British Pound Options Market in a ‘State of Panic’

Research from ABN Amro has revealed a notable divergence in performance between the spot market for pound sterling and that of the options market.

The spot market in pound sterling - i.e the exchange rates we are used to observing on a day-to-day basis, appear relatively stable with a mere twenty days to go until the UK votes on continued EU membership.

I say ‘relatively’ because the ups and downs witnessed at the turn of the month will appear anything but stable for someone who is closely watching the major GBP pairs.

The options market - i.e the market for contracts on the pound - is meanwhile described by one analyst as being in a state of panic.

The options market is where corporates and investors go to in order to hedge against falls in sterling, particularly in the event of the UK voting to leave Europe.

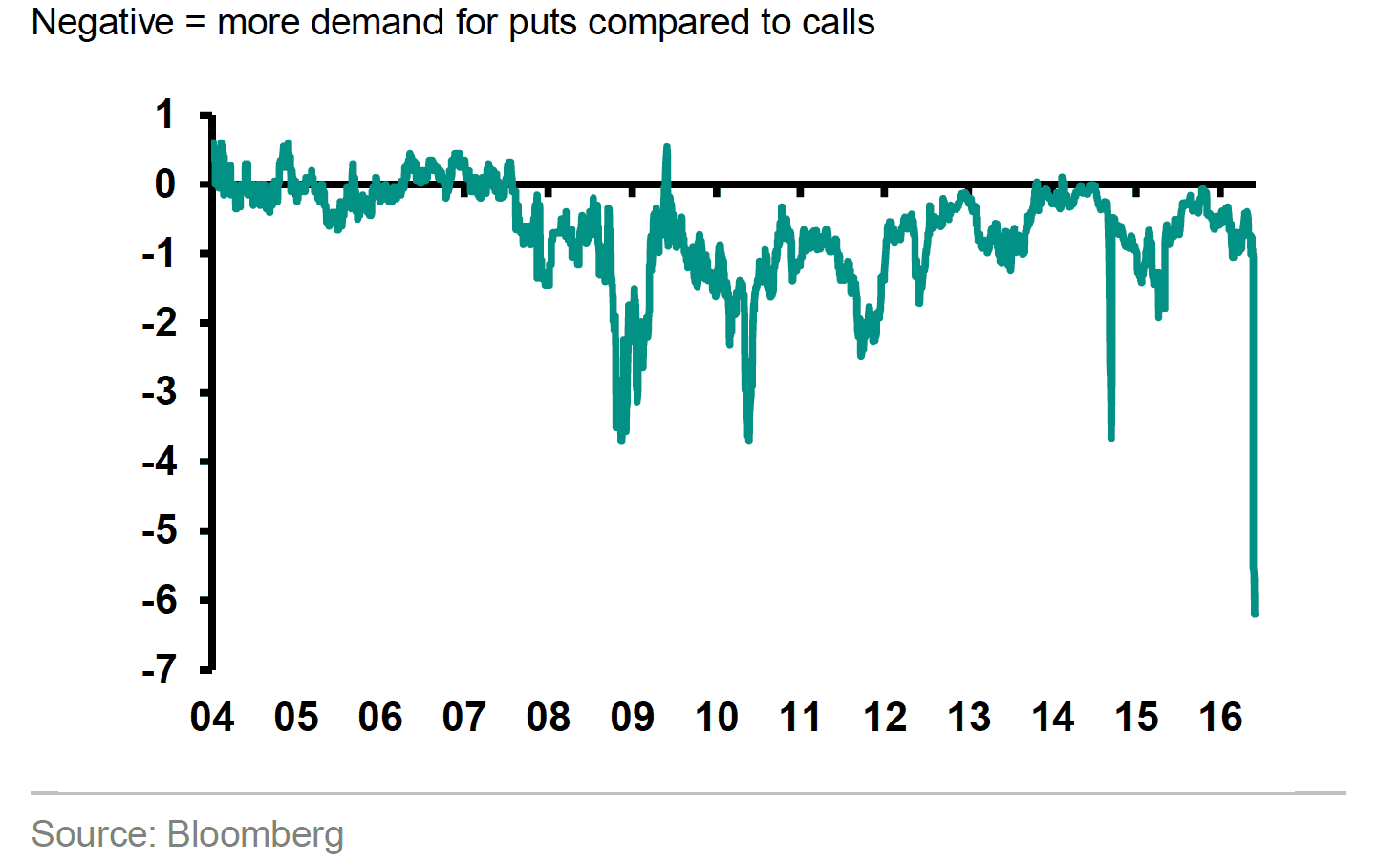

Demand for hedges has risen sharply resulting in levels not seen since 2004 (the preference for puts over calls has risen to extreme levels) and the referendum is still more than three weeks away.

Often such activity impacts the spot market as well, but analysts at ABN Amro contend that the turmoil in underlying spot markets is not yet being felt.

In fact, analysts have suggested the options market is “boiling below the surface.”

Why?

“The depth in the spot market could currently be large enough to absorb these option market related flows,” says Roy Teo, an analyst with ABN Amro, the Dutch lender.

Another reason suggested by Teo could be that at this point in time market makers are not unwinding these positions.

If so, they may do this at a later stage or after result of the referendum is known.

Teo reckons that if the outcome of the vote were to be Brexit then a sharp sell-off in the spot market will likely be the result.

In the event of a Remain vote then the opposite move would be likely as these cautionary bets are unwound.

ABN Amro are forecasting the GBP to USD exchange rate to end 2016 at 1.48 while the EUR to GBP rate is forecast to close its account at 0.78 (or 1.2820 in GBP/EUR terms).