New Zealand Dollar: GBP/NZD Uptrend Boosted by Dairy Price Figures

The GBP to NZD conversion maintains its uptrend as global dairy prices keep a lid on the value of New Zealand's main export.

News that diary prices have taken another plunge has seen the New Zealand dollar fall.

The Global Dairy Trade Price Index fell 7.9% to an average price of $2345 USD/MT from the last auction held at the start of the month.

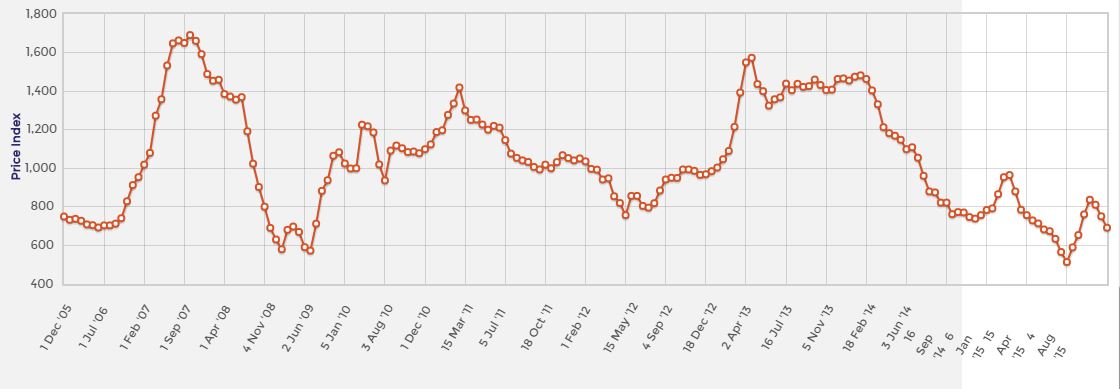

It seems that the recovery witnessed from the record 4th August low is now over. If we consider the chart below, the downtrend is certainly in place but breaking below the 2008/2015 lows will be a hard ask in our opinion based on technical observations:

The reaction by the New Zealand dollar is notable with the pound sterling to NZD exchange rate rising to 2.3527 ensuring the recent uptrend remains alive.

"Core CPI was a tenth higher than expected in the UK supporting GBP against a NZD weighted upon by lower commodity prices. For now this cross looks like it will head lower," say ANZ Research of the NZD to GBP equation.

The kiwi has fallen to 0.6467 against the US dollar while the euro has pushed its exchange rate to 1.6492.

The continued poor performance in the dairy sector is one reason why the Reserve Bank of New Zealand (RBNZ) may have to lean on the levers and cut interest rates over coming months.

"The low run of dairy prices looks set to consign the dairy sector to another dismal season and the key for Fonterra’s current $4.60/kg MS milk price forecast will be how long the current downtrend persists," say ANZ Research from Aukland.

ANZ cite the broader commodity sector declines as being the main driver to NZD weakness describing the dairy auction’s impact on the currency as being, “within the range of expectations.”

However, Fonterra believe that dairy prices will start rising once more before long.

"We certainly expect it to start moving up over the coming months," says Fonterra’s Chief executive Theo Spierings.

Fonterra say a persistent oversupply of milk on global markets, which has almost halved the prices of several key dairy commodities, was now waning.

Spierings said the rate of milk production growth in big dairy exporting countries had eased, with New Zealand falling 1 per cent and both the European Union and United States slowing to 1 per cent growth from January to August 2015.

Whether or not the RBNZ will bank on this assumption remains to be seen.