Pound Sterling Holds Weekly Advance against Euro & Dollar but December GDP Slump Underlines Poor Outlook

- Written by: Gary Howes

- UK economy shrank 0.5% in December

- But recession narrowly avoided

- Sterling holds weekly gains

- As global drivers in charge

Image © Adobe Images

The British Pound looked to defend a weekly advance against the Euro and Dollar as it was revealed the UK economy shrank by more than expected in December.

UK GDP declined 0.5% in December, which was deeper than the 0.3% decline the market was looking for.

The ONS said that overall the economy grew 0% in the final quarter of the year, meaning the UK has avoided a technical recession by a whisker. (A recession requires two consecutive quarters of decline, and the economy shrank 0.2% in the third quarter).

The data underscores the difficult position facing the UK economy which is widely expected to contract in 2023; expectations that continue to harm investor sentiment towards Pound Sterling.

"December's 0.5% contraction in monthly GDP, which was worse than expected, can be largely blamed on either strikes (visible most clearly in transport and health, both of which shrank by close to 3% on the month) or, more bizarrely, a lack of Premier League football games in December due to the World Cup," says James Smith, Developed Markets Economist at ING Bank.

Smith says the football 'shortfall' was enough to drive the recreation/entertainment category down almost 8%.

Nevertheless, the Pound has recovered over recent days amidst a technical unwind of the previous week's sharp selloff and supportive global investor sentiment.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

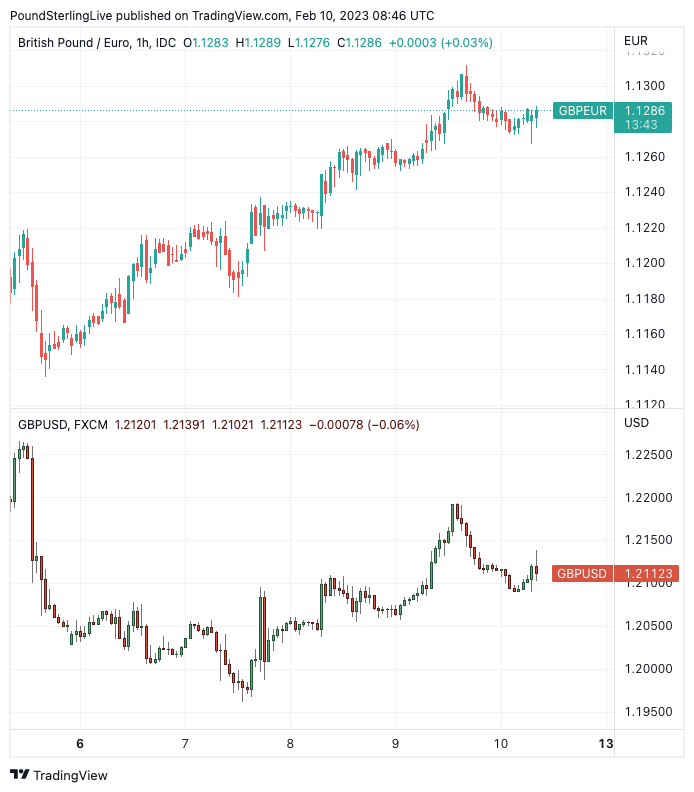

The Pound to Euro exchange rate has recovered a percent this week to trade at 1.1287 at the time of writing, the Pound to Dollar exchange rate is up 0.42% at 1.2105. Both exchange rates were boosted by softer U.S. data and communications from members of the Federal Reserve.

"The GBP managed to outperform the EUR and was generally better able to hold its ground vs the resurgent USD so far this week. We think that the recent moves in EUR/GBP reflect the correction of the significant overvaluation of the cross relative to its short-term fair value," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Where the Pound ends the week could well depend on how markets behave and whether optimistic sentiment can extend, or is ultimately reversed.

A reversal would see the recent gains shaved from the Pound's weekly tally.

Above: GBP/EUR (top) and GBP/USD showing this week's recovery. Consider setting a free FX rate alert here to better time your payment requirements.

The soft UK GDP data was widely anticipated and could therefore be considered to be 'in the price' of the Pound at this juncture.

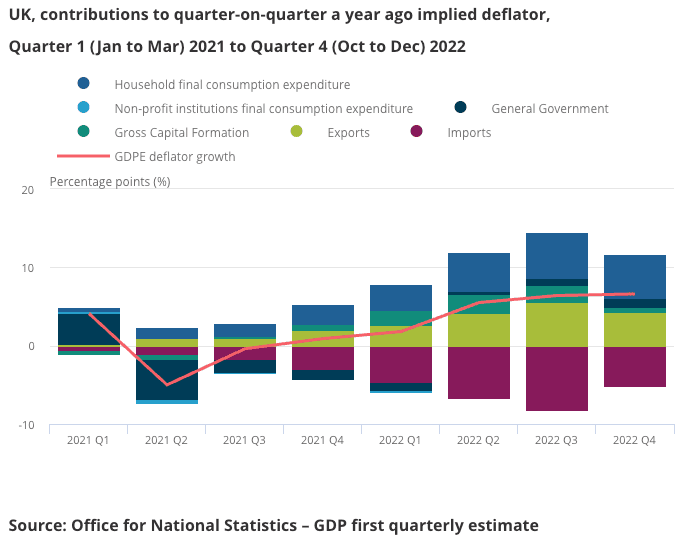

The domestic outlook nevertheless remains challenging and the economy would have suffered a recession were it not for a better-than-expected outturn in fourth-quarter private consumption which read at 0.1%, beating expectations for -0.1% and improving on the third quarter's -1.1%.

Growth also came from business investment which increased by an impressive 4.8% in the quarter, recovering from -2.5% and beating expectations for -0.3%.

Growth of 0.3% in construction was meanwhile offset by a 0.2% fall in the production sector in the fourth quarter.

Looking at the year as a whole, UK GDP increased by an estimated 4.0% in 2022, following a 7.6% increase in 2021.

"Although a distinct chill descended in December, as bad weather, strikes and more painful price hikes blew in, the downturn wasn’t deep enough to push Britain into recession. There is still a chance the economy will still suffer two back-to-back quarters of negative growth this year, but the murky stretch of water ahead is set to be shallower and less lengthy than predicted in the Autumn when the country was also wracked with financial instability," says Susannah Streeter, head of money and markets, Hargreaves Lansdown.

The Bank of England last week revised higher its growth projections for the economy, although it still foresees a lengthy, shallow recession ahead.

But the independent NIESR raised their forecasts this week and said the economy would likely avoid a recession.

Looking ahead, economists at Pantheon Macroeconomics expect UK GDP to decline by almost 1% between the fourth quarter and the second quarter of 2023.

Declines are expected to be a response to the tightening of both monetary and fiscal policy, which will squeeze households' real disposable incomes further, spur businesses to cut employment and investment, and trigger a sharp decline in residential investment.

"Admittedly, the recent collapse in wholesale energy prices suggests that households’ real expenditure will be picking up in the second half of this year, dragging GDP up with it," says Samuel Tombs,

Chief U.K. Economist at Pantheon Macroeconomics.

In 2023 as a whole, Pantheon Macroeconomics estimates GDP will be about 0.8% lower than 2022.

"With other countries facing less severe headwinds from monetary and fiscal policy, the U.K. probably will be alone among advanced economies in seeing GDP drop this year," says Tombs.

Given that exchange rates are ultimately decided by the relative performance of economies, this view is therefore consistent with Pound Sterling underperformance in 2023.

ING's Smith says recession remains his base case expectation, "especially if we include the contraction in the third quarter of last year. But this looks like it is going to be very mild by historical standards."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes