative guide): 1.2858-1.2940

- More information on FX specialist rates here

The Dollar is firmer against the Euro and a host of other currencies at the start of a week characterised by falling equity markets and commodity prices, testament to the U.S. currency's pervasive 'safe haven' characteristics that are being tipped to remain in demand in the short-term.

However, analysts say without its 'safe haven' status the currency would likely be under pressure, pointing to fundamental vulnerabilities that could yield notable downside in coming months particularly in the event a covid-19 vaccine is deployed and next week's U.S. vote yields a conclusive outcome.

European and U.S. markets followed Asia lower at the start of the new week thanks to a combination of rising covid-10 cases in the Northern Hemisphere, disappointment over the failure of U.S. politicians to secure a new stimulus bill and lingering uncertainty over next week's U.S. vote.

"Rising coronavirus cases throughout Europe and the U.S. damped markets sentiment once more," says Joshua Mahony, Senior Market Analyst at IG. "With France Covid cases at record highs, and Spain entering a state of emergency, there is a fear that this second wave will be more detrimental than the first."

The Dollar tends to see demand rise in times of investor uncertainty, given the currency's huge liquidity that allows for the pricing of a swathe of assets in U.S. dollars across the world. When those assets are sold a resultant demand for cash then bids up the value of the Dollar.

"Strong data and potential risk-reduction ahead of the US elections could support the USD in the near term. However, month-end rebalancing flows could modestly weigh on the dollar this week," says a weekly currency briefing from Barclays.

"Global markets have started the week on a cautious footing and this tone could extend as the U.S. election campaign enters its final stretch. We think the main bias will be for the market to reduce risk and unwind positions when given the opportunity. This could see the USD firm near-term," says Mark McCormick, a foreign exchange strategist with TD Securities in New York.

Global covid-19 cases have now surpassed 43.34 million, while the death toll has surpassed 1.15 million; recoveries are at 31.90 million, the U.S. has 8.88 million cases, accounting for 20% of global cases, the death toll there is 230,510.

Spain has implemented a national curfew while Italy has introduced the tightest restrictions since May and France has warned of another shutdown.

"Markets are in risk-off mode today as coronavirus cases continue to surge in Europe and the US. The US and France have recorded their highest ever number of new Covid-19 cases for two days in a row and Spain has announced a new state of emergency. Meanwhile, the lack of progress towards a US stimulus package has also fuelled demand for safe haven assets, benefiting the USD," says George Vessey, Currency Strategist at Western Union. "All eyes are on the US and whether or not a pre-election fiscal deal will be achieved to help the world’s largest economy through this crisis and support risk appetite across financial markets. Given there are still little signs of progress and in the wake of rising Covid-19 cases, a capital rotation away from risk assets like stocks and commodities and emerging market currencies has kick-started the week."

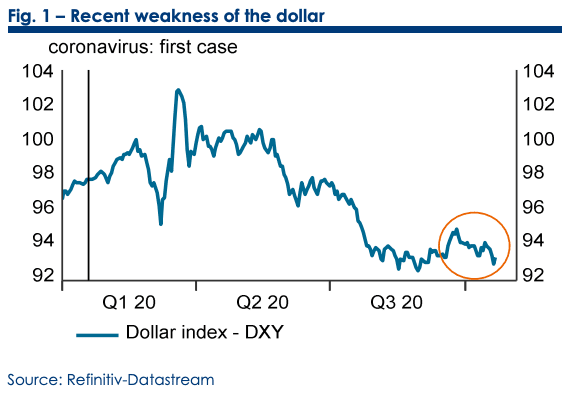

Above: The Dollar has lost ground against all major peers over the course of the past month, confirming its 'safe haven' as being a potential lone pillar of support. Secure today's exchange rates for use over coming months if you would like to protect your international payments budget, learn more here.

"In the year of the pandemic, a negative correlation has been observed between the Dollar and the U.S. stock markets, testifying that the dollar’s safe haven status is back in the limelight," says Asmara Jamaleh, Economist at Intesa Sanpaolo.

Despite the 'risk off' tone to markets of late, the downside limit to key USD-based exchange rates such as GBP/USD and EUR/USD still appears to be relatively limited, suggesting there remains limited substantial fundamental demand for the Dollar, which leaves it to exposed to weakness in the event sentiment perks up.

The Pound-to-Dollar exchange rate is seen at 1.3067, up 0.12% from the week's open, the Euro-to-Dollar exchange rate is meanwhile seen at 1.1821, down 0.20% from the week's open.

"The fact that both EUR/USD and GBP/USD managed to regain and hold the key levels of 1.18 and 1.31, respectively, remains a positive signal for the two crosses," says Robert Mialich, FX Strategist with UniCredit in Milan. "The resilience these two exchange rates have shown so far indicates that the USD’s margin of appreciation is based solely on its role as a safe-haven currency."

"Markets do not appear to see great upside potential for the USD in the absence of an increase of global risk aversion," adds Mialich.

Indeed, the Dollar's broader multi-year period of appreciation, that could be at risk of ending, had been driven by the fundamental outperformance of the U.S. economy relative to global peers, such as those of the UK and Eurozone.

The economic outperformance meant greater returns on U.S. stocks relative to the rest of the world, while the U.S. Federal Reserve was able to respond to the improved growth dynamics by raising interest rates. Higher interest rates meant the yield on U.S. government and corporate bonds were elevated, securing strong inflows of global investor capital into the U.S.

The reset triggered by the covid-19 crisis meant this U.S. economic outperformance was questioned, and with it the assumption that had for many years underpinned the Dollar.

Yet, downside damage to the Dollar has certainly been restricted by the currency's safe-haven dynamics, and this demand could well be a feature of the remainder of 2020 given the worsening covid-19 infection rates in Europe and the pervasive uncertainty surrounding the U.S. election.

"The correlation with the news flows on the much-anticipated fiscal stimulus package in the US has strengthened. Reports on improving chances of an agreement being reached to approve the package caused the dollar to weaken, a counterintuitive reaction when considering that the effect of stronger fiscal stimulus on growth is positive (in particular by improving post-pandemic recovery capacity), and may therefore be explained by the stronger negative correlation with the US stock markets, which, by contrast benefit, from news in this direction," says Jamaleh.

Image courtesy of Intesa Sanpaolo

"The correlation between the dollar and the stock markets turns negative in the presence of major shocks to the market – this year: the pandemic – that bring back to the fore the dollar’s safe haven status1. The relation is symmetrical, therefore when the shock materialises, and the stock markets lose ground, the dollar appreciates, whereas when the state of crisis eases and stock indices recover, the dollar retreats," says Jamaleh.

Image courtesy of Intesa Sanpaolo

The clear risk to Dollar strength therefore comes in the form of a clear outcome to the U.S. election and the easing of the covid-19 crisis, something most financial commentators say would happen in the event of a vaccine being found and deployed over coming months.

It is reported that AstraZeneca - a leader in the vaccine race - has resumed the Phase-3 trial of its coronavirus vaccine in the U.S where it had been temporarily halted while Johnson & Johnson is preparing to restart its late-stage trial this week after getting FDA clearance following a similar stoppage

J&J has indicated that the first batches of its vaccine may be available for emergency use by January while the UK's Health Secretary Matt Hancock says it is possible a vaccine rollout would commence before year-end.

U.S. infectious disease expert Anthony Fauci has said that “we will know whether a vaccine is safe and effective by the end of November, the beginning of December”.

"Despite the rise in Covid cases, traders remain torn as they weigh up the potential impending benefits of a US stimulus package and potential vaccine. The latest update from Oxford highlighted how their early trials show a positive reaction to the vaccine for the elderly, with an immune response for those at most risk likely to prove a key cornerstone for any worthy vaccine candidate," says Mahony.

Pfizer last week said it will apply for emergency US approval of the Covid-19 vaccine it is developing with Germany’s BioNTech in the third week of November, assuming it receives positive results from its current trial.

Albert Bourla, Pfizer’s chief executive, said in an open letter that he wanted to “provide greater clarity around the development timelines” of the vaccine, which is being tested on some 38K people worldwide.

"Pfizer's proclamation that they will fast-track their vaccine into production in November, there is an element of optimism that is likely to ensure stocks can navigate this second wave of infection better than the first," adds Mahony. "Nevertheless, with haven currencies such as the dollar gaining ground in early trade, there is clearly going to be some caution from traders given the risks ahead."