Pound Sterling Better Supported, UK to Avoid Recession in 2023 says NIESR

- Written by: Gary Howes

- GBP/EUR finding support amidst EUR/USD selloff

- NIESR forecasts show UK to avoid recession

- Findings suggest Bank of England too gloomy

- GBP still subject to widespread investor gloom

The British Pound is seen stabilising against the Euro and U.S. Dollar midweek as a recent sell-off reaches extended levels and investors are confronted with a more optimistic outlook for the UK economy in 2023.

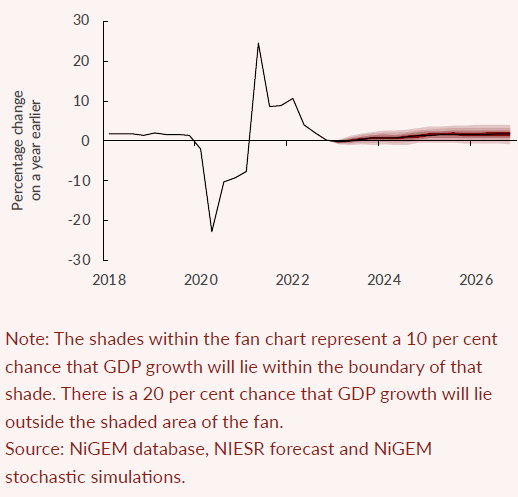

The National Institute of Economic and Social Research (NIESR) on Wednesday released its latest forecasts for the UK economy that finds the UK will likely avoid a protracted recession in 2023.

"The UK is likely to avoid a 'technical recession' in 2023," it says in its latest quarterly economic assessment.

The Pound declined against most major currencies last week amidst fresh predictions from the Bank of England that the UK economy is to fall into a relatively long, albeit shallow, recession in 2023 but the new research from the NIESR says the Bank might be too pessimistic about the UK economy's prospects.

The independent think-tank says GDP growth is set to remain close to zero, which would be an improvement on recent IMF and Bank of England forecasts for a more discernible contraction.

Above: NIESR GDP inflation forecasts.

The Bank of England now forecasts a decline in UK GDP of 0.7% in the year to the end of the first quarter of 2024.

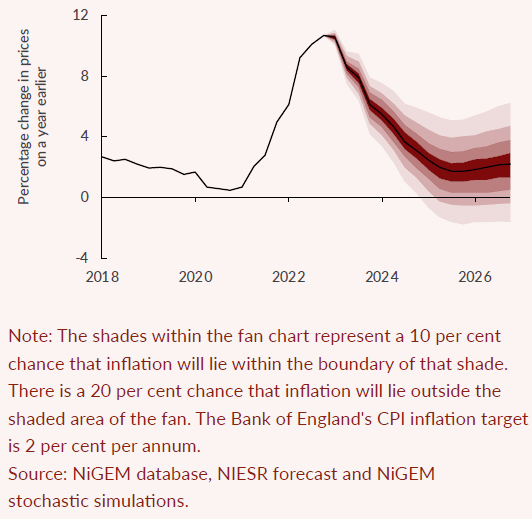

The NIESR's latest forecasts also reveal inflation will still be above 3% at the end of 2024 and will not reach the Bank of England’s 2% target until the third quarter of 2025.

This suggests the Bank of England's most recent forecasts for inflation to slump towards 1% over the 2-3 year horizon are too aggressive, something Monetary Committee Member Catherine Mann also warned of in a speech delivered Monday.

"The tide of optimism washing over the London market is being pushed higher with the latest economic assessment judging that the UK could avoid a recession. The FTSE 100 has opened with another spring in its step, hitting a new high in early trade," says Susannah Streeter, senior investment and markets analyst Hargreaves Lansdown.

Above: NIESR CPI inflation forecasts.

The Pound was sold last week as markets read the Bank's forecasts as signalling they had ultimately done enough by way of interest rate hikes to bring inflation back under control on a two-year horizon.

"We expect inflation to fall quickly this year," said the Bank in its Monetary Policy Report.

"The BoE's mandate dictates it should target price pressures, not growth. Two years from now - not today, tomorrow or next week - the bank sees inflation falling to around 1%, half its 2% target," says Dean Turner, Economist at UBS AG.

The Bank's guidance prompted investors to lower their bets for the peak in Bank Rate and raise expectations for rate cuts towards the end of 2023. This lowered UK bond yields and weighed on the Pound, which tends to track the differential between UK yields and those of the Eurozone and U.S.

But the findings of the NIESR suggest the Bank will have to contend with above-expected inflation readings over the coming months, which implies higher rates, for longer.

Such upside data surprises could therefore be consistent with a stronger Pound as it would boost UK bond yields relative to those of the Eurozone and U.S.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sterling is the second-worst performing major currency when screened over a one-week period owing to Thursday's Bank of England guidance update and surprisingly strong U.S. jobs report that suggested U.S. interest rates will rise further than anticipated.

In fact, the UK economy is tipped to endure the deepest drawdown of in the G7 by the IMF and Bank of England.

Weak economic performance has prompted investors to bet the Bank of England will imminently end its interest rate hiking cycle, making the Pound a 'sell' on rallies.

"The BoE is likely to stall rate hikes even as prices prove stickier than in the US and elsewhere. Overall, we remain biased toward GBP downside versus both the EUR and the JPY," says Jeremy Stretch, a foreign exchange strategist at CIBC Capital Markets.

But sentiment towards the UK and its currency has been poor for some time and this limits the scope for significant downward adjustments in value.

The Pound to Euro exchange rate (GBP/EUR) has been better supported this week aided by rising UK bond yields, which reflects a rerating higher of Bank of England interest rate expectations following comments from committee member Catherine Mann.

Above: A stabilisation in the yield differential (top) between the UK and Germany has aided GBP/EUR recently. Consider setting a free FX rate alert here to better time your payment requirements.

GBP/EUR also finds technical support owing to the proximity of the 1.11 area - a long-term value marker - and amidst a rapid selloff in the EUR/USD exchange rate.

The Euro had been an outperformer in the approach to last Thursday's European Central Bank policy update but has since fallen owing to a less-assured commitment to future interest rate hikes.

EUR/USD came under additional pressure following Friday's U.S. jobs report that revealed the U.S. economy remained in rude health, suggesting the potential for further Federal Reserve rate hikes.

"That surprise 500-thousand-plus job gains we saw on Friday means the market may gravitate towards 'higher for longer' narrative which may help provide support for the dollar on the dips," says Fawad Razaqzada, Market Analyst at City Index.

The data boosted the Dollar against both the Pound and Euro, but it is EUR/USD that has declined faster than GBP/USD in the days following the data, offering support to the GBP/EUR cross.

The Pound to Dollar exchange rate (GBP/USD) is meanwhile expected by analysts to retain near-term support as investors adjust for higher Fed interest rates.

Following the jobs data the expected peak in the Funds rate has risen above 5.0%, although rate cuts are still seen later in the year.

This suggests the potential for near-term USD strength ahead of the widely expected decline through the rump of 2023.

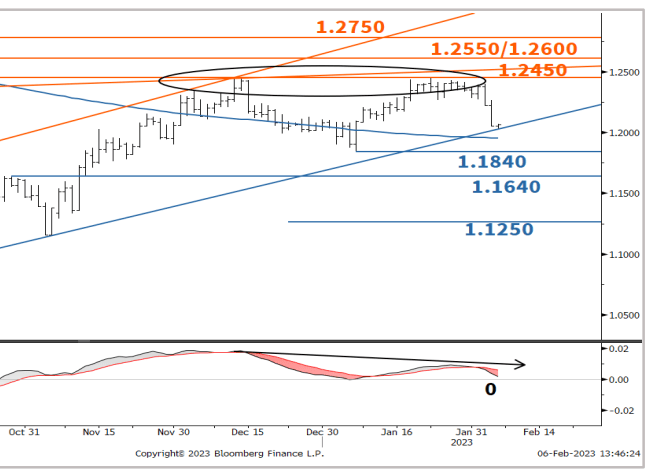

"GBP/USD has failed to reclaim the December peak of 1.2450 on the second attempt forming a double top. Daily MACD has started posting negative divergence denoting receding upward momentum. A short-term pullback is not ruled out," says Tanmay G Purohit, a technical analyst at Société Générale.

Image courtesy of Société Générale.

Purohit is particularly interested in the neckline of the formation at 1.1840, which is said to be a crucial support.

"A break can lead to an extended down move towards 1.1640 and target of the pattern at 1.1250," says Purohit.

W. Brad Bechtel, Global Head of FX at Jefferies, says last Friday's labour market report was a bit of a watershed moment for markets.

"But it is only one data point for now and markets are wrestling with how to interpret what was revealed there. Many of the FX pairs are starting to show trend reversal patterns developing," he says in a regular daily briefing to clients.

The sharp reversal higher in the Dollar index, and the associated reversal in the likes of GBP/USD and EUR/USD, signals to Bechtel some recent trends are possibly set to reverse.

"We'll see if EUR/USD can continue to grind lower, through minor support levels like the Jan 18 low and continue or if we run out of steam, the next couple days matter in that regard. Same for DXY, USD/JPY, GBP/USD and many of the Asian pairs that have done so well this year thus far," he says.

With the Dollar being the driving force behind GBP/USD all eyes now turn to the next release of U.S. inflation, due February 14.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes