Barclays: Pound Sterling's Strength can Continue against Euro, Dollar

- Written by: Gary Howes

- UK economic rebound underpins GBP

- GBP benefits amidst Russia-Ukraine uncertainty

- Johnson announces all remaining Covid laws to be scrapped

Above: Prime Minister Boris Johnson announces all further Covid restrictions will be lifted in England. Picture by Andrew Parsons / No 10 Downing Street.

The UK economic rebound and its relative insulation from Eastern European tensions is driving demand for the British Pound, and this can continue say analysts at one of the UK's most recognisable high street banks.

Barclays says the coming week could be characterised by an extension of the Pound's recent outperformance against the Dollar, Euro and other currencies which has came despite fears of a Russian invasion of Ukraine.

"The UK is seen as economically more removed from the Russian-Ukraine tensions," says analyst Eimear Daly at Barclays.

Rising tensions in Eastern Europe has helped the Pound to Euro exchange rate overturn the losses suffered in the wake of the early-February European Central Bank policy decision, that means it will now entertain raising interest rates later in 2022.

The Euro rallied as investors cheered the imminent end of the negative interest rate era at the ECB, but soon began to struggle after it became clear Russia was mobilising forces ahead of a potential invasion of Ukraine that would put European energy security at risk.

But Sterling has also gained against the Dollar and other currencies as investors anticipate further Bank of England interest rate hikes in light of an ongoing economic recovery.

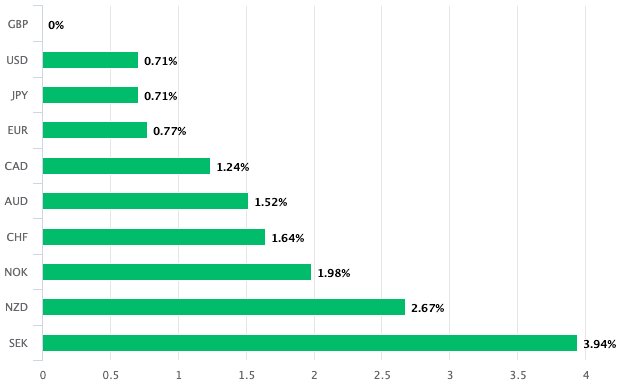

"GBP silently outperformed the majority of the G10 last week. The surprising resilience of the UK recovery, the Bank of England's reputation for delivering on tightening, a moderation in market expectations and still short positioning suggest that sterling strength will continue," says Daly.

- Reference rates at publication:

GBP to EUR: 1.2018 \ GBP to USD: 1.3590 - High street bank rates (indicative): 1.1780 \ 1.3310

- Payment specialist rates (indicative): 1.1958 \ 1.3523

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

The UK last week printed consensus-beating wage, employment, inflation and retail sales data which economists said underscored the likelihood of a March Bank of England interest rate rise.

In fact over 120 basis points of rises are factored into money market pricing for 2022.

Monday's PMI data for February meanwhile easily beat analyst expectations and confirmed an economic rebound was well underway during February.

The IHS Markit Composite PMI read at 60.2, beating consensus at 55.0 and January's 54.2.

"The U.K. economy is rebounding from Omicron at a fair clip," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics. "The forward-looking components of Markit’s survey suggest growth will remain brisk over the coming months."

"The PMIs suggest the economy shrugged off the hit from Omicron. And the tentative signs of easing supply disruptions and price pressures are encouraging too. But with CPI inflation far above the Bank of England’s 2% target and rising, we still expect Bank Rate to reach 1.25% by the end of this year and 2.00% by the end of next year," says Adam Hoyes, Assistant Economist, at Capital Economics.

The UK economy slumped again at the turn of the year amidst the spread of the Omicron variant but fast forward to February 21 and Prime Minister Boris Johnson has told Parliament that all Covid-related laws are to be dropped from Thursday.

This will include the ending of routine contact tracing and the legal requirement for unvaccinated close contacts to isolate.

Until April 01, stay home will be advice for positive tests but after this own judgement must be exercised.

The developments will further boost consumer sentiment and business investment intentions.

Barclays' Daly says the strong wage growth and rising inflation vindicated the Bank of England's justification for tightening while solid employment gains and retail sales showed the economy's ability to withstand it.

Ahead of the March 17 monetary policy meeting Daly notes that market expectations for an aggressive "front-loaded" U.S. monetary tightening cycle have eased over recent days, which in turn brought down expectations for other economies.

"The market is now pricing in 34bp of hikes for the BoE's March meeting, down 9bp on the week," says Daly. "This means GBP is less vulnerable to elevated market expectations going into the meeting."

Furthermore, the Barclays analyst sees room for rate markets' expectation of the terminal rate to be marked higher, from current levels of around 1.95%.

"We continue to forecast GBPUSD at 1.42 by year-end," says Daly.