Pound Jumps on Strong PMI & Retail Data but Brexit Trade Talks see Gains Unravel

- GBP outperforms ahead of weekend

- Retail sales rebound

- PMIs easily beat expectations

- Unemployment expected to put a brake on UK's economic recovery

- Brexit trade negotiations end in deadlock

Image © Adobe Images

- GBP/EUR spot: 1.1150 | GBP/USD spot: 1.3243

- GBP/EUR bank rates: 1.0930 | GBP/USD bank rates: 1.2970

- GBP/EUR specialist rates: 1.1050 | GBP/USD specialist rates: 1.3120

Learn more about market beating exchange rates, here

The British Pound was sent higher against the Euro and Dollar on Friday after a strong set of UK retail sales and Flash PMI data aided a recovery in the currency that had been underway over the past 24 hours, but the gains were promptly undone following an update on the state of UK-EU Brexit trade negotiations.

The EU's chief negotiator Michel Barnier said "no progress whatsoever" had been made on fisheries and the two sides remain "far from agreeing" a deal on governance. The UK's David Frost meanwhile said the EU continue to block progress.

"We hear the British government's concern about maintaining its sovereignty and its regulatory autonomy and we respect that clearly. But no international agreement was ever reached without the parties agreeing to common rules," said Barnier following the conclusion of talks in Brussels. "At this stage an agreement seems unlikely. I simply do not understand why we're wasting valuable time."

Ahead of the the conclusion of talks we said negotiators would confirm no progress would be made, and they would seek to blame the other side for intransigence.

We also said the risk for Sterling was the tone coming out of Brussels would be particularly negative, and this does indeed appear to be the case with Barnier all but suggesting this deadlock is unlikely to be broken.

"Those who were hoping for negotiations to move swiftly forward this week will have been disappointed. I'm disappointed, concerned and surprised. Once again UK negotiators haven't shown any real willingness to move forward on issues of fundamental importance to the EU," said Barnier.

The Pound had been running higher against the majority of its major peers ahead of the update thanks to some supportive UK economic data releases, however gains have unwound as the latest update on negotiations remind markets that a tense few weeks lie ahead.

If you have Sterling or Euro based international payments and would like to protect your budget in the face of further expected volatility, we would recommend booking today's rate for future use.

While the news on the Brexit front is disappointing, expect the downside potential in Sterling to be limited courtesy of signs the country's economy is putting in a decidedly gutsy effort at recovering.

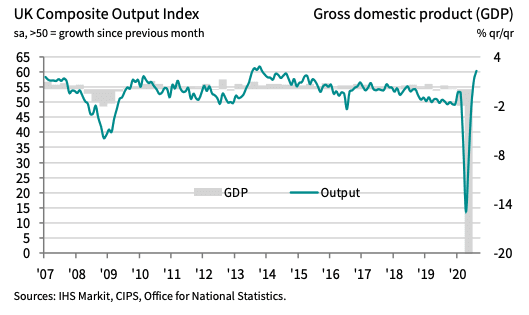

Data released mid-morning showed the UK's economic recovery picked up pace in August as companies reported a sharp and accelerated increase in business activity.

The UK's Flash Manufacturing PMI read at 55.3 according to IHS Markit, which is better than the 53.8 forecast by markets and stronger than July's reading of 53.3.

However, it was the Services PMI that raised eyebrows with a reading of 60.1, which is better than the 57 forecast by economists and the 56.5 recorded in July.

The Composite PMI - which takes into account the share of services and manufacturing in the economy - read at 60.3, which is better than the 57.1 that markets were looking for and stronger than July's reading of 57.0.

IHS Markit report that UK private sector companies reported a sharp and accelerated increase in business activity during August, with both the manufacturing and service sectors continuing to experience a recovery in customer demand.

Higher levels of private sector output were overwhelmingly attributed to the reopening of the UK economy after the lockdown period in the second quarter of the year and a subsequent increase in both consumer and business spending.

"August's data illustrates that the recovery has gained speed across both the manufacturing and service sectors since July. The combined expansion of UK private sector output was the fastest for almost seven years, following sharp improvements in business and consumer spending from the lows seen in April," says Tim Moore, Economics Director at IHS Markit.

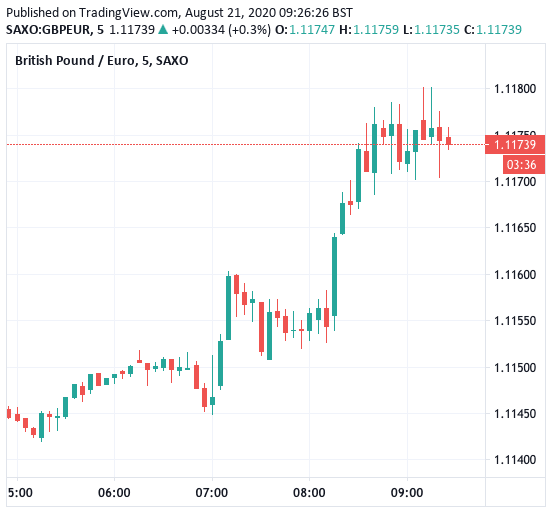

The Pound was seen higher against the majority of its peers following the numbers, with the Pound-to-Euro exchange rate looking particularly strong as the UK's PMIs contrasted sharply with those released for the Eurozone just half an hour earlier.

Eurozone PMI data disappointed across the board, suggesting the UK's economic recovery is now running hotter than that of the Eurozone and with foreign markets paying attention to the speed of respective economic recoveries, Friday's data understandably lend themselves to a firmer GBP/EUR:

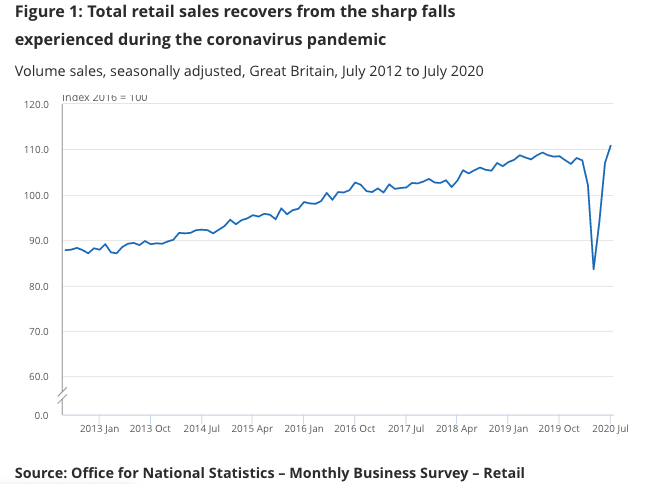

The Flash PMI data followed on from an equally supportive set of retail sales data which was released at 07:00 BST.

UK retail sales grew 3.6% between June and July, according to the Office for National Statistics, while sales grew 1.4% in the year to July, meaning retail sales are in fact now above they were before the economically damaging lockdown.

The recovery in retail sales will inject a shot of optimism into market sentiment regarding the UK economy's recovery from the covid-19 crisis and further underpin expectations that the Bank of England won't rush in to cutting interest rates any further in the near future, which is a net positive for Sterling.

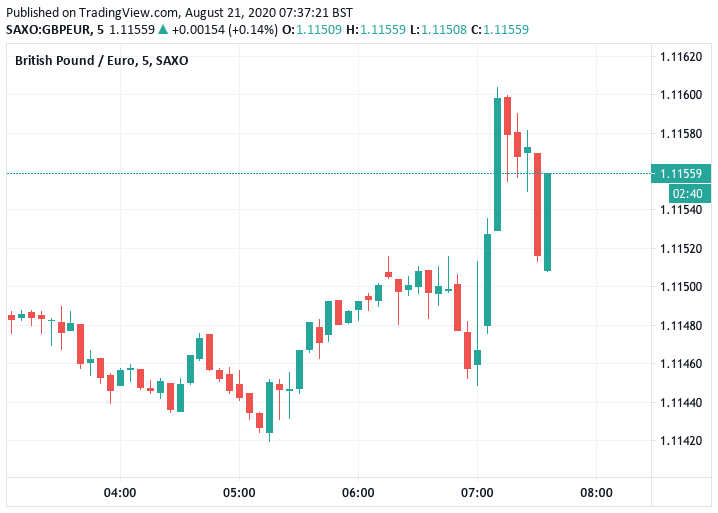

Above: GBP/EUR in the wake of better than forecast retail sales data.

"The broadly positive news will help keep the sterling rally alive however is unlikely to have any material impact as markets drift into the weekend. Many participants will be happy to sit on the sidelines after a busy week for GBPUSD," says Sam Cooper, Vice President of Market Risk Solutions at Silicon Valley Bank.

Looking ahead, economists remain cautious with regards to the UK's economic outlook as they believe the recovery will lose pace heading into year-end.

"We expect rising unemployment to put a brake on the recovery later this year," says Ruth Gregory, Senior UK Economist at Capital Economics.

The PMI data and survey responses reflect weak employment expectations, with businesses citing concerns about the speed and duration of the recovery. IHS Markit report this concern resulted in sustained job cuts across the private sector during August. "In contrast to the positive trends for output and new orders, latest

data indicated the fastest pace of decline in employment numbers," said IHS Markit.

"At 38.7 in August the composite employment index remains well below 50.0, suggesting the recovery in output hasn’t stopped firms from letting workers go. That is a key reason why we think that an impressive initial rebound of about +17% q/q in GDP in Q2, will give way to a much slower recovery in the second half of this year," says Gregory.