Dollar Smiles as Durables Data Fuels Correction but Pound-Dollar Rate Swings Back into Black

- Written by: James Skinner

- USD smiles as durables data bode well for business investment.

- Fuels broad USD correction, but GBP/USD swings back in black.

- Following robust demand for new 10Yr GB bonds as yields rise.

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3083

- Bank transfer rate (indicative guide): 1.2731-1.2823

- FX specialist providers (indicative guide): 1.2893-1.2971

- More information on FX specialist rates here

The Dollar smiled on Wednesday after durable goods data bolstered the outlook for business investment and fueled a correction in U.S. exchange rates, although this didn't prevent Sterling from swinging back into the black following robust demand for new 10-year British government bonds amid rising yields.

Dollars were bought widely after the Census Bureau said durable goods orders rose 11.2% last month, when markets were looking for just a 4.4% increase, and revised higher its estimate of June's increase from 7.3% to 7.6%.

"This does not recover the lost ground from the spring; the cumulative shortfall in auto orders in the past five months, compared to the prior trend, is some $81B. This won’t be recovered anytime soon, given the continued depression in fleet auto sales, even though private consumers are buying as many cars and trucks as before the pandemic," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Core durable goods orders data, which excludes volatile and lumpy transportation-related orders for things like aircraft components, were less impressive but still ahead of expectations. Core durable goods order rose 2.4% in July, down from an upwardly revised 3.6% in June but ahead of the consensus for a 1.9% increase.

"The upside surprise came despite elevated uncertainty around the outlook due to the surge in virus cases and the drying up of government assistance, as well as ample spare capacity," says Katherine Judge, an economist at CIBC Capital Markets. "We continue to see the recovery in business investment from here as occurring relatively slowly given the prevalence of spare capacity."

Above: Dollar Index shown at daily intervals. Rises above 21-day moving-average in potentially bullish sign for outlook.

Durable goods are an important indicator of the business investment that gets toted up by statisticians when they measure GDP so the strong bounceback bodes well for the U.S. economy early in the third quarter, which was marred by a resurgence of the coronavirus.

The second wave preceded an expiry of enhanced welfare benefits for households impacted by government closure of the economy, with both having been expected to weigh on the economy over the balance of summer.

But data available thus far suggests the U.S. economic rebound out of its April and May trough endured into the beginning of the second quarter, with more jobs either created or recovered from the coronavirus as households continued to spend in those locations where they were able to.

"With an existing bearish “reversal day” in place as well as a near bearish “outside day” from the end of last week, the immediate risk is seen marginally lower," says David Sneddon, head of technical analysis at Credit Suisse, who looks for GBP/USD to find support upon any fall 1.3023. "EURUSD stays rangebound but with a bearish “outside day” in place and momentum poor, the threat of a top remains, with key support seen at 1.1729/1.1697."

Above: Euro-to-Dollar rate shown at daily intervals. Falls below 21-day moving-average in bearish sign for outlook.

Wednesday's data comes hard on the heels of two months of decline for the Dollar Index and many U.S. exchange rates including GBP/USD and EUR/USD, although the greenback was higher against all on Wednesday ahead of a possibly-landmark speech from Federal Reserve Chairman Jerome Powell scheduled for Thursday at 14:10.

Powell will deliver a speech titled "Monetary Policy Framework Review" during a digital attempt to recreate the annual Jackson Hole Symposium of central bankers. This could see Powell touching on the increasingly "symmetric" nature of the bank's inflation target and potentially, setting out how the Fed's traditional monetary policy toolbox may change in future as a result of the pandemic.

The Dollar might not take kindly to suggestions of a higher tolerance for inflation or hints that new policy tools could become a regular feature of either monetary policy or a combined fiscal and monetary policy. Prompt and comprehensive Fed initiatives have injected unprecedented amounts of new Dollars into the financial system to both ease liquidity shortages as well as support government fiscal policy throughout the pandemic. But given the scale of its recent decline, not to mention doubts about the pace of the Eurozone recovery in August, the Dollar risk might be to the upside heading into the weekend.

"His speech could be a fork in the road for the USD. Either the Chairman drops something tasty for the reflationistas (aka USD bears) or the USD rips higher for a few weeks," says Brent Donnelly, a spot FX trader at HSBC. "For now, I’m flat but I think Thursday’s Powell Zoom is a fork for USD direction. If anyone has anythoughts on what Powell could say that would be clearly and instantly dovish, I’m 100% ears...the USD looks cheap on a micro scale."

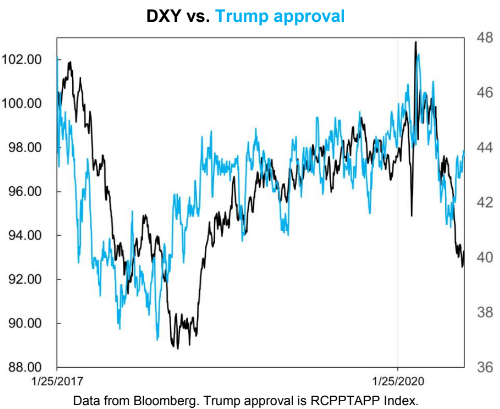

Above: HSBC graph. U.S. Dollar Index correlates with Trump job approval rating until mid-2020.

"Andy Haldane speaks later today (17:00 BST) – it might not be the forum for an economic update (Edinburgh International Culture Summit) but we suspect he may be a little more concerned over the very optimistic outlook he has for the economy. We believe GBP risks remain to the downside and early evidence of weaker sentiment could soon translate into renewed GBP underperformance," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "We should not assume that continued equity market resilience will continue to fuel USD selling. At higher and higher levels, non-dollar currencies could become influenced by other factors."

The Pound was as much a victim of the Dollar comeback Wednesday as any other comparable currency after having gotten no obvious help from robust demand at a 10:06 am British government auction of 10-year bonds, which were sold with an average interest rate of 0.32%, the highest since April 08. The bid-to-cover ratio for the auction was 2.7, meaning the 2.7 bids were made for every one that was accepted, the highest since June 16 and a ratio that's at the very high end of the long-term range for British auctions.

Trading in the Pound-to-Dollar was choppy, with Sterling lower throughout much of the session before swinging back into the black and advancing to the north in afternoon trading. There was no obvious catalyst for the move beyond higher yields that resulted from the morning's bond auction. Pound Sterling has largely defied gravity since Friday when Brussels' negotiator warned of the possibility that it may not be possible to reach a UK-EU trade agreement, although many analysts doubt this performance is sustainable.

"This week, traders turn their attention to UK monetary policy signals with the Bank of England’s (BOE) chief economist and optimist Andy Haldane speaking on Wednesday and BOE governor Andrew Bailey speaking on Friday," says George Vessey, a strategist at Western Union Business Solutions. "Against expectations, GBP/USD is slightly stronger this month as it hovers around the $1.31 zone. The currency pair is around three cents higher than last year’s average rate, and is 1% weaker year-to-date, which represents a strong recovery considering GBP/USD was 14% weaker during the market crash.”

Above: Pound-to-Dollar rate shown at daily intervals alongside 10-year GB bond yield (black line, left axis).