Pound-to-Dollar Rate Forecasts Upgraded after Parliament Prevails over Prime Minister

- Written by: James Skinner

© moofushi, Adobe Stock

- GBP/USD forecasts lifted at BMO after Parliament passes extension bill.

- The Benn Bill delays threat of 'no deal' Brexit but not on indefinite basis.

- Year-end forecasts lifted but GBP seen headed lower again in early 2020.

- Inevitable election risks another Tory-led coalition heading for 'no deal'.

The Pound-to-Dollar rate could continue to trade around its Monday level until year-end, new upgraded forecasts from BMO Capital Markets suggest, after parliament appeared to have prevailed in its push to force the Prime Minister into requesting another extension of the Article 50 negotiating window.

Opposition MPs, backed by rogues from within the governing Conservative Party,hijacked the parliamentary agenda and passed the 'Benn Bill' requiring Prime Minister Boris Johnson to seek a third extension to the Article 50 negotiating period. The request is contrary to government policy and passing of the bill opens a constitutional can of worms, but markets have celebrated because it delays a 'no deal' Brexit for at least a few more months.

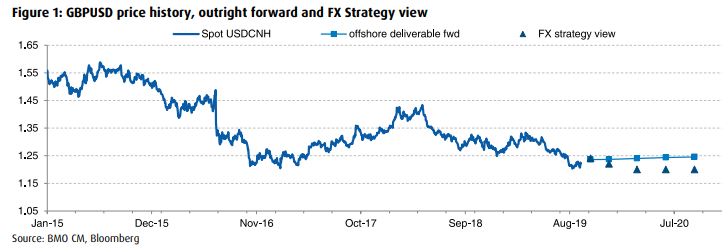

"Given the higher likelihood of another Brexit extension, we have moved our 3M & 6M GBPUSD calls up to 1.22 and 1.20 respectively," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "Our base scenario has been that a reset of the UK's parliamentary arithmetic is coming in the form of new elections. The events this week suggest the vote is likely to fall during the month of November, regardless of whether Brexit is delayed or not."

Above: Pound-to-Dollar rate shown at daily intervals.

The Benn Bill cleared both houses of parliament last week and was set to receive Royal Assent on Monday, although it will not become law unless and until it does receive assent, which is a process that is still entirely under the control of the Prime Minister. It's passing of parliament has already led the government to see its numbers in the House of Commons fall by 21 after rogues who backed the bill were ousted from the party.

If it becomes law, markets are expected to quickly focus on the prospect of an election that will not only determine whether or not Brexit goes ahead in the short term, but also the future composition of the UK's typically two-party political system in more ways than would normally be the case. With both major parties having pledged unequivocally in their 2017 manifestos to 'respect the result of the referendum', their actions in parliament since the previous poll have been deeply damaging to both.

"It is quite likely that this election will determine the future shape of the UK's multi-party structure and the Conservative Party itself. Our best judgment at this early stage is that the result will be a Tory-led coalition with a modest majority. But if this week has taught us anything it is that even a split pro-Remain caucus can blockade effectively, regardless of the constitutional implication," Gallo says.

Above: BMO Capital Markets graph showing GBP/USD forecasts and FX forward rates.

The openly anti-Brexit and once-vanquished-to-the-margins Liberal Democrats have now built themselves into a credible contender for government by pledging to overturn the June 2016 referendum result, although it's not yet clear the exact road they will take. Meanwhile, the Brexit Party led by Nigel Farage has quickly built itself into a contender to represent the 'Leave' side in parliament and is threatening to take votes that would typically have gone to the Conservatives.

This has left what was once as a matter of routine, a two-horse race, into a four-way face off that has made predictions of the likely outcome increasingly difficult to make. Polls have shown the Conservatives rising in popularity among voters since Boris Johnson took over the party in late July but former PM Theresa May had 16% poll lead at the time when the 2017 election was called only to be lumbered with a hung parliament by the time the ballot was done.

"The GBP-negative side of a Tory majority is that it raises the likelihood of a WTO Brexit, especially if it involves an agreement with the Brexit Party. A proRemain coalition would seek to revoke Brexit, but it could also be unwieldy and contain far left-leaning policies," Gallo warns. "A workable Tory majority could lessen any economic costs of a WTO Brexit."

Above: Pound-to-Dollar rate shown at weekly intervals.

BMO's Gallo said in February, when the Pound-Dollar rate was above 1.33 and at its highest for around a year, that he was making a "no deal Brexit by accident" and a fall all the way down to 1.21 in the Pound-to-Dollar rate his "base case" for this year. At the time, markets were clinging to the hope the UK would still either leave the EU with a withdrawal agreement, while some had speculated the country might not even leave at all.

He was among the first, if not the first, to foresee repeated parliamentary failures to pass the EU withdrawal agreement followed by a gridlock that ultimately leads the UK out of the EU without any withdrawal agreement. Now, Gallo has a new take on how the process is likely to evolve, which he forecasts will see the Pound-Dollar rate back around 1.22 at year-end before falling back to 1.20 in March 2020, where it's seen remaining until year-end.

The new forecasts are upgrades from projections of 1.16 and 1.15 that were issued for year-end and March 2020 respectively at the end of July, when an a 'no deal' Brexit appeared to be the working assumption of the new government led by Boris Johnson.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement