The Indian Rupee Peaks as Markets 'Sell the Fact' of Modi's Crushing Win, but Bigger Gains are Coming

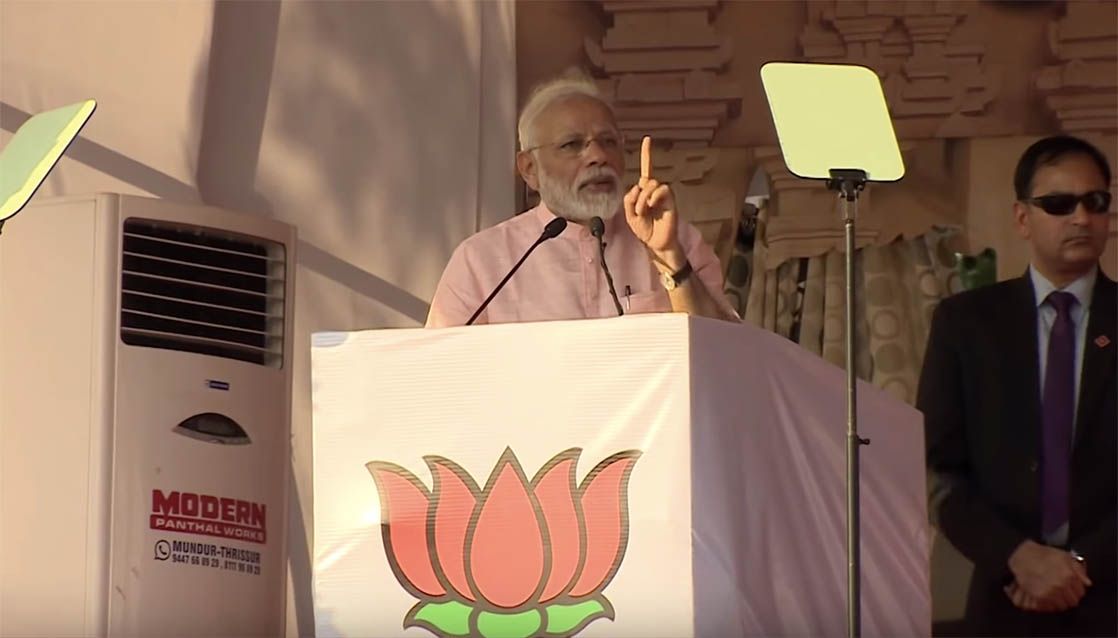

Image © Pound Sterling Live, Still Courtesy of BBC

- INR peaks as Modi seals victory

- More gains still likely over 1-2 months

- Reforms may take time to impact positively

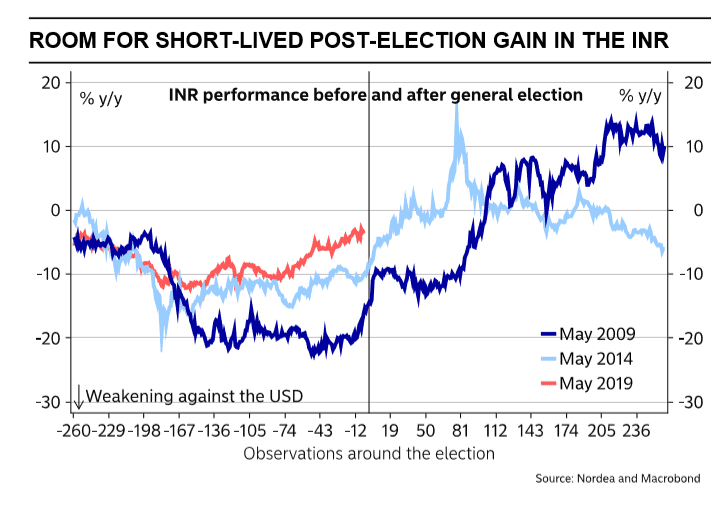

The Indian Rupee appears to be unwilling to push fresh highs against the Pound, Dollar and other major currencies with markets exhibiting some classic 'buy the rumour, sell the fact' on the convincing victory by Narendra Modi in just-held elections.

The currency playbook suggests the win for Modi should provide the Rupee with a boost but 1) the Rupee has been rallying over recent days, suggesting markets saw the result coming, and 2) markets will want to see the details of Modi's intended reforms now he has a new mandate.

The Pound-to-Rupee exchange rate is quoted at 88.19 but had been as low as 87.66 earlier in the day.

The Dollar-to-Rupee exchange rate is quoted at 69.69 but had been as low as 69.38 earlier in the day.

Modi's BJP has swept back to victory with a resounding majority of well over 300 seats, easily exceeding expectations.

The Modi win is positive for the Rupee because currencies tend to react positively to the status-quo being maintained while Modi's pro-market reform agenda is seen as laying the ground for improving economic performances in the Indian economy.

“Overall, the Modi win should be good for markets, as long as new reform initiatives will not be too long in coming. The result is also particularly relevant in the current global environment where EM investors are primarily worried about Chinese trade and pressure on Asian IT supply chains. India is a relatively closed economy, with limited vulnerability to these issues," says Maarten-Jan Bakkum, Senior Emerging Markets Strategist at NN Investment Partners.

Where the Rupee and Indian assets go next is now largely dependent on how effective Modi is at delivering reforms.

"Overall, the Modi win should be good for markets, as long as new reform initiatives will not be too long in coming," says Bakkum.

“India is not expected to see a sharp growth acceleration anytime soon, which limits the room for large gains in the Rupee. A few years down the line, a more liberalised economy will likely attract more foreign capital and boost the INR's long-term potential,” says Amy Yuan Zhuang, chief analyst at Nordea Markets.

Not all the reforms Modi is planning are likely to bring short-term affluence, and there may even be some growing pains in store for the economy which will curb short-term growth and the strength of the Rupee. Longer-term, however, beyond about two years, Nordea see the Rupee as a good bet.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

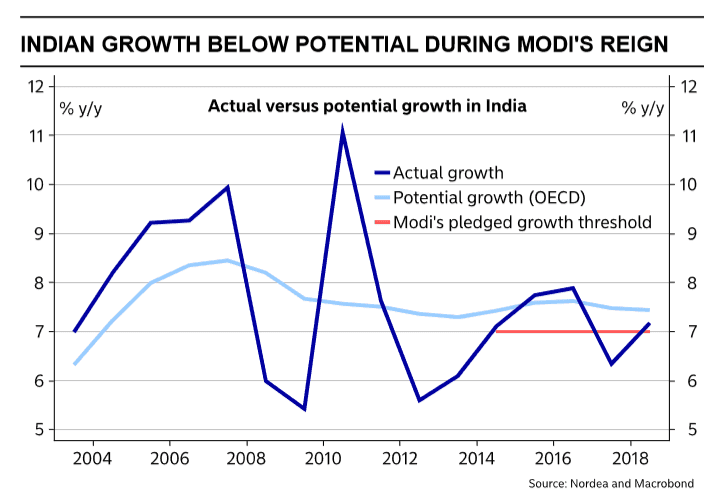

Zhuang’s main reason for expecting slower growth over the next two years is the delaying effect of bureaucracy on Modi’s attempts at reform and his past track record.

“While the Indian Rupee will likely gain versus the Dollar in the coming few months as election uncertainties evaporate, its upside potential on a two-year horizon is limited as the pace of reforms is not expected to exceed that of the past five years,” says Zhuang.

The reforms made over the past five years have had a mixed effect on growth and the economy. Real GDP has averaged about 7.0% which although world-leading, is nevertheless, not all that high compared to India’s historical average, says Yuan Zhuang.

“The failure to lift growth above its potential rate indicates to us that the government has not removed the structural blockades faced by the economy,” says the analyst.

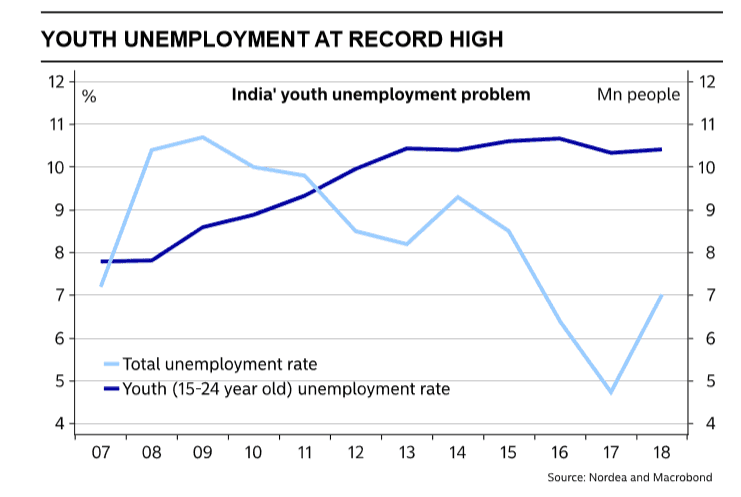

Modi’s track record on the labour market is, “even less impressive” with employment standing still. Unemployment has risen to 7.6% and youth unemployment to 10.4%.

As far as the other reforms implemented over Modi’s first term, few appear to have had a positive impact on growth.

Reforms to the farming sector failed to meet expectations. Farmer’s incomes have not doubled as was promised and the sector is hampered by rising costs and falling prices as bumper harvests create an oversupply.

One high profile reform which actually lowered growth was demonetisation as it lowered the cash in circulation and hit cash dependent rural economies.

The goods and services tax was another well-documented reform but it was found to be complicated and difficult to manage.

Reforms to insolvency laws aimed at speeding up the bankruptcy process failed to lower the average time below 4.3 years, although it may be a little early to judge.

Modi’s ‘Make in India’ initiative met with better success and saw large foreign investment inflows.

“The government's efforts in easing foreign direct investment (FDI) restrictions, quickly approving infrastructure projects and reducing bureaucratic procedures were rewarded with an improved ranking in the World Bank's ease of doing business index and soaring FDI inflows to India. However, the efforts have not yet led to an industrial boom,” says Zhuang.

India could gain from the fallout between China and the U.S. as many companies ponder moving their factories out of China. India’s huge cheap workforce is an obvious allure.

Better transport infrastructure is considered a high priority reform which enable more rapid growth and prosperity, says Yuan Zhuang.

No reforms are planned to deal with the high 12% level of non-performing loans held by Indian banks, however, even though this is a major risk factor for the economy.

Nevertheless, the Rupee is an attractive long-term play, says the analyst.

“The INR remains attractive on a horizon beyond two years, in our view, benefiting from the economy's vast potential, net capital inflows and the government's efforts to diversify the economy. More manufacturing exports should help counterbalance the large oil imports and reverse the current account deficit to a surplus.”

Pound-to-Rupee Outlook

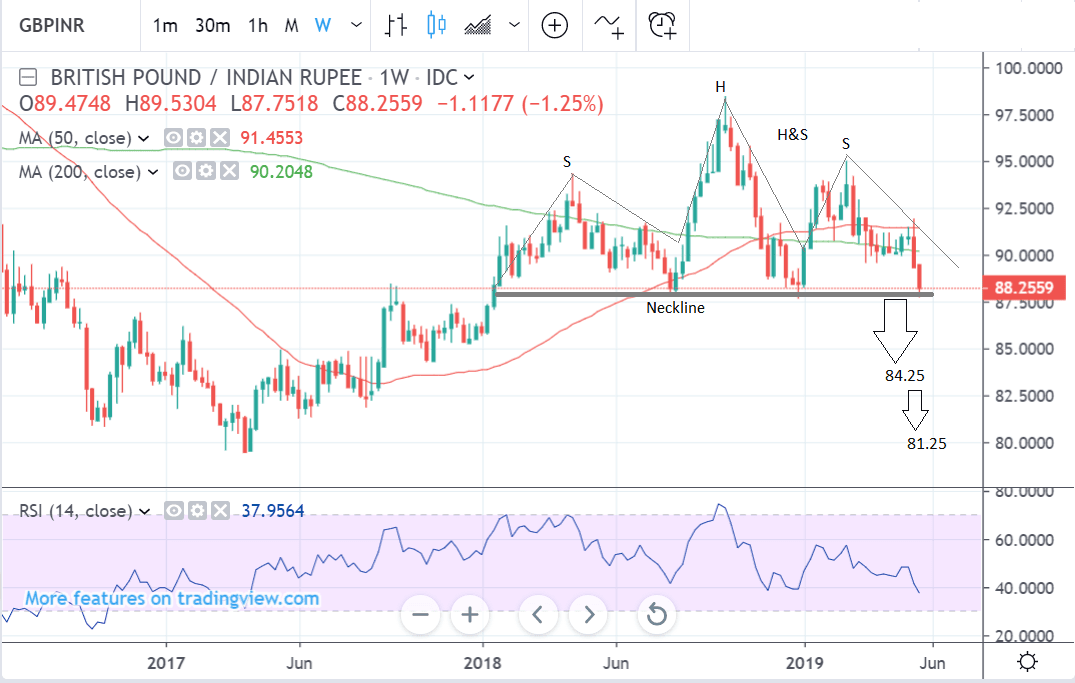

From a technical perspective GBP/INR is poised to break down to the lower 80s. It has already fallen to a key level at the 2019 lows, at 88.00, which is also the neckline of a potential bearish head and shoulders (H&S) topping pattern.

A break below the neckline would give the go-ahead for a decline down to a target at roughly 84.25, at the level of the 200-month MA, a key support level for the pair. This could happen with the next two months.

A further decline is also possible to another target at 81.25, based on a percentage of the height of the pattern extrapolated lower. This might take a longer 3-6 months to achieve.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement