Swedish Krona Rebounds against the Pound: Mama Mia Here We Go Again

Image © Adobe Stock

- Swedish Krona rises after surprise increase in Q2 growth

- SEK extremely undervalued but if growth returns Riksbank could start raising rates

- Wildfire damage is a potential spoiler

The Krona (SEK) strengthened to a six week high against the Pound on Monday after Sweden’s economic growth accelerated more than forecast in the second quarter of the year.

GDP rose by 1.0% in the three months to June 2018, compared to the first quarter, which itself was revised up 0.1% to 0.8%.

The increase also beat consensus expectations from a Thompson-Reuters poll of economists who had expected growth to rise only 0.5% in Q2.

The more than double expected increase was driven by 'household consumption', which increased 0.9%, government spending, which rose by 0.2%, and net trade after exports which went up 0.5% (vs -0.2% in Q1) while imports fell 0.1% (vs 0.6% in Q1).

"Sweden’s economy roared ahead in the second quarter of the year driven by a boom in consumer spending, giving the krona a lift and defying expectations for a moderation in the pace of economic growth in the Scandinavian country," says Cat Rutter Pooley, a correspondent for the Financial Times.

At an annual rate the economy grew by 3.3% in Q2 compared to the same quarter in 2017, which comfortably beat the 2.6% expectation.

"The krona strengthened as much as 0.7 percent to 10.2313 per euro. The Swedish currency has advanced 2.1 percent this month, the best performance among the Group-of-10 exchange rates," says Anooja Debnath, a correpsondent for Bloomberg News.

Hike Back on The Cards

The strong growth in Q2 increases the chances the Riksbank will raise interest rates from their current supper-low level of -0.5% - the second lowest in the world after Switzerland.

A rise in interest rates is likely to drive up the value of the Krona as rising interest rates increase inflows of foreign capital. Higher interest rates make a country a more attractive destination for investors to park their cash and vice versa for low rates.

The minutes from the July Riksbank policy meeting also suggest a marginal but potentially crucial shift in stance towards hiking interest rates after Ricksbank member Henry Ohlsson, joined sole hawk Martin Floden in floating the idea of a change in policy, in a marked changed from previous meetings when Floden had stood alone.

Higher inflation from rising electricity and food prices after the drought and wildefires ravaged the Swedish countryside may also contribute to higher interest rates expectations.

The drought dried up hydro-electricity dams and reduced the supply of power from the country's many hydro-electric plants, whilst wildfires ravaged the countryside, ravaging crops and leading to a major agricultural crisis, which is likely to increase food inflation.

At the same time, although Q2 growth beat expectations Q3 growth may undershoot them as a result of the damage caused by natural disasters, and this may make the Riksbank cautious again.

Seriously Undervalued

Speculators have been stalking the Krona for a while now due its bargain potential.

The Swedish currency is the most undervalued currency in the G10 on a Purchasing Power Parity (PPP) valuation basis, which suggests it could offer speculators a bargain.

The Krona was -45.8% undervalued on a PPP basis on July 17, substantially more than the next weakest currency the Japanese Yen, which itself was 33% undervalued.

This made it a buying opportunity according to analysts at Barclays, due to this gross undervaluation.

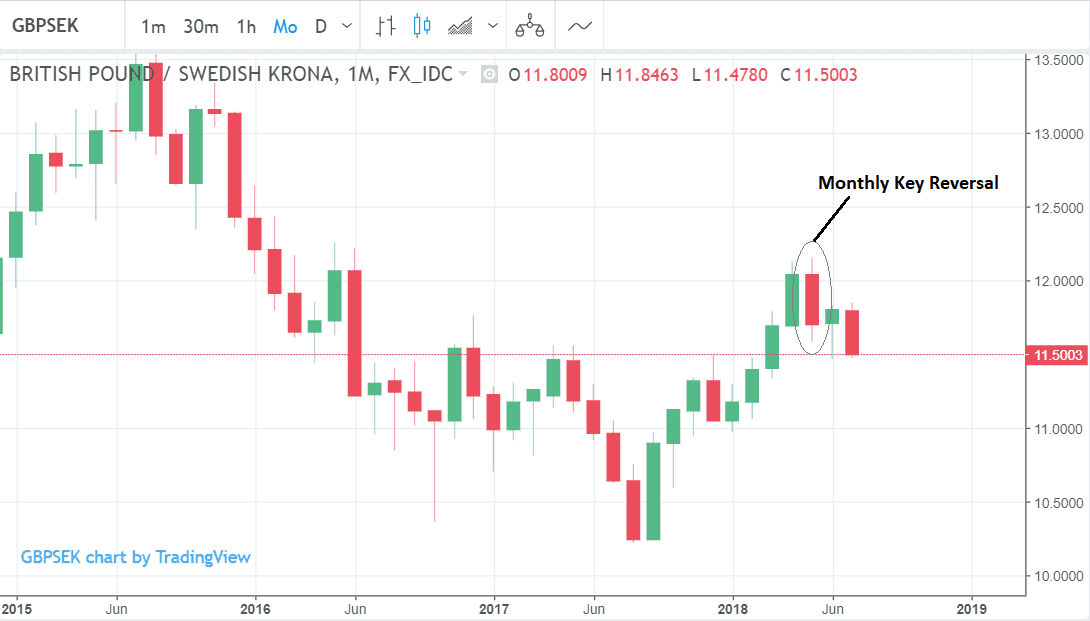

Add to this several major techncial indicators on the price charts such as a bearish monthly key reversal in May on GBP/SEK, and overall the Krona is looking more and more like a potential buy candidate.

Is the growth overshoot in Q2 the sign investors have been waiting for to pull the trigger?

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here