New Zealand Dollar Retreats as Collapsing Business Confidence Stokes Fears of RBNZ Rate Cut

- Written by: James Skinner

© Naru Edom, Adobe Stock

New Zealand's Dollar went into retreat Tuesday after another survey showed business confidence collapsing to its lowest level since the financial crisis, prompting analysts to warn of ebbing momentum in the economy and a possible rate cut from the Reserve Bank of New Zealand (RBNZ).

The New Zealand Institute of Economic Research (NZIER) business confidence index fell to -30 during the third quarter, down from -20 for the three months ending in June, which marks its lowest ebb since the first quarter of 2009.

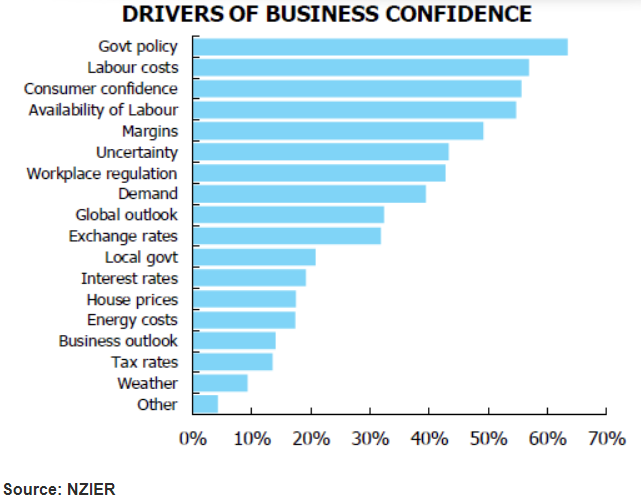

Companies cited government policies as being behind the decline, with those in the retail, manufacturing and construction sectors singling out staff shortages, costs and consumer confidence as being behind their own pessimism about the general business environment over coming months.

However, and more importantly, declines in firms' own activity and expectations for their own performance in subsequent quarters were equally as pronounced. Just 0.4% of firms reported a pickup in their own activity, which is a better indicator of GDP growth, for the September quarter according to the NZIER.

"We found Government policy, labour costs, consumer confidence, availability of labour and operating margins were the key considerations for businesses when it came to an assessment of general economic conditions. Larger firms were more influenced by Government policy when assessing the general business outlook," says Christina Leung, chief economist at NZIER. "This suggests uncertainty over the effects of new Government policies and higher costs have contributed to the decline in business confidence over the past year."

Above: NZIER graph showing concerns of New Zealand business in order of importance.

Kiwi business confidence has been low ever since September 2017, the month of New Zealand's last election, which marked the beginning of a process that culminated in the Labour Party entering office alongside coalition partner New Zealand First.

Coalition has given Labour the parliamentary majority needed to implement its cocktail of left-leaning and "populist" policies that have included a 20% increase to the minimum wage by 2020, the cancellation of corporate tax cuts and roll-out of various new welfare programmes.

Slashing migration and shutting foreign buyers out of the market for existing residential properties have also been among its early priorities.

"Today’s data are consistent with a softening in annual GDP growth – challenging the RBNZ’s outlook for acceleration in the second half of the year. We continue to believe the next OCR move is more likely to be a cut," says Liz Kendall, a senior economist at Australia & New Zealand Banking Group (ANZ).

Above: NZD/USD rate shown at daily intervals.

The NZD/USD rate was quoted 0.30% lower at 0.6584 Tuesday although the Pound-to-New-Zealand-Dollar rate was down 0.34% at 1.9682, denoting a weaker Sterling.

Above: Pound-to-New-Zealand-Dollar rate shown at daily intervals.

Tuesday's data from the NZIER tallies with the broad thrust of the monthly ANZ business confidence surveys from the recent quarter. Those have also shown confidence declining to post-crisis lows in June and July, although the latest report detailed a bounce-back in September.

This matters for the Kiwi Dollar because the business surveys are pointing to a loss of economic momentum during the second half of the year. And the Reserve Bank of New Zealand has made clear that it wants to see a clear pickup in economic growth during that period if an interest rate cut is to be avoided over coming quarters.

New Zealand's economy grew by 1% during the three months to the end of June which, up from 0.5% at the beginning of the year, was more than twice the 0.5% expansion the RBNZ had forecast. However, the jury is still out on the likely pace of growth ahead.

For the RBNZ, which has been fighting against below-target inflation for a number of years now, waning economic momentum is a problem because slowing growth will only serve to sap more inflation pressure from the economy.

Changes in interest rates, or hints of them being in the cards, are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

"The NZD has been one of the worst performing currencies this year, largely reflecting a deterioration in the domestic economic picture which has seen the market embrace the possibility that the RBNZ could cut interest rates," says Daniel Been, head of FX strategy at ANZ.

The New Zealand Dollar has fallen by 7% against the U.S. greenback this year and by 3.2% against Pound Sterling. In fact, the Kiwi has ceded ground to most of its G10 rivals during the 10 months to the beginning of October.

This is thanks largely to the deteriorating outlook for New Zealand interest rates and market unease over President Donald Trump's trade war with China, which has seen commodity-sensitive currencies like the Kiwi shunned by investors.

"NZD/USD will continue to trade on the defensive this week on more evidence of softer global economic activity. The global and China’s manufacturing PMIs eased to multi-month lows in September. Consequently, the IMF is expected to cut its global growth outlook next week," says Elias Haddad, a currency strategist at Commonwealth Bank of Australia.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here