Pound Sterling Trails Near Back of FX Pack as Remorseless Dollar Builds Gains

- Written by: James Skinner

"Forward OIS is repricing terminal higher (closer to 5%) after Kashkari’s comments last night," - CIBC Capital Markets

Image © Adobe Images

The British Pound was trailing behind both a broadly stronger Dollar and a generally softer Euro in midweek trade following another surprise increase from UK inflation rates and as financial markets fixated on rising U.S. bonds yields following yet more hawkish commentary from Federal Reserve (Fed) officials.

Sterling scraped the bottom of the major currency bucket multiple times on Wednesday when it, the Swedish Krona and Swiss Franc were accompanied by the Polish Zloty and Indian Rupee to form the main group of underperformers within the G20 currency complex.

The Pound's losses initially began to build after the Office for National Statistics said UK inflation returned to the double-digit percentages in September when the annual pace of consumer price growth climbed from 9.9% to 10.1% in order to mark its highest level for four decades.

"GBP’s reaction to slightly higher than expected CPI data this morning highlights how the currency is trading in a structural rather than cyclical manner. In a cyclical world, higher inflation would be met with higher yields and currency strength," says Dominic Bunning, head of European FX research at HSBC.

"However, when markets are more concerned about structural risks, higher inflation and higher yields are seen as symptoms of a broader problem rather than signs of a strong economic outlook," he added.

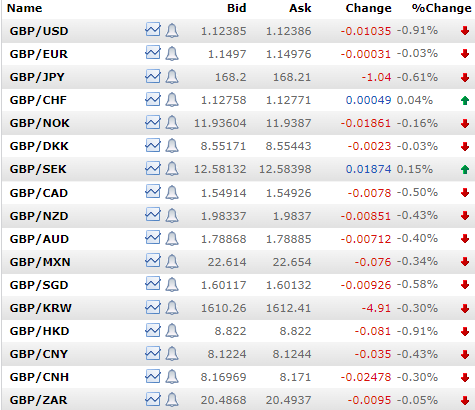

Above: Selected interbank reference rates for Sterling. Source: Netdania Markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

September's inflation data does little on its own to discourage the Bank of England (BoE) from raising interest rates aggressively in November and HSBC's Bunning wrote in a Wednesday research briefing that this could mean the Pound is at risk of sustaining further losses in the weeks and months ahead.

"GBP may continue to trade in this structural manner until the UK government has shown more efforts to rein in the domestic budget deficit or inflation has more clearly peaked. This might allow more of a stabilisation in the bond market and GBP. But until then, we expect underlying downward pressure to remain," he said when tipping Sterling to fall back to 1.08 over the coming months.

Remember Poundland? This is them now. pic.twitter.com/AHDan0hP0K

— No Context Brits (@NoContextBrits) August 24, 2022

Bunning also warned on Wednesday that "even when cyclical forces return" Sterling could still struggle to recover much from its recent losses due to likely weak levels of economic growth and the risk of persistently high inflation.

However, and despite that the Pound's midweek losses were clearly connected to the troublesome UK inflation picture, it's also likely that they were at least partly the result of U.S. bond yields eliciting a further widespread rally from a remorselessly strong Dollar.

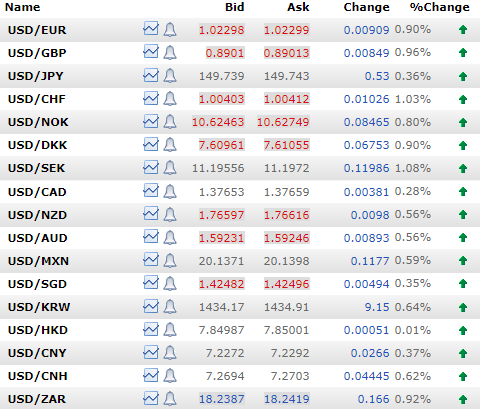

Above: Selected interbank reference rates for the U.S. Dollar. Source: Netdania Markets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Forward OIS is repricing terminal higher (closer to 5%) after Kashkari’s comments last night," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

"The discount rate minutes show that the board of the Minneapolis Fed would have preferred to raise the rate by 100bps last month. Our take: Note, this doesn’t determine how each regional Fed President would vote (fwiw, Kashkari doesn’t have one this year)," Rai also said on Wednesday.

Wednesday's U.S. Dollar price action follows remarks from Federal Reserve Bank of Minneapolis President Neel Kashkari, who will be one of the Federal Open Market Committee (FOMC) voters who determines U.S. interest rate policy next year, which were as 'hawkish' as they were widely reported.

Kashkari said in a Q&A session at an event hosted by the Women Corporate Directors, Minnesota Chapter that he has "very little confidence in where inflation will be in six months" and argued that the Federal Reserve should continue to raise interest rates until there is "persuasive evidence" that non-energy and food inflation has peaked.

This is similar in substance to the stance adopted by others including this year's FOMC voters who lifted U.S. interest rates by three quarters of a percentage point for a third time running and September and warned using quarterly forecasts that borrowing costs will likely rise much further by year-end.

September's forecasts suggested the Fed Funds rate range would likely rise a further 1.25% to leave the top end of its at 4.5% by year-end while also warning that the benchmark could be lifted to 4.75% early next year, although since then the U.S. inflation situation at least appears to have deteriorated even further.

This is after U.S. inflation rose from 6.3% to 6.6% in annualised terms during September once energy and food items are removed from the basket of goods for which prices are analysed while the official or overall inflation rate remained stubbornly elevated at an annualised 8.2%.

"It’s the front end of the curve which is guaranteed to be dragged higher by rising Fed Funds. It’s also the 2yr Note that the Dollar Index tracks more closely" says Kit Juckes, chief FX strategist at Societe Generale.

"The dollar certainly isn’t cheap up here, but how can we look to fade this move yet? And how much would it cost the BOJ to prevent USD/JPY breaking, now?" he also wondered aloud in a Wednesday market market commentary.

Above: Pound to Dollar rate shown at weekly intervals alongside U.S. Dollar Index and 02-year U.S. government bond yield.

Above: Pound to Dollar rate shown at weekly intervals alongside U.S. Dollar Index and 02-year U.S. government bond yield.