Pound Sterling to Extend August Losses against Euro and Dollar if Inflation and Wage Figures Undershoot

- Written by: Gary Howes

- Pound has underperformed Euro and Dollar in August

- This trend would extend on soft wage, inflation data

- But downside likely limited in wake of Friday's GDP surprise

Image © Adobe Images

The British Pound is set for a volatile week ahead with the release of inflation and wage data that will determine how many further interest rate hikes the Bank of England has left in the tank.

Foreign exchange markets are currently highly reactive to differences in interest rates and interest rate expectations of various economies, and the Pound has been driven higher for much of 2023 by the Bank of England's aggressive rate hiking cycle.

But of late the Pound has waned in value against the Euro and Dollar as the market reduced bets for future BoE rate hikes following July's surprising below-consensus inflation release which suggested the UK's inflationary problem is finally easing.

Market participants will be looking for further evidence disinflationary trends are in motion.

"Next week is a key one for the pound, expect some pre-CPI positioning to dominate in GBP trading and volatility to pick up," says Francesco Pesole, FX strategist at ING Bank. "The focus is firmly on services inflation and wage growth."

Tuesday sees the release of average earnings data for June where a 7.2% increase is anticipated by market participants as wage growth accelerates from the previous month's 6.9%, which proved to be a Pound-boosting surprise.

Wages are a key component of domestic inflationary trends and should wages come in above expectation then markets would likely price in higher odds of a November interest rate hike at the Bank of England, which would boost the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

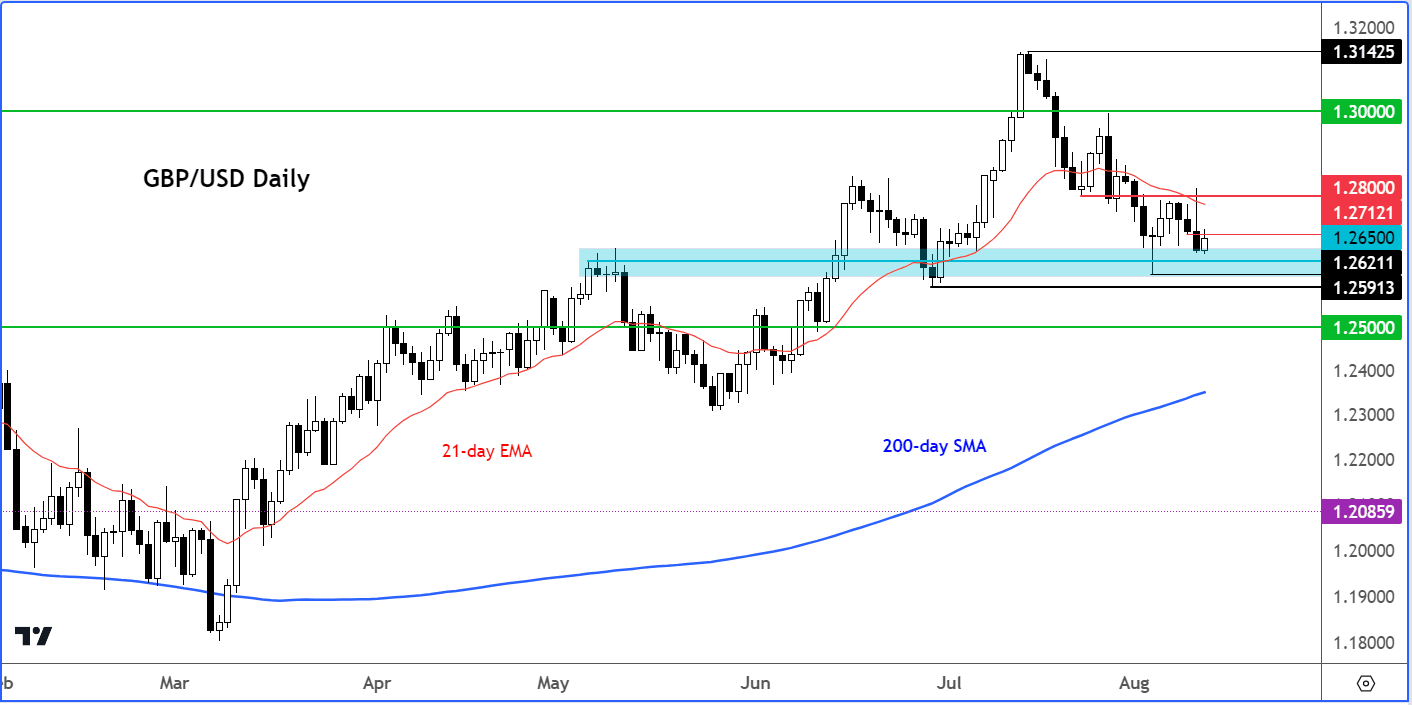

An undershoot would have the opposite impact and the Pound to Euro exchange rate would extend its current bout of short-term weakness to below Friday's 1.1536 low. The Pound to Dollar rate has also been trending softer and could break below key support at 1.2680 (see more on this below).

"Most anecdotal evidence suggests that wage pressure may be starting to diminish, at least in the private sector, but the evidence is not yet fully convincing," says Philip Shaw, an economist at Investec.

"While we remain convinced that wage trends will ease back in due course, we concede that the story for the time being is one of continued upside risks and with it the probability that the Bank of England has not quite finished raising interest rates," he adds.

The unemployment rate is expected to remain at 4.0%, but should it rise the Pound could soften given this suggests the labour market is starting to ease which would be a precursor to softer wage dynamics.

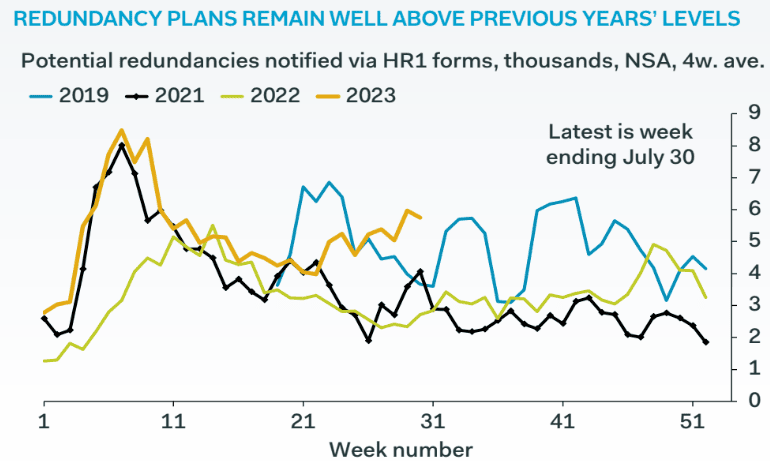

"The timeliest labour market data continue to suggest that the Monetary Policy Committee is too optimistic in expecting unemployment not to reach 4.25% — its estimate of its equilibrium rate — until Q2 2024," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics who notes evidence that redundancies are likely to pick up over the coming months:

Above image courtesy of Pantheon Macroeconomics.

Wednesday brings with it the highlight of the month's docket in the form of inflation data, where a headline figure of 6.7% year-on-year is expected to be reported as inflation drops sharply from 7.9% in the month prior.

"The sharp fall in headline inflation in July is set to be driven by non-core components, specifically energy, and to a lesser extent food," says Abbas Khan, an economist at Barclays. "Reflecting previous falls in market energy prices, the Ofgem price cap decreased in July such that the average annualised household energy bill fell."

The Pound's reaction will depend on the scale of the deviation in either direction: the Pound fell and entered a short-term downtrend against the Euro and Dollar in the wake of July's inflation release that prompted markets to price out aggressive bets for the number of rate hikes still to come.

Core CPI inflation is expected to read at 6.8% and services inflation - another key metric for the Bank - is expected to print at around 7.2%, unchanged on the previous month.

"The Bank of England, meanwhile, remains firmly focused on services inflation and wage growth. We will have data on both fronts in the week ahead, which should impact the GBP/USD in the direction of the surprise," says Fawad Razaqzada, an analyst at City Index.

"The bulls have bought the dip again, defending key support in the 1.2680-1.2700 range once more," says Razaqzada of the Pound-Dollar exchange rate's most recent price action:

Image courtesy of City Index.

Markets are currently positioned for a September interest rate hike, but a November move is not yet fully 'priced in' and this is where the action for fixed income and foreign exchange market lies.

Should this week's data come in on the stronger side then bets for a November hike would likely firm and offer the Pound support, but weaker data would diminish such odds, in turn weighing on the Pound.

The UK currency nevertheless enters the new week with some positive momentum courtesy of Friday's strong economic figures that showed the economy unexpectedly rebounded by 0.5% in June.

The performance meant the economy expanded 0.2% in the second quarter, defying expectations for no growth.

But it was the broad-based strength seen in the June figures that underscored the Pound's recovery, with the rebound being led by manufacturing and subcomponents such as businesses investment and construction also pulling weight.

The data suggests the UK economy continues to perform in a robust fashion, despite previous interest rate hikes, potentially offering some downside protection for the Pound in the event the coming week's data undershoots.

"GBP had a decent bump overnight with a 28bps gain on the back of a relatively positive data dump out of the UK. The data in the UK has held up rather well throughout this whole cycle despite the trauma of Liz Truss and super fast rate hikes," says Brad Bechtel, Global Head of FX at Jefferies LLC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes