Gilt Yields Spike on Budget Rethink

- Written by: Sam Coventry

Gilt yields - the interest rate on government debt - rose after the government announced £40BN in additional borrowing in 2024/2025.

The surge in yields happens as the value of the underlying bond falls, meaning investors are selling bonds.

Typically, this would be because they see more risk in holding UK government debt, which is not exactly the market reaction Chancellor Rachel Reeves would hope for.

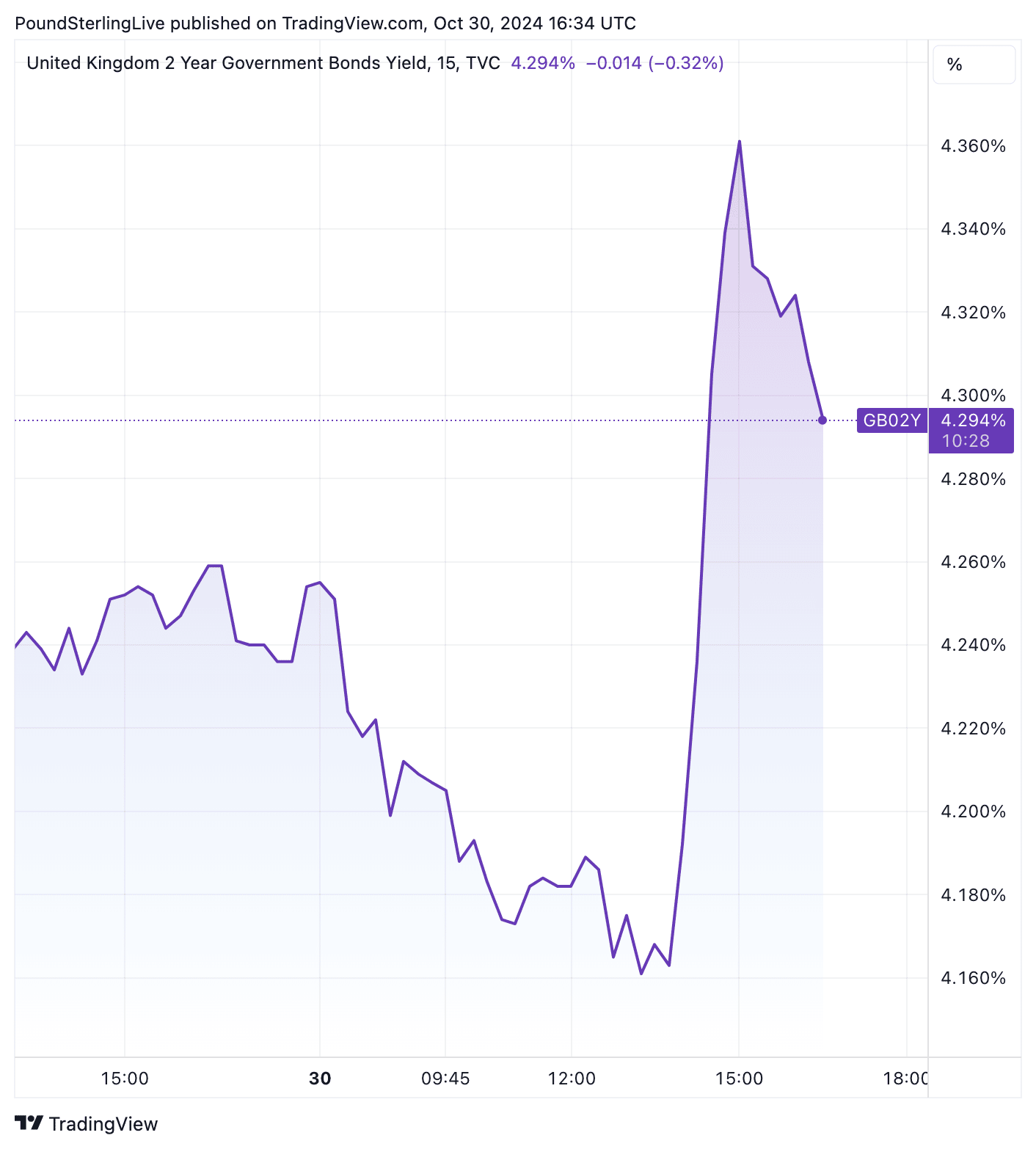

Bond yields initially fell as Reeves laid out her plans (meaning bonds were bought, signalling initial relief) but suddenly spiked from 14:00 GMT, as shown in the above chart showing the 2-year gilt yield.

The sudden rise suggests market participants had enough information and time to trigger a change in heart.

"In the end, markets will have to grapple with higher borrowing. Borrowing will be nearly GBP 30bn/annum more by the end of the decade, a lot of that driven by investment spending," says Sanjay Raja, Chief UK Economist at Deutsche Bank Research.

Borrowing will be much higher this year than previously forecast, coming in at £127BN in 2024/25 vs £87.2BN previously expected.

Borrowing rises to £72BN vs. £39BN in 2028/29.

"Gilt yields are up in response to the Budget. There are at least two reasons for this, much more gilt supply than expected providing a rationale for yields at the long-end, and additional fiscal stimulus potentially stifling the Bank of England's easing cycle at the front-end," says Sam Hill, an analyst at Lloyds Bank.

Hill says there was a notable upside surprise to the aggregate upward revision to borrowing for the five-year period for 2024-25 to 2028-29 inclusive. "At +£142 this. was a lot more than the +£80BN we had as our central case."