British Pound: "More Stormy Conditions for Sterling" vs. Euro and Dollar as No Brexit Deal Likely in 2019 says Analyst

- Written by: James Skinner

Image © Gov.uk

- Cross-party Brexit talks fail

- GBP eyes volatile summer amid Conservative leadership change.

- Risk of 'no deal Brexit' to rise, weigh on GBP in months ahead.

- UBS warns of huge losses to EUR and USD in 'no deal' scenario.

The Pound is on course for a summer of discontent as an embattled Prime Minister comes under increasing pressure to step aside for a Brexit-supporting replacement to take the helm, stoking market fears over the likely path the UK will take out of the European Union.

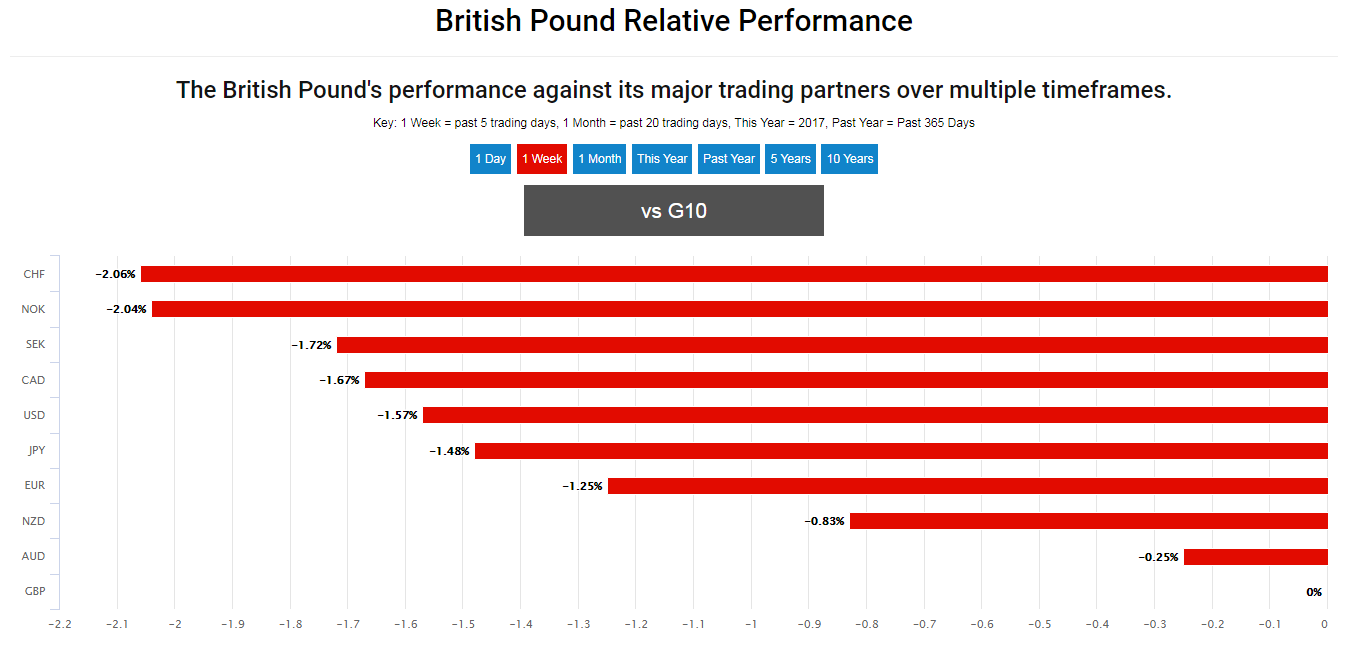

Pound Sterling is the worst performing G10 currency of the week after ceding ground to all its major rivals in recent days, with the currency selling off on news the Labour Party have decided to pull out of cross-party Brexit talks.

In a letter to the Prime Minister, Labour leader Jeremy Corbyn says "the increasing weakness and instability of your government means there cannot be confidence in securing whatever might be agreed between us."

With the prospect of a cross-party backing for a Brexit deal now dead, and no prospect of the majority of her own party backing the deal, May is likely to see her attempts to take the UK out of the EU fail.

When the vote, scheduled for the week commencing June 03, fails, May will announce her exit plan.

An eviction of the Prime Minister from 10 Downing Street is widely expected at some point in the summer, resulting in the appointment of a Brexit-supporting replacement who might then pursue 'Brexit at any cost' in order to save the Conservative Party from electoral oblivion, which would be the worst scenario for the currency market.

Boris Johnson, the long-time favourite replacement, confirmed Thursday he will be standing as the next Conservative leader.

Financial markets have long feared a 'no deal' Brexit, where the UK leaves the EU and defaults to doing business with it on World Trade Organization (WTO) terms and, after months of believing a 'no deal' was off the table, complacent investors now face the very real prospect the UK exits the EU on October 31 without a deal in place.

"We caution that a Brexit transition deal will probably not pass this year. It will probably take another deadline extension, and then a general election or a referendum, to resolve the political deadlock. So we will likely see more stormy conditions for Sterling again from time to time," warns Daniel Trum, a strategist in the chief investment office of UBS.

Pound Sterling Live reported Thursday that the ongoing decline in Sterling comes amidst the growing likelihood of the resignation and replacement of PM May over the summer months, which would raise the risk of both a 'no deal' Brexit as well as a general election that risks ushering the Marxist, anti-market, opposition leader Jeremy Corbyn into 10 Downing Street.

Amid relentless selling pressures the Pound-to-Euro exchange rate has fallen back down to 1.1442, having been as high as 1.1776 ten days ago.

The Pound-to-Dollar exchange rate is quoted at 1.2792 having been as high as 1.3177 ten days ago.

Above: Pound Sterling performance relative to G10 rivals this week. Source: Pound Sterling Live.

"EUR/GBP has risen for 9 days in a row after failing to break March's almost 2-year lows. Economic data have played little part in the pound's weaknes but political uncertainty may have ratcheted up another notch, if that's possible. Does a change of PM in July change anything? Neither no-deal, nor no-Brexit is off the table yet!," warns Kit Juckes, chief FX strategist at Societe Generale.

The governing Conservative Party has been hemmorrhaging support in the opinion polls ever since PM May began consorting with the Labour Party in the hope of moving her EU withdrawal agreement through parliament on the back of opposition votes.

So far the cross-party talks are yet to yield any progress and even if they do, some observers have said the PM risks losing more MPs from her own party than she stands to gain from the opposition.

Backbenchers are now increasingly vocal about wanting rid of PM after the party suffered a drubbing of almost historic proportions in local elections, and given the UK is less than a week away from participating in the European Parliament elections.

Opinion polls suggest The Brexit Party, which sprung from the political ether less than two months ago and is headed by arch Brexit campaigner Nigel Farage, will emerge from that vote as the UK's largest.

"A cliff-edge Brexit could push EURGBP toward 0.97. Downside risks include a very soft Brexit or the ECB easing its monetary policy stance further, which could pull the exchange rate toward 0.80," Trum warns, in a recent note to UBS clients.

A EUR/GBP exchange rate of 0.97 would put the Pound-to-Euro rate all way down at 1.03, which is close to the parity level that many analysts have warned will materialise for Sterling in the event of a 'no deal' or so-called cliff edge Brexit. But a EUR/GBP rate of 0.80 would put the Pound-to-Euro rate at 1.25.

The UK parliament has until October 31 to approve Prime Minister Theresa May's EU withdrawal agreement or it will face the choice between cancelling Brexit, leaving the EU via the WTO route and requesting a further extension of the Article 50 notice period.

Above: Pound-to-Euro rate shown at weekly intervals.

"Over the next three months, GBP/USD is unlikely to leave the 1.28–1.36 range, in our view," says UBS' Trum. "A no-deal Brexit could push the exchange rate down to 1.15. Over 12 months, a combination of a weaker Dollar and the UK halting Brexit altogether could lift it to 1.48."

Many parliamentarians are opposed to a 'no deal' exit and some have threatened to bring down the government if it attempts to pursue one but opposition to a deal - ultimately the only thing that can prevent it - remains high in the House of Commons.

MPs from both sides of the aisle still say they will vote against the EU withdrawal agreement if Prime Minister Theresa May puts it before the house for another ballot, which she's planning to do for a fourth time early in June.

The opposition Labour Party are demanding that PM May openly commits to placing the UK in a permanent customs union with the EU as the price for backing the withdrawal agreement, to the ire of Brexit-supporting lawmakers and voters which appear to be shifting behind The Brexit Party ahead of the EU elections.

If Westminster again rejects May's proposed model of exit from the EU it will leave MPs with the choice of either cancelling Brexit altogether or leaving the bloc via the WTO route on October 31, because the EU has said it won't renegotiate the exit agreement.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement