GBP/EUR: Is the All-important 1.11 Area Under Threat?

- Written by: Gary Howes

Image © Adobe Images

The British Pound is set to move lower against the Euro over the coming weeks say a number of prominent currency analysts we follow, although whether or not it will break below a key psychological level is where the big debate is to be had.

The level in question is 1.11 for the Pound to Euro and 0.90 when we flip the equation from Euros to Sterling.

Jane Foley, Senior FX Strategist at Rabobank says the Pound will most likely continue to decline in value against the Euro as the European Central Bank 'out hawks' the Bank of England, ultimately resulting in a test of 1.11.

The focus on central bank policy as the potential catalyst for such a move comes ahead of the first policy decisions of 2023 at both the ECB and BoE; both are tipped to deliver a 50 basis point rate hike.

But 50bp is where the similarities end and for the GBP/EUR exchange rate, it is the guidance as to future interest rate decisions at the two central banks that matter.

"Even though the BoE is again expected to match the ECB in terms of the size of rate hike, there is a chance that the BoE will again be 'out-hawked'," says Foley in a recent currency research briefing.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB surprised in December by ramping up the heat on interest rate expectations, telling markets that at least a further two 50bp hikes were required in the current cycle.

This propelled the Euro higher against the Pound and Dollar as the Federal Reserve is expected to downshift to a 25bp hike this week while the BoE will likely signal it is nearing the end of its cycle.

Rabobank expects the Pound to ultimately weaken against its Eurozone counterpart over the coming weeks and months.

"We would view any move lower as an opportunity to sell GBP and maintain our forecast of a move to EURGBP 0.90 on a 6-month view."

0.90 is a significant ceiling level for EUR/GBP and a source of support for GBP/EUR at 1.11.

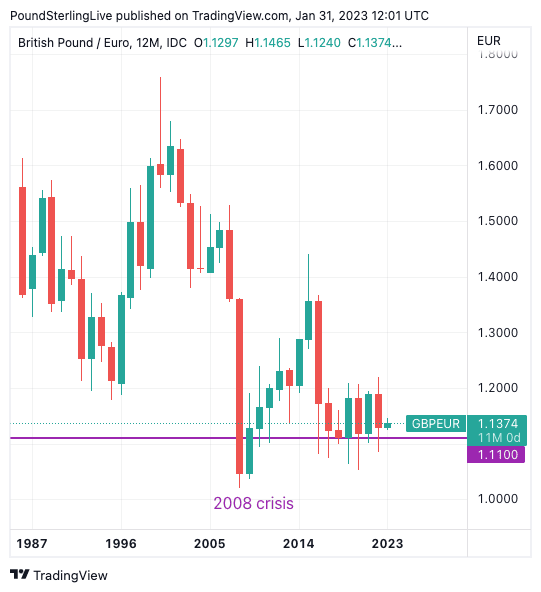

The GBP/EUR tends to avoid protracted moves below here and has only once ever closed below 1.11 on an annual basis; this was back in 2008 when global markets melted as the Great Financial Crisis rocked the global economy.

The reluctance to occupy sub-1.11 for any protracted period indicates that it represents a fundamental undervaluation and is why many analysts tend to see it as a line in the sand for GBP/EUR weakness.

Above: GBP/EUR at annual intervals, giving a long-term perspective of GBP/EUR behaviour. Consider setting a free FX rate alert here to better time your payment requirements.

But strategists at TD Securities - the Canada-based global lender and investment bank - are looking for GBP/EUR to crack 1.11 over the coming weeks (EUR/GBP to go above 0.90).

"The BoE might be the more interesting of the two big European central bank meetings next week. We continue to see a wedge between important EUR and GBP drivers in the months ahead," says Mark McCormick, Global Head of FX Strategy

at TD Securities.

Economists at TD Securities expect the 'terminal rate' - at which interest rates peak - to be higher at the Bank of England, which would typically be associated as a supportive development for Sterling.

But McCormick says "the journey over the next few months should favour EUR" as the ECB has more to deliver in the first half of 2023 (somewhere in the region of 150bp is expected).

"We also see upside risks to the ECB profile and downside risks to the BoE, which should play into EUR's favour," says McCormick.

The Euro is also expected to benefit from Eurozone economic outperformance and the reopening of China, which should boost industrial exports from the likes of Germany.

The UK economy is meanwhile widely anticipated to fall into recession in 2023 as consumers grapple with a hit to incomes and wealth amidst elevated inflation and falling house prices.

This economic and monetary policy divergence, "should reinforce a push through 0.90," says McCormick.

Looking at the near-term, potential surprises that could inject some volatility into GBP/EUR would include either the BoE or ECB raising interest rates by a smaller-than-expected 25bp.

CIBC Capital Markets says its base case expectation is that the BoE will react to slowing survey data and downgraded inflation forecasts with a 25bp hike, which would result in a weaker Pound.

But Foley at Rabobank warns it could be the ECb that delivers such a surprise.

"In our view the ECB may favour a smaller 25 bps rate hike in March. If Lagarde’s guidance this week disappoints the hawks, there may be some near-term downside potential for EUR/GBP," says Foley.

"We would view any move lower as an opportunity to sell GBP and maintain our forecast of a move to EURGBP 0.90 on a 6-month view," she adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes