Pound Sterling Strengthens against Euro and Dollar, but Gains Tipped to be Limited

- Written by: Gary Howes

Image © Adobe Images

The British Pound is softer on Tuesday following Monday's strong recovery with price action suggesting the UK currency is taking its cues from global drivers in a week that is characterised by a light domestic events calendar.

Analysts nevertheless say the UK's domestic picture remains challenging and any gains are likely to be short-lived in nature.

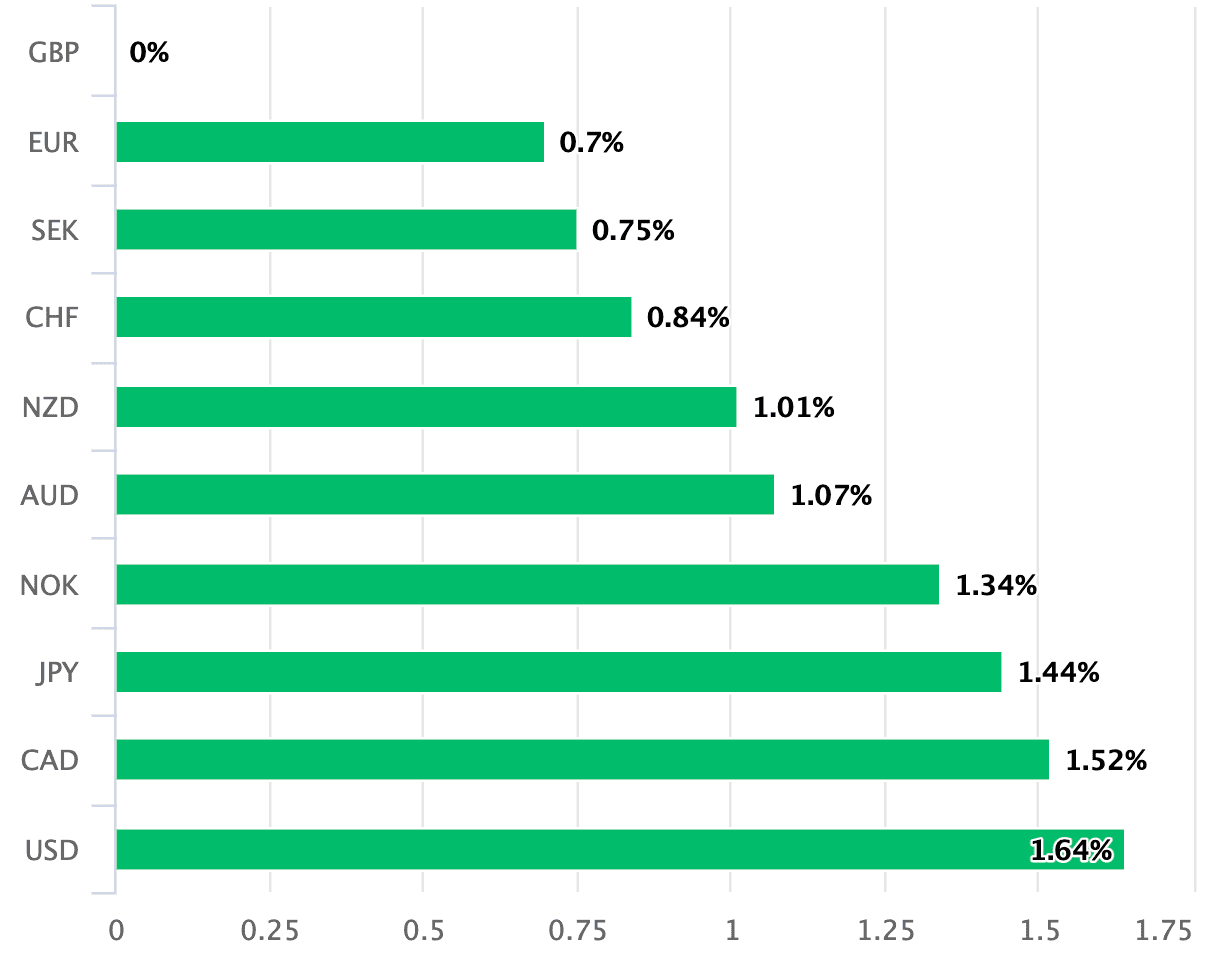

The Pound was nevertheless the best-performing major currency on Monday as global markets extended a recent rally, allowing the UK currency to recover some of the losses it experienced in the wake of last Thursday's Bank of England update.

Provided the global mood music remains relatively upbeat, the Pound's recovery could potentially extend over the coming days.

"If risk can remain bid we are set to register modest Sterling gains," says Jeremy Stretch, an analyst at CIBC Capital Markets.

Above: GBP was the best-performing major currency on Nov. 07. To better time your payment requirements, consider setting a free FX rate alert here.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Global stock markets were higher on Friday and through Monday as investors bet China was laying the groundwork to exit its zero-Covid policy stance following a string of rumours; such development has the potential to kick-start a faltering global economy and boost risk-sensitive currencies such as the Pound.

Although markets and Sterling are softer on Tuesday losses are relatively shallow amidst a relatively quiet overnight session in Asia.

The Pound to Euro exchange rate fell as far as 1.1383 last week but is quoted at 1.1485 at the time of writing, taking bank transfer rates to approximately 1.1255 and those at payment specialists to around 1.1450.

The Pound to Dollar exchange rate was over a percent higher on Monday and is quoted at 1.1460 at the time of writing on Tuesday. Dollar payment rates at a typical bank are around 1.1280 while those at payment specialists are around 1.1477.

Although rates have risen from the previous week's floors analysts remain of the view that upside potential for the Pound will likely be limited.

"The pound still has to fully recover from the post-Bank of England blow. Indeed, the combination of a highly concerning economic outlook and a forced dovish repricing in rate expectations look set to keep the pound rather unattractive," says Francesco Pesole, FX Strategist at ING Bank.

The Bank of England hiked interest rates 75 basis points on Thursday but warned rates would not need to go as high as the ~5.25% investors were expecting in the run-up to the announcement.

The Bank warned that if rates were to go that high the economy would sink into an eight-quarter-long recession.

These dire warnings spooked investors and contributed to a sharp dip in Sterling's valuation.

"We continue to think that Sterling should underperform given the difficult external environment and less support from real rates, and we continue to forecast further downside against both the Euro and Dollar," says Michael Cahill, an analyst at Goldman Sachs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sam Lynton-Brown, Global Head of Macro Strategy at BNP Paribas, says he is anticipating a weaker Pound over the coming days.

"Tight fiscal, tight money mean weaker GBP," says Lynton-Brown in a weekly research note issued by BNP Paribas.

He says the tighter fiscal policy will weigh, with Chancellor Jeremy Hunt set to outline £50BN of savings at the autumn budget statement on November 17.

Tightening monetary policy - thanks to higher interest rates at the Bank of England - will meanwhile come as the UK's growth outlook deteriorates says Lynton-Brown.

"Remain bearish for GBP," he says.

BNP Paribas positions for further weakness in the Pound against the Euro on a tactical basis, saying EUR/GBP could rise as far as 0.93 (or down to 1.0750 in GBP/EUR terms).

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

With the Pound highly reactive to global sentiment what happens in the U.S. this week could be key.

With markets obsessing over when the U.S. Federal Reserve might end its rate hiking cycle upcoming U.S. inflation data forms this week's main event when released on Thursday.

A stronger-than-expected inflation reading (the market is looking for+8.0% year-on-year) will almost certainly support the Dollar, send stocks lower and trigger an across-the-board negative reaction in Sterling exchange rates.

But a softer-than-expected figure could have the opposite impact.

Volatility is therefore more likely to be a feature of the second half of this week.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks