Pound Sterling Looks for a GDP Boost to Recapture Lost Levels against the Euro and Dollar

- Written by: Gary Howes

-

Image © Adobe Images

The British Pound could recover recently lost ground against the Euro and Dollar if GDP data for June and the second quarter comes in better than expected.

With the Bank of England in 'data watch' mode any signs of unexpected strength or weakness in the economy could influence a repricing in expectations for future interest rate developments, in turn impacting the Pound which has struggled thus far in August.

The market is looking for second-quarter GDP to have been unchanged on the first quarter but up 0.2% in the year to the second quarter. Growth is meanwhile expected to have picked up to 0.2% for the month of June.

An undershoot in expectations might trigger further weakness in the Pound which has entered a short-term spell of weakness against the Euro and Dollar, although it does remain in the ascendency against other members of the G10 complex.

Economist Samuel Tombs at Pantheon Macroeconomics says he expects to see signs of gradually improving trends in June's GDP figures.

"June’s GDP report, released on Friday, looks set to show that output is starting to edge up, after flatlining since mid-2022," says Tombs. "The underlying trend in GDP appears to have begun to improve."

The economist cites the S&P Global PMI and Lloyds Business Barometer surveys as pointing to GDP rising at a moderate pace in June, while the CBI’s Monthly Growth Indicator rose to a level that is no longer consistent with falling GDP for the first time in 11 months.

These findings open the door to a potential upside surprise in the figures that could boost the Pound to Euro exchange rate which on Wednesday slipped back below the 1.16 figure, although the Pound to Dollar exchange rate's performance will almost certainly be more of a function of Thursday's U.S. CPI inflation release.

But Tombs says there are some drags on growth that could yet disappoint, including the public health sector which was impacted by strike action.

The ending of the Premier League season is meanwhile anticipated to knock 0.03pp from GDP and the downturn in the construction sector - which is proving sensitive to higher interest rates - has likely not been captured by the more optimistic business surveys.

However, looking ahead, Pantheon Macroeconomics continues to think that GDP will pick up in the second half of this year, as households’ real incomes benefit from a sharp slowdown in the rate of price rises.

The headwind to aggregate disposable incomes from mortgage refinancing is expected to get "only slightly more intense" in the second half of this year.

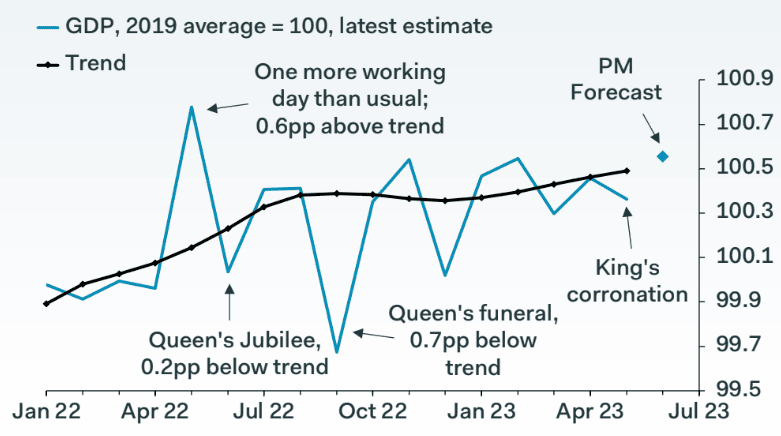

Above: "GDP likely picked up in June as working days returned to normal" - Pantheon Macroeconomics.

"Accordingly, we think the risk of a recession is declining and look for quarter-on-quarter growth in GDP of 0.3% in both Q3 and Q4," says Tombs.

Any boost, or otherwise, to the Pound stemming from Friday's economic growth figures will however likely prove limited given the looming jobs figures due next Tuesday and the inflation report due Wednesday.

The wage component of the former will be particularly crucial in that it will inform the Bank of England's newly minted message that UK interest rates are likely to remain higher for longer owing to a 'tight' labour market, a development which some currency analysts reckon is ultimately supportive of the Pound.

Therefore, any downside miss in the jobs figures could add to the dreary late-July and early-August trade experienced by the Pound.

The CPI release on Tuesday is meanwhile the highlight of the week given getting inflation lower is the Bank of England's ultimate aim, the figures will therefore bolster or lessen the chances that September is the final interest rate hike of the current cycle.