Bond Market Stress Weighs on the Pound

- Written by: Gary Howes

- GBP under pressure

- As BoE announces fresh emergency measures

- UK borrowing costs soar

- IFS says significant spending cuts are now in order

Image © Adobe Images

The British Pound is under pressure amidst signs the UK's trillion pound debt markets are creaking at the seams, forcing fresh intervention from the Bank of England.

The Bank of England on Tuesday announced it will widen its gilt purchase operations to include index-linked gilts.

These are gilts (UK government bonds) linked to the Retail Price Index and are understandably increasingly costly to the government given UK RPI inflation stood at 12.3% in August.

The Bank said it would buy up to £5BN of index-linked debt per day in order to stabilise the market which on Monday underwent a significant selloff.

This is in addition to the Bank's currency emergency programme that sees it buy long-dated gilts.

"We’ve now had weeks of markets being rattled - as we have seen with the turmoil in the mortgage market and the pension market, and with the plummeting pound - because there seems to be no credible long-term plan. Instead, it’s all just last-minute, reactionary moves," says Nigel Green, CEO of deVere Group.

The Bank said it would enter the index-linked gilt market citing a "material risk" to financial stability.

Disorderly gilt markets carry significant implications for pensions, mortgages and all forms of borrowing.

In short, the Bank is acting to prevent a full-blown financial crisis.

For the British Pound, such a crisis would likely trigger significant selling pressure, therefore this intervention by the Bank is broadly supportive.

Nevertheless, the Bank of England's intervention does not detract from clear signs UK assets are looking increasingly fragile and international investors might be inclined to keep clear of them.

The Pound is therefore likely to remain under pressure with rallies sold into.

The Pound to Euro exchange rate is down a third of a percent on the day at 1.1367, taking international payment rates at high-street banks to around the 1.1140 level and those at independent payment providers to around 1.1334.

The Pound to Dollar exchange rate is down a third of a percent at 1.1044, placing high-street bank rates at around 1.0820 and those at payment specialists at around 1.1010.

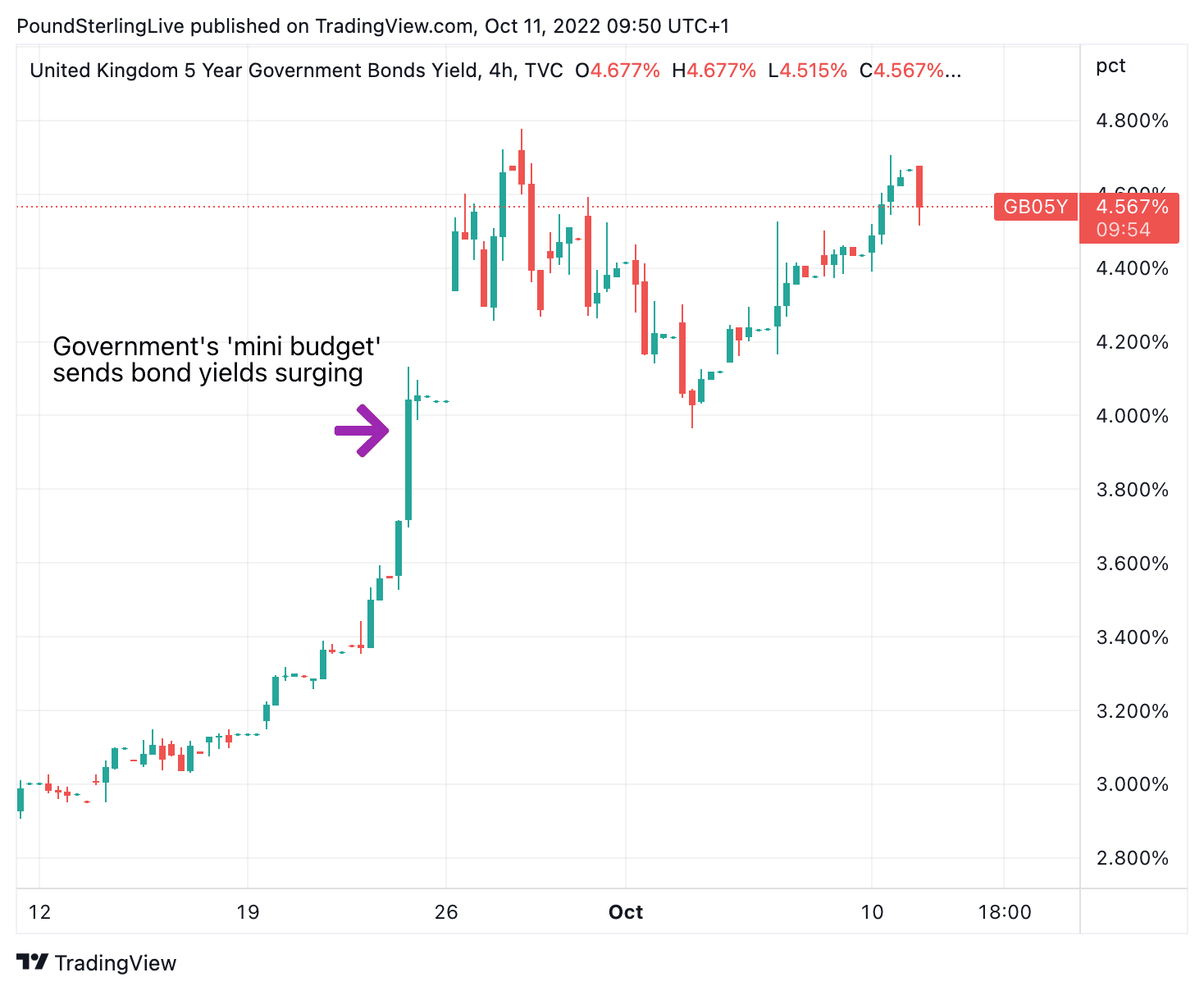

Above: The yield paid on UK government 5-year gilts has surged, as they have done on all tenors of UK debt.

"If we witness more volatility in the UK gilt market, expect the British pound to also suffer as it underlines the fragility of investors’ confidence in UK policy and economic and financial stability. Even GBP/EUR, which has held relatively firm this year compared to other GBP-denominated currency pairs, is sliding further south of the €1.14 handle," says George Vessey, an analyst with Western Union Business Solutions.

Government bonds around the world are becoming increasingly unattractive to investors owing to surging inflation, forcing governments to increase yield payments to investors in order to entice them into buying.

But the UK's bond market has suffered more than others given the new government's decision to spend big on subsiding household energy bills whilst cutting taxes at the same time.

In short, investors are worried the government's debt pile might become unsustainable and they are demanding greater compensation.

At the heart of the UK's financial stresses is the significant regime shift underway globally: the return of inflation means the sun is setting on the brief age of ultra-low interest rates.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ever since the financial crisis of 2008 interest rates have fallen sharply and central banks have willingly funded government spending via their purchases of government bonds through quantitative easing.

But this all stops when inflation is surging as central banks must instead restrict the money supply.

Markets will therefore place a high premium on fiscal discipline going forward.

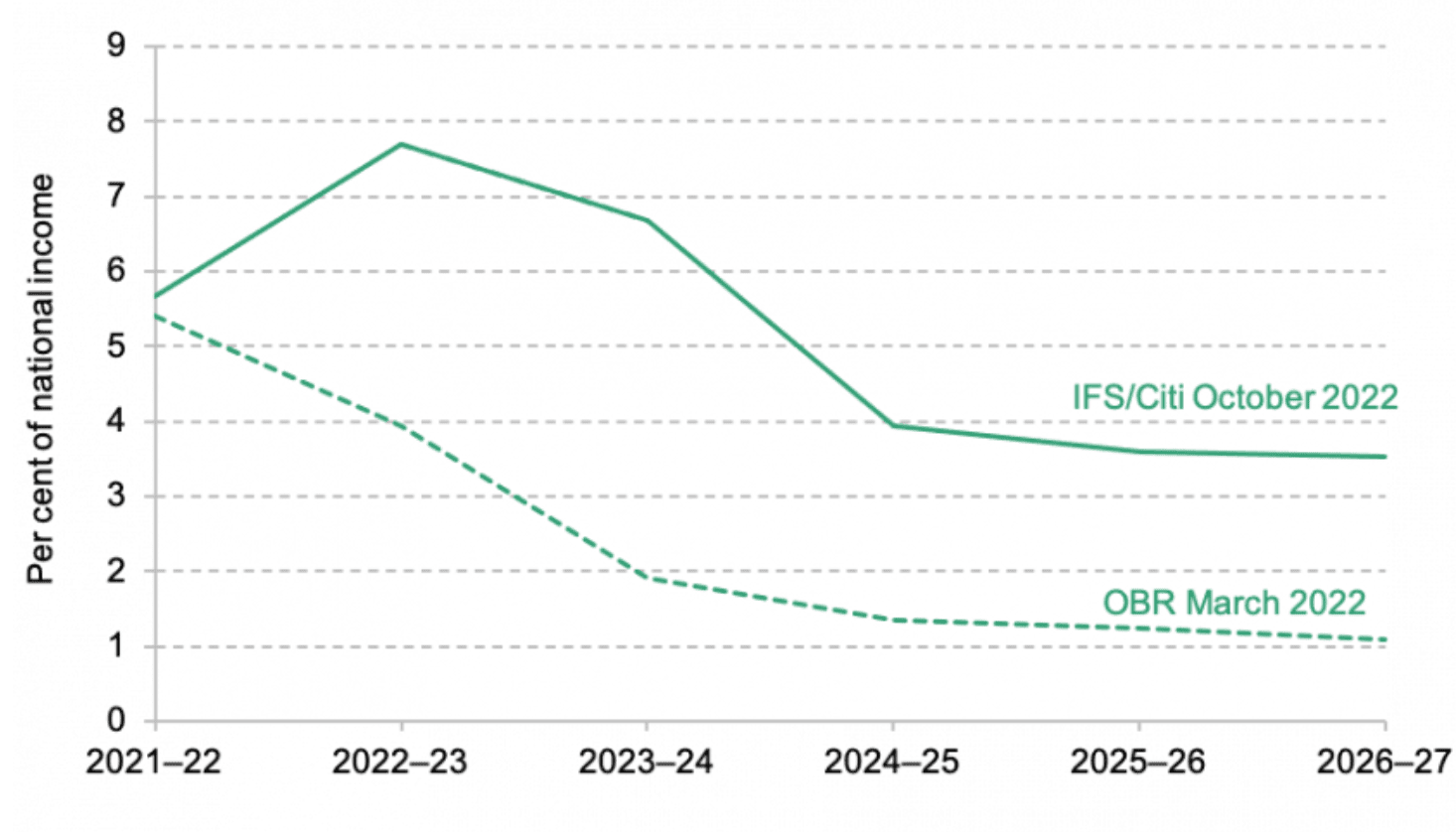

Above: Forecast borrowing, per cent of national income. Source: Office for Budget Responsibility, Economic and Fiscal Outlook, March 2022; + IFS calculations.

The adjustment the UK faces, and other countries, for sure, is stark.

The Institute for Fiscal Studies on Tuesday published new research into the UK's public debt situation, showing significant spending cuts are now required.

The IFS estimates that by 2026-27 UK government borrowing would come in at £103BN, which is £17BN more than official forecasts in March.

This is largely due to the recently announced tax cuts.

However, the IFS does acknowledge wide uncertainty around these estimates.

"But the particularly painful backdrop is even if those cuts were reversed, the rise in gilt yields would require a bigger fiscal tightening of £62BN in 2026-27," says Elsa Lignos, Global Head of FX Strategy act RBC Capital Markets.

Lignos goes on to highlight the impossible situation that Chancellor Kwasi Kwarteng faces:

"Indexing benefits to earnings rather than inflation for 2yrs would save £13BN but spark a backbench rebellion. Cutting investment spending to 2%/GDP could save £14BN but would hardly be pro-growth."

The IFS says the remaining £35BN would equate to a 15% cut in all day-to-day spending, or if the NHS and defence were exempt, a 27% cut in all other areas.

"Kwarteng may end up feeling he would much rather have not opened Pandora’s box. We are long EUR/GBP in our trade of the week as GBP builds in a fresh risk premium with BoE support expiring," says Lignos.

The government on Monday brought forward the date of its planned spending review, which is in effect another 'mini budget'.

It is hoped that by bringing the review forward, and including independent economic forecasts, the government can convince the market its plans will not mean UK debt is placed on an unsustainable path.

But this might not be enough.

“Enough is enough. We urgently need the Bank and the government to work together on a serious plan to calm markets," says de Vere's Green. "At the moment, we still have the central bank trying to hit the brakes whilst the government is trying to hit the accelerator. The result? Chaos."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes