Pound Sterling: A Recession for the Middle-class

- Written by: Gary Howes

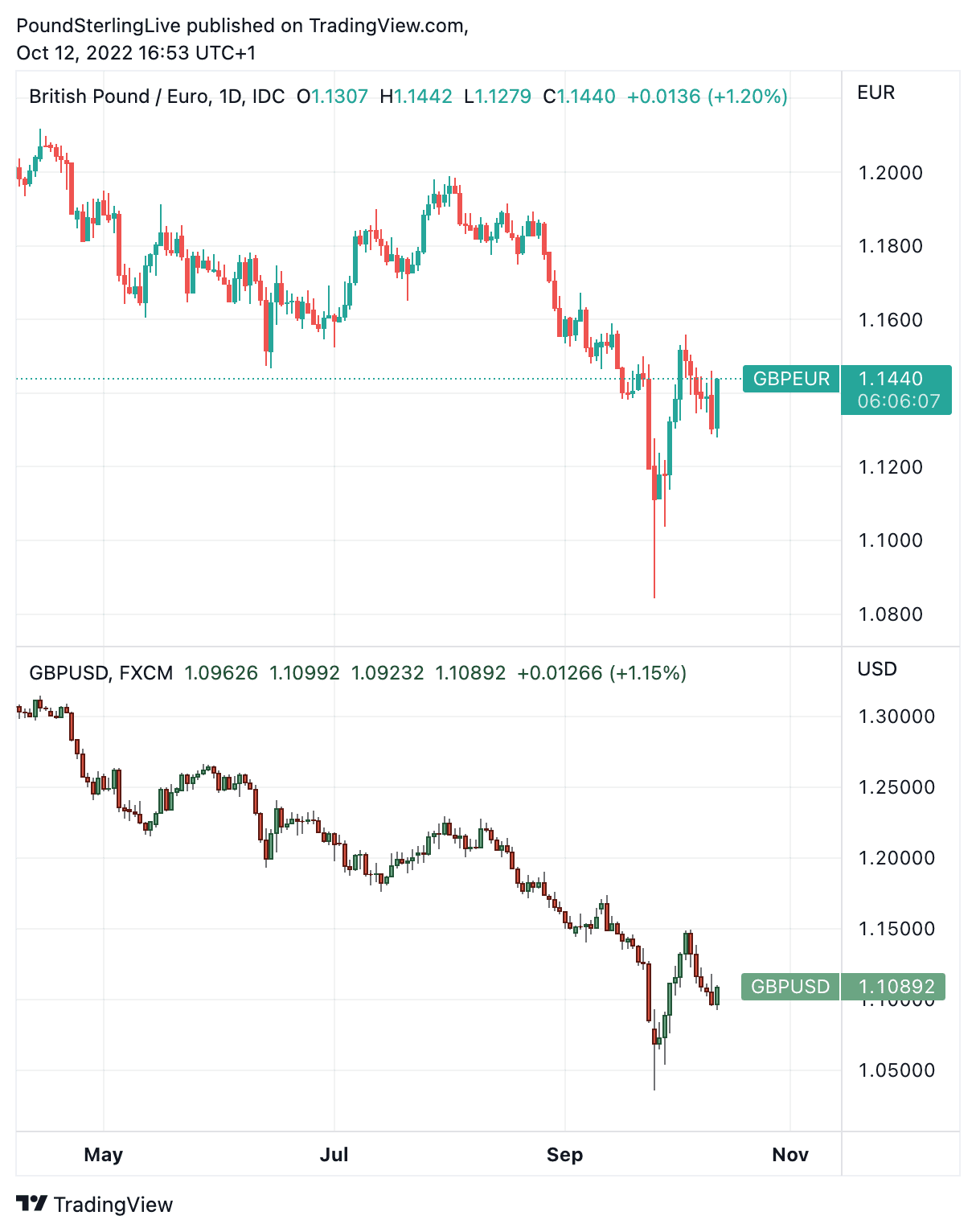

- Pound to Euro rate today: 1.1440

- Pound to Dollar rate today: 1.1083

- Bank of England risks deepening recession says Oxford Economics

- NatWest says middle-income households to bear the brunt of pain

Image © Adobe Images

The British Pound is expected to remain under pressure as markets factor in the scale of the looming economic recession, which analysts say will now hit middle-income households more than poorer households as the housing market finds itself in the eye of the storm.

Economists are increasingly of the view that the recent turn of events that has seen the cost of borrowing spiral higher will deepen the recession in the UK.

Lending costs have risen sharply as investors demand greater compensation for buying UK debt (bonds, known as gilts), pushing up the cost of mortgages and other forms of credit.

The Pound has meanwhile come under selling pressure as foreign investors shun UK assets.

But the pro-cyclical Pound faces a more fundamental medium-term problem: it tends to decline during times of economic contraction and would only likely make a sustained recovery when UK economic growth picks up on a sustained basis.

And according to economists, the UK's economic downturn could only be getting started with downside risk to growth increasing.

"The cost of living crisis will be exacerbated by a cost of borrowing crisis," says Paul Dales, UK Economist at Capital Economics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ross Walker, Head of Global Economics and Chief UK Economist at NatWest Markets, says the borrowing crisis will manifest most acutely in mortgages and this will translate into a recession that hits middle-income households the hardest.

"What began as an energy-centred shock which would hit the bottom-third of households by income hardest is evolving into a more conventional monetary policy shock which will hit middle-income households hardest," says Walker.

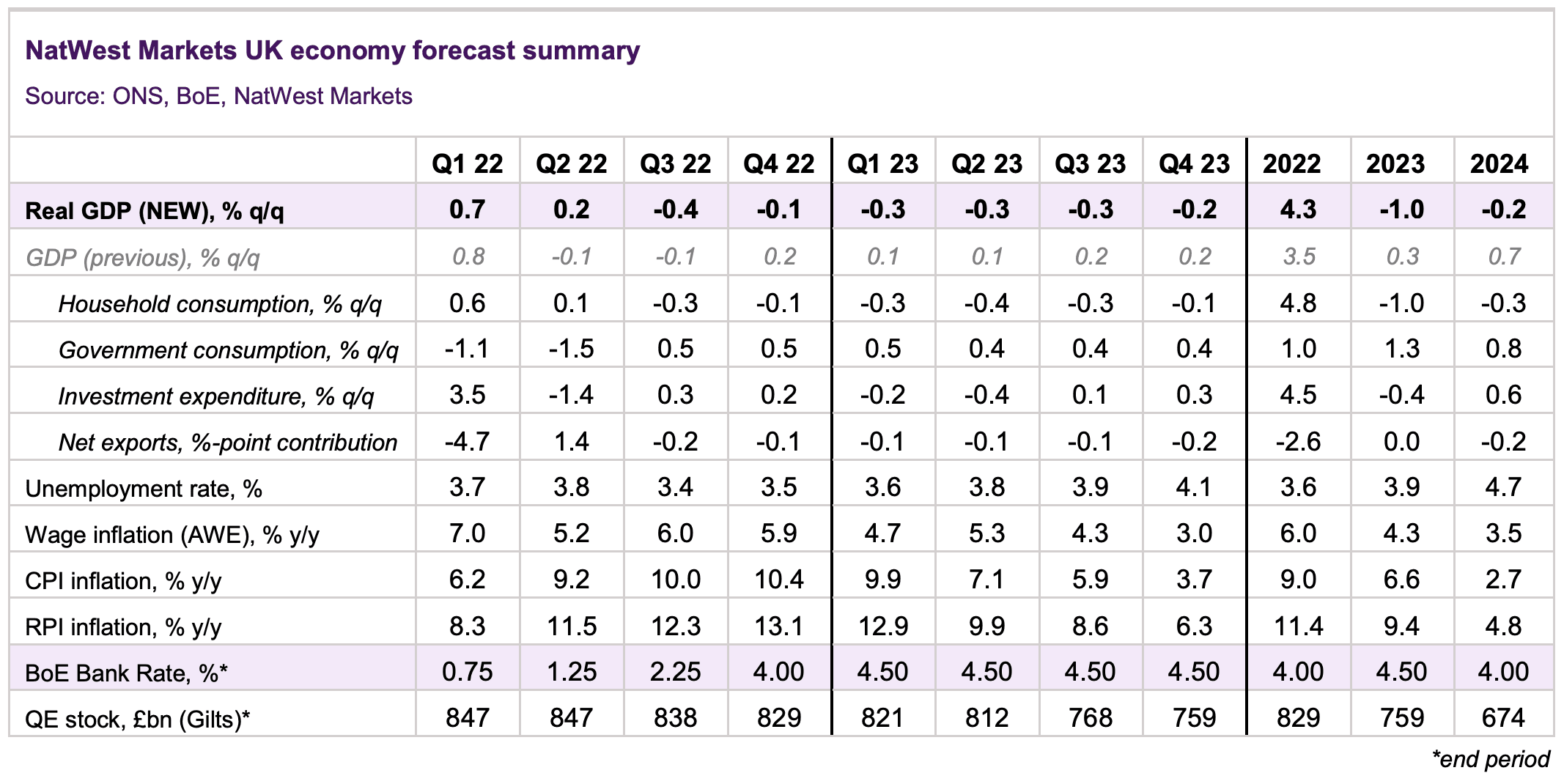

NatWest's central case for the UK economy in 2023 is for recession, with UK GDP contracting 0.8% year-on-year, as Bank of England interest rate hikes exert a sharp and persistent squeeze on household disposable incomes and demand.

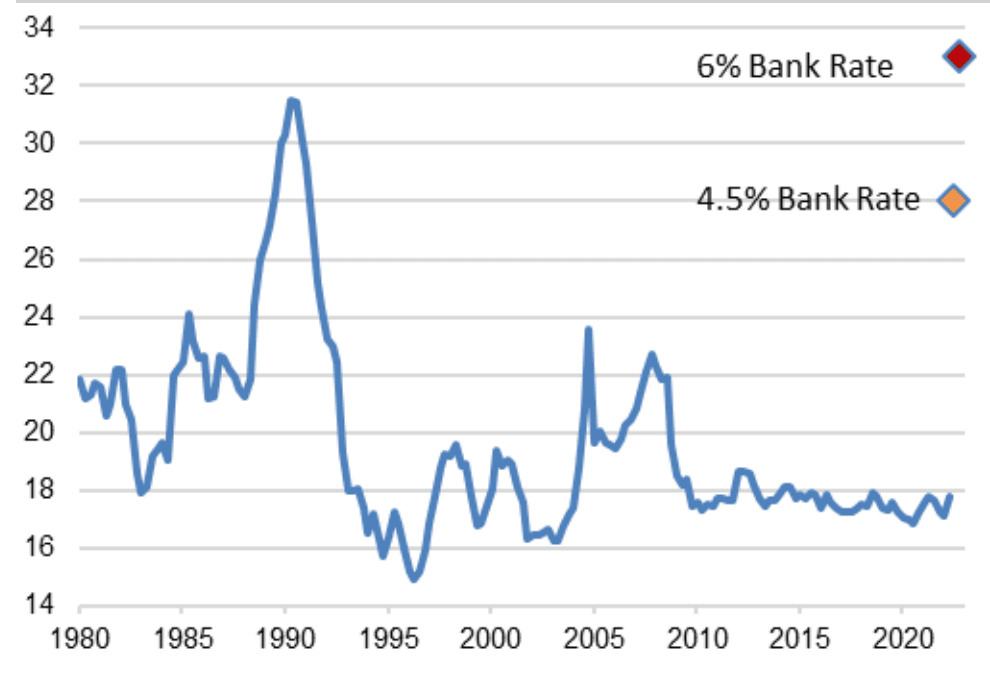

Above: UK household debt-servicing costs, % of income. Source: ONS, UK Finance, NatWest Markets.

The UK lender forecasts negative quarterly GDP outturns from the third quarter of 2022, persisting throughout 2023.

NatWest says the government's attempt at delivering a pro-growth set of policies in the September 'mini budget' will in fact elicit a deeper contraction.

"The fiscal expansion from the misnomered ‘mini budget’ looks set to elicit a more 'significant' monetary policy tightening," says Walker.

Above: GBP/EUR (top) and GBP/USD (bottom) at daily intervals, showing strong downtrends. To better time your payment requirements, consider setting a free FX rate alert here.

NatWest forecasts Bank Rate to rise by 100bp in November to 3.25%, 75bp in December to 4.0% and 50bp in February to a cyclical peak of 4.5%.

This is nevertheless some way below market pricing that a sees Bank Rate at approximately 5.75% by May 2023.

For the British Pound, this could present downside risks.

"Going forward, the BoE will need to deliver the massive rate hikes now priced into the Sonia strip, even if it intends to manipulate longer term gilt yields lower in the first half of October. A failure to hike aggressively leaves GBP exposed," says Shahab Jalinoos, Global Head of FX Strategy at Credit Suisse.

"Our forecast for Bank Rate to peak at 4% in February implies that sterling will weaken further, boosting imported inflation. Indeed, we think that our forecast is consistent with sterling dropping to about $1.05 and €1.10 at the end of this year," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Walker says the squeeze on households from the likely interest rate hike path would take household debt-servicing costs close to multi-decade highs.

"It is far from clear that this degree of policy tightening is required to return inflation to its 2% target," he says.

Near-term, Pound Sterling will likely remain sensitive to concerns that UK debt markets are malfunctioning.

Surging gilt yields have not only raised the cost of borrowing but have also highlighted weaknesses in the UK financial system, with sectors of the pension industry coming under pressure.

The Bank of England responded to this distress by introducing an emergency and time-limited programme that allowed it to buy bonds, which in turn limited the ascent in yields.

But the Bank maintains the programme will end as planned on Friday, despite some concerns the pension industry is not ready for a potential spike in yields when the Bank steps back.

"The pound has not taken kindly to news that the Bank of England is planning to suspend its emergency intervention in the bond markets," says Sophie Lund-Yates, Equity Analyst at Hargreaves Lansdown.

For its part, the Bank of England takes the view that if the programme is extended it disrupts a much-needed adjustment in UK markets, something it loathes to delay given it is fully committed to getting inflation lower via monetary tightening.

"Markets must be allowed to function freely, without external intervention. At some point, the bond market needs to find its own feet. It's not impossible for the Bank of England to delay its exit from its bond-buying plans, but Andrew Bailey, and the market, know that this would simply be kicking the can down the road," says Lund-Yates.

Innes McFee, Chief Global Economist at Oxford Economics, says the Bank will be forced into a climbdown and will likely extend its emergency bond-buying programme.

"BoE governor Andrew Bailey's insistence that emergency support will end on Friday is an unsustainable position that we expect to be reversed quickly. The muted sell-off in long-end gilt yields this morning (30-year yields are up 27bps currently) already seems to be pricing in a climb down and the extension of support," says MccFee.

"Arguments against extending the emergency purchase of gilts centre around moral hazard and are as flawed today as they were in 2008," adds McFee.

Back in 2008 governments realised letting big banks fail would prompt unimaginable hardships for the general population and they introduced measures to save them from going under.

"The investment strategies of UK pension funds are born out of necessity rather than excessive risk-taking (albeit with questionable implementation) so it's not clear that intervention by the central bank to help markets operate efficiently is inappropriate," says McFee.

The economist warns that if the Bank of England fails to calm the rise in gilt yields, this will add significant further downside risk to our forecast of a moderate UK recession.

"In that scenario, we expect tighter credit conditions would have a material impact on the housing market and wider business and consumer confidence," says McFee.

The looming middle-income recession could therefore be made more acute by Bank of England dogmatism.

Further intervention by the Bank could therefore be treated positively by currency markets, potentially limiting Sterling's downside.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes