Pound Sterling Rises against Euro and Dollar after UK Economy Defies the Pessimists

- Written by: Gary Howes

Image © Adobe Images

The UK economy was firmly back in growth territory in June according to the latest GDP figures from the ONS which also revealed a solid uptick in quarterly and annual growth.

The British Pound jumped in an initial reaction to news the economy grew 0.5% in the month of June, overturning May's -0.1% shrinkage, and beating expectations for a reading of 0.2%, with the ONS saying a rebound in production was largely behind the surprise.

The quarterly data roundly beat expectations with the second quarter seeing growth of 0.2%, which was more than the flat 0% the market expected and up on the first quarter's 0.1%.

In the year to the end of the second quarter, the economy grew 0.4% said the ONS, which was more than double the rate of the first quarter and expectations for 0.2%.

"The UK economy continues to surprise on the upside, evidenced by GDP unexpectedly rising through the second quarter. This is a feature we are seeing around the world and the UK is joining in. It gives the Bank of England a headache though, they may well have been thinking about pausing interest rate increases soon, but this data will make that more difficult," says Neil Birrell, Chief Investment Officer at Premier Miton.

There was further good news with both industrial (1.8% m/m) and manufacturing production (2.4% m/m) returning to growth in June while business investment jumped an unexpected 3.4% in the q/q in the second quarter, surpassing expectations for 0.8% growth.

"Sterling slipped yesterday but has initially bounced this morning against both the euro and the US dollar after the better-than-expected GDP figures," says Rhys Herbert, an economist at Lloyds Bank.

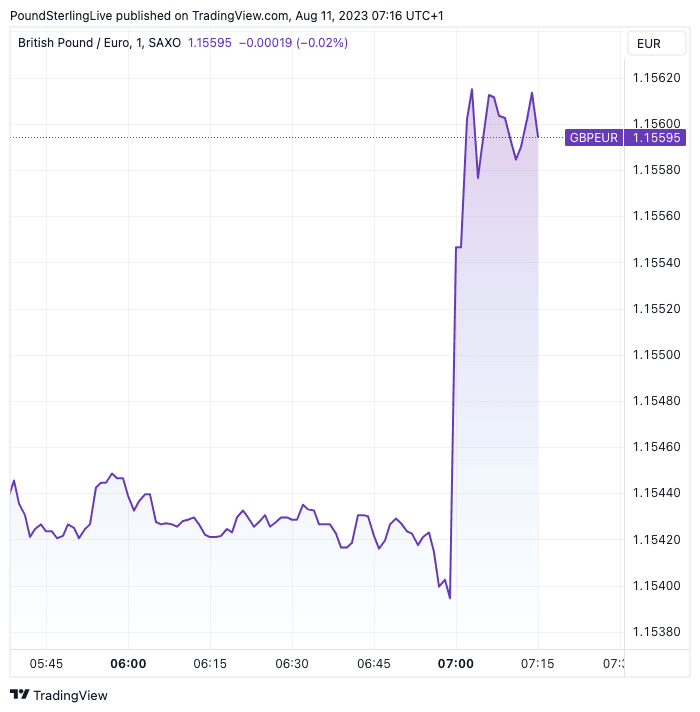

Above: GBP/EUR at one-minute intervals showing the post-GDP release reaction.

The Pound to Euro exchange rate rose to 1.1560 on the back of the release - from 1.1534 prior - as the data suggests the Bank of England can proceed with another rate hike in September, and potentially November, on the basis the economy is thus far handling higher interest rates.

The Pound to Dollar rose from 1.2684 to 1.27. Regular readers of Pound Sterling Live who read our preview piece out Thursday won't be surprised by today's market developments as we based the piece around one of the UK's most accurate economists who said GDP was likely to have turned a corner and was set to see improvement heading into year-end.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, extends his upbeat assessment of the economic outlook following today's figures by saying this is "probably the start of a sustainable recovery."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A surprise beat from the UK economy is seeing sterling make some advances this morning. Industrial output rose much higher than forecast, showing a 1.8% monthly increase against expectations of a 0.2% advance," says Charles Hepworth, Investment Director at GAM Investments.

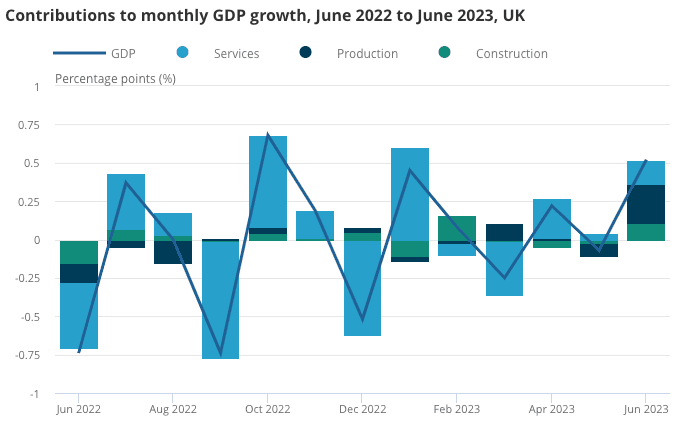

Service output grew 0.2% in June 2023, following no growth in May 2023, unrevised from the previous publication, but it was production that was the largest contributor of growth as output grew by 1.8% in June 2023, following a fall of 0.6% in May 2023. This was the largest contributor to the growth in GDP in June 2023 and the strongest growth seen since August 2020 said the ONS.

Service output grew 0.2% in June 2023, following no growth in May 2023, which was unrevised from the previous publication.

The ONS said monthly GDP is now estimated to be 0.8% above its pre-COVID-19 levels (February 2020) as services showed 0.1% growth in the three months to June, while production grew by 0.7% and construction grew by 0.3% over this period.

Looking ahead, Tombs says the UK still has more work to do when catching up with other nations as the quarter-on-quarter measure of GDP has not yet caught up to pre-Covid levels (recall the monthly measure has surpassed this level).

He says households probably will build upon Q2’s 0.7% quarter-on-quarter increase in their real expenditure, "we expect households' real incomes to continue to rise further, as prices continue to rise less quickly than wages."

Pantheon Macroeconomics expects the economy to avoid a recession with GDP rising by 0.3% quarter-on-quarter in both Q3 and Q4.

"Forecasters have long predicted a recession that has yet to arrive. The economy may continue to find a way to muddle through. News of wage growth surpassing inflation for the second half of the year May provide the confidence the economy needs to avoid falling into recession," says Jonathan Moyes, Head of Investment Research, Wealth Club.

Despite the upbeat figures, economists at independent research house Capital Economics say they still anticipate the economy to slide into recession in 2023.

"With much of the drag from higher interest rates still to come, we are sticking to our below-consensus forecast that the UK is heading for a mild recession later this year," says Ruth Gregory, Deputy Chief Economist at Capital Economics.

"GDP will fall in Q3 and a mild recession will begin," she adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes