Pound-Euro Exchange Rate Catches a Bid as Eurozone PMIs Disappoint

Image © European Central Bank

- GBP/EUR spot rate at time of writing: 1.1172

- Bank transfer rates (indicative guide): 1.0880-1.0960

- FX specialist rates (indicative guide): 1.1000-1.1070

- Access bank beating exchange rates here

Economic data out of the Eurozone for August showed the region's economic recovery had lost some of its earlier vigour, which has been reflected in a softer Euro ahead of the weekend.

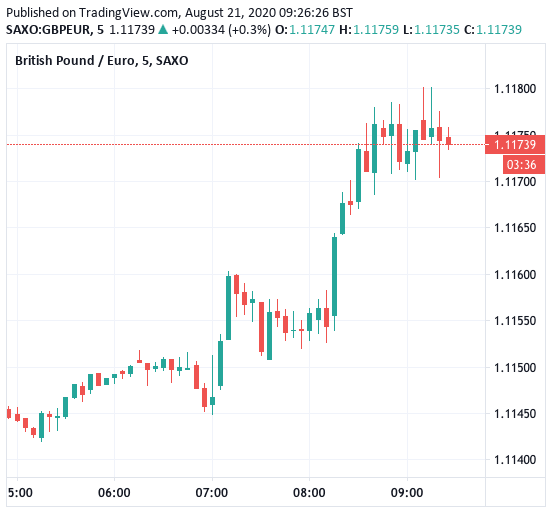

The Pound-to-Euro exchange rate rallied to 1.1173 on a combination of better than expected UK economic data (retail sales beat expectations) and weaker than expected Eurozone data.

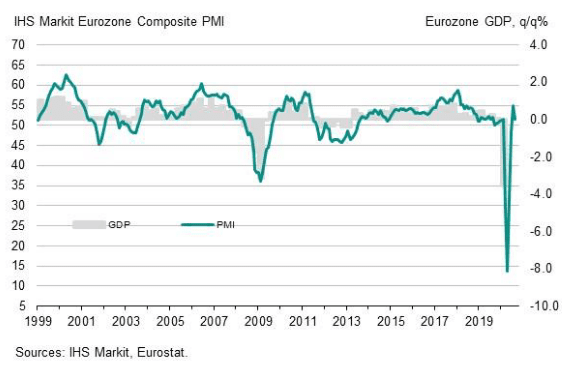

The Flash Eurozone Flash Services PMI for August read at 50.1 according to IHS Markit, which is below the 54.5 expected by markets and less than the 54.7 reported in July.

The region's Manufacturing PMI read at 51.7, which is below the 52.9 expected by the market and less than the 51.8 recorded in July.

The Composite PMI for August - which weighs the manufacturing and services figures according to their share of the overall economy - stood at 51.6, below the 54.9 expected and the 54.9 reading from July.

"The economy is coming to grips with feeble demand," says Francois Cabau, an economist with Barclays. "Today's print very much echoes our analysis of high frequency indicators, highlighting that we are likely past the initial post lockdown-exit technical rebound in activity. Thus, we believe the economy is coming to grips with feeble underlying demand, likely exacerbated by a notable resurgence of COVID-19 cases, especially in Spain, France and Germany."

In short, the Eurozone's economy is slowing and given the view that Euro exchange rate were on the rise due to the region's seemingly enviable recovery, some weakness in the single currency will come as no surprise.

The Pound-to-Euro exchange rate is quoted at 1.1173, which is up a third of a percent:

The Euro-to-Dollar exchange rate is meanwhile lower by 0.40% at 1.1825.

"August saw a loss of growth momentum across the eurozone private sector, according to provisionalPMI survey data, following a rebound from the coronavirus disease 2019 (COVID-19) related downturn.Both business activity and new orders rose modestly, and at slower rates than in July," says a note from IHS Markit accompanying the release of their data.

The region's two main economies of France and Germany meanwhile released activity figures that disappointed against expectation.

German Composite PMI for August read at 53.7, which is below the 55.0 expected and the 55.3 released previously, with the Manufacturing PMI reading at 53.0, which was slightly better than the 52.5 expected and above July's 51.0.

However, it was Germany's Services PMI which disappointed, coming in at 50.8, which is below 55.1 expected by the market and well below July's 55.6.

France's manufacturing sector actually slipped into contractionary territory with the Manufacturing PMI for August printing at 49.0, which is a significant disappointment given the market was looking for 53.7. July's reading was at 52.4.

The French Services PMI came in at 51.9, which is well below the 56.3 expected and the 57.3 printed in July.

This leaves France's Composite PMI at 51.7, which is a disappointment against the 57.2 expected by markets and the 57.3 released previously.

"A setback was looming, but this is bigger than we expected," says Claus Vistesen, Chief Eurozone Economist at Pantheon Macroeconomics, commenting on France's data. "It’s not nice to see the manufacturing gauge dumped below 50 so soon after its rebound. The details reveal that new orders slowed, especially in manufacturing, while growth in output and sales were mainly driven by strength in the domestic economy. New orders and sales to foreign markets remain under pressures."