Euro-Dollar Could "Easily" Run to 1.18: SEB

- Written by: Gary Howes

Image © Alfred Yaghobzadeh, European Commission Audiovisual Services

The Euro's rally against the U.S. Dollar could just be getting started.

According to Swedish investment bank and lender SEB, the 2025 outlook for Europe looks clearer with inflation at target and modest growth, but there is more uncertainty about the U.S. outlook.

"This could be 2017 for the Euro," says Namik Immelbäck, Chief Strategist at SEB, referencing a previous episode of outperformance for the bloc's currency.

"Assuming the fiscal story in Europe can be fully implemented into 2026 this could significantly change the underlying story from one of US divergence to maybe even Europe outperforming US growth," adds the analyst.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The call comes at a time of shifting tides in the global financial sphere, with U.S. economic outperformance going out and hopes for a Eurozone pickup rising.

"Consensus growth expectations for the Euro zone have been very muted while they have been moving higher for the US. Assuming the fiscal story in Europe can be fully implemented into 2026 this could significantly change the underlying story from one of US divergence to maybe even Europe outperforming US growth – the last time that happened was in 2017," explains Immelbäck.

The strategist cautions that it remains to be seen whether Europe could achieve the full fiscal impact as soon as 2026, but that doesn’t mean markets can't start to price it.

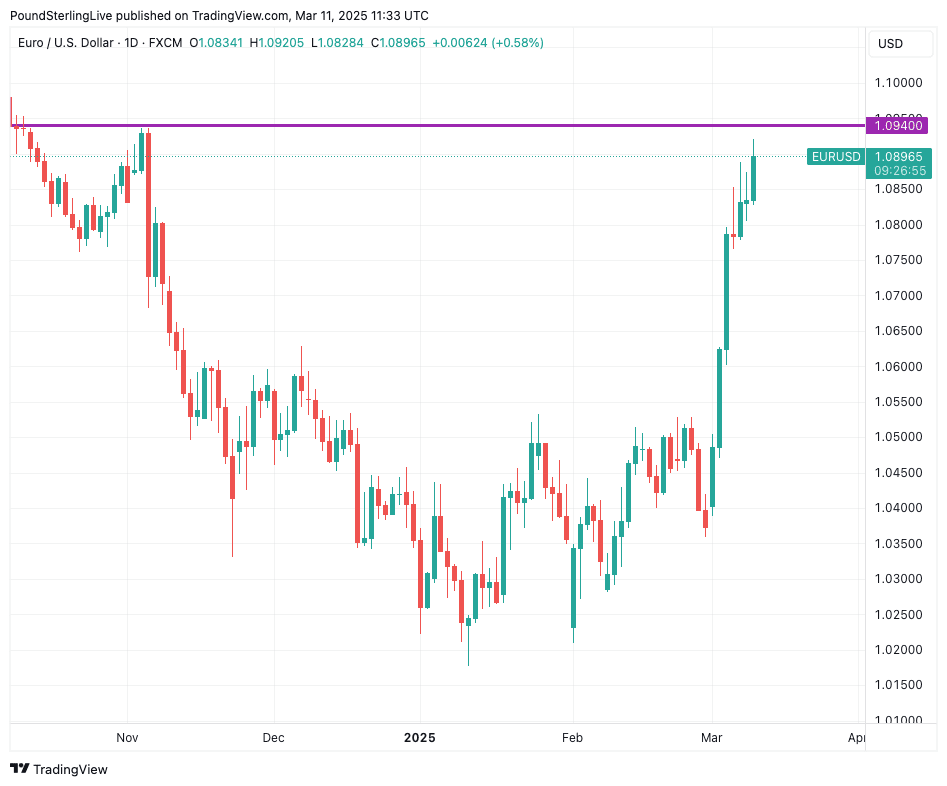

The Euro has rallied 4.0% since Germany announced last week it was ready to change its constitution, taking the Euro-to-Dollar exchange rate to 1.0890, a level last seen in November.

Above: The EUR/USD rally has been powered by a position unwind of USD longs.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

According to SEB, this run-up in EUR/USD looks "largely driven by short covering."

If positioning has merely been unwound, it implies the Euro is yet to build a genuine book of long positions that would reflect a more constructive view on the outlook.

"Looking at episodes when positioning has gone from extreme bearish to max positive, EURUSD could easily rise around 15%, which would take it to 1.18," says Immelbäck.

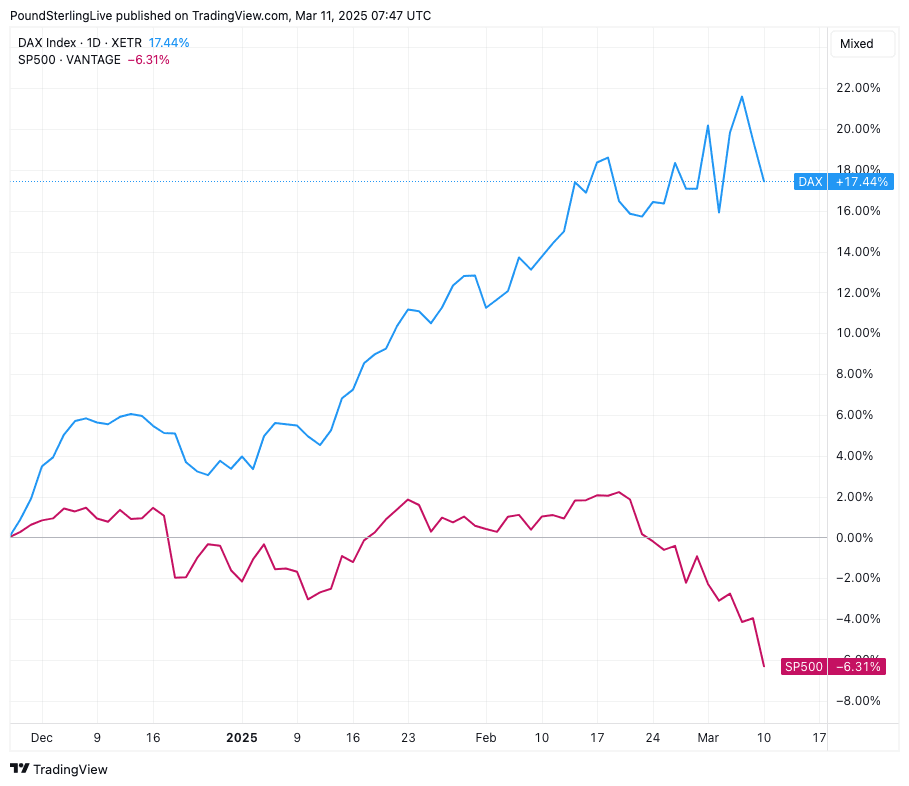

Above: European stocks are massively outperforming U.S. peers in 2025.

SEB says that compared to 2017, equities are now a stronger underlying factor driver of the Euro.

Research shows most of the Euro gyrations are currently explained by European equities, which are currently outperforming those of the U.S.

"The structurally improving story for Europe can have legs, but there should be a speedbump first in Q2," says Immelbäck.

April 02 sees the U.S. announce a broad set of tariffs, with many hitting European exports to the U.S., and most analysts agree the extent and depth of these tariffs pose a risk to the Euro.