Euro-Dollar to Fall Back in Coming Weeks: Investment Banks

- Written by: Gary Howes

Above: German exporters are particularly at risk of U.S. import tariffs, which still loom. Image © Adobe Images

Investment bank researchers say the Euro will retreat again in the coming months.

A surprising surge in the value of the Euro this week has caught analysts and market participants by surprise and reshaped expectations for the Euro's outlook in 2025.

Analysts we follow are near-unanimous in the observation that the downside risks to the Eurozone's currency have greatly diminished, owing to huge investment commitments made by Germany and the European Commission, with many shelving their point forecasts for a test to parity and below.

Some investment bank strategists are now buyers of the Euro, looking for the recovery to extend, but a large portion of those we follow agree that the current rally will stall and retreat.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"We expect the EUR-USD exchange rate to fall back somewhat in the coming weeks," says Ulrich Leuchtmannm, Head of FX and Commodity Research at Commerzbank.

His call is based on the premise that the expected U.S. tariffs are likely to dampen US demand for European goods – and thus the economy – in the near term.

"It is to be expected that the long-term view, which is currently leading to EUR strength, will then no longer have such a strong effect," he explains.

Biggest Weekly Gain Since 2008

In a remarkable week for foreign exchange markets, the Dollar slumped, and European currencies surged following the confirmation that U.S. tariffs on Canada and Mexico would proceed.

The reaction upended the FX playbook that says the only sure-fire route forward for the Dollar under such circumstances was higher.

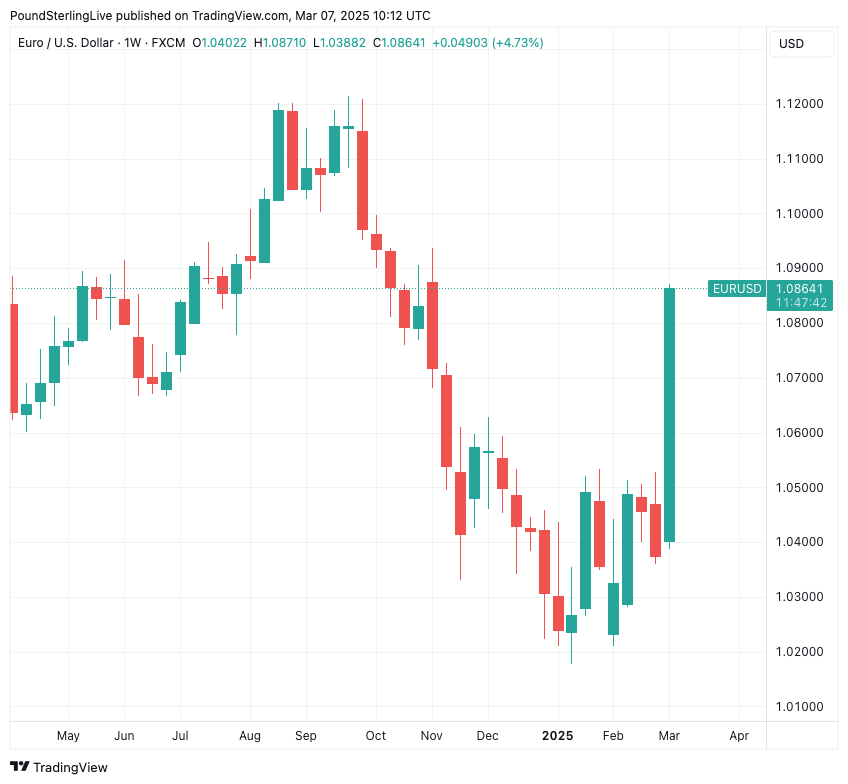

Above: EURUSD at weekly intervals.

The Euro's rally suggests some fatigue with the tariff play, but also a significant market adjustment to account for the negative impact to the U.S. economy tariffs would bring, which diminishes the U.S. outperformance potential against the Eurozone.

Throw in the German and EU announcements on defence and infrastructure spending, and you have the conditions for a rip higher in the Euro-to-Dollar exchange rate which mooned to 1.0865 on Friday morning.

This is a remarkable 4.75% gain for the week, its biggest since 2008.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Tariffs Still a Threat to EUR

U.S. President Donald Trump implemented tariffs on Canada, Mexico and China this week, shocking a market that was expecting either another extension or a pared-down set of tariffs.

Stocks slumped, and after just two days, Trump relented and announced a stay of execution on about half the tariffed goods until April 02.

It is on April 02 that a significant tariff decision will be made, which will include the EU, and it is a date that will prompt enough uncertainty and caution to weigh on the Euro.

"While downside risks for the EUR and euro-zone economy have diminished, they have not completely gone away," says Lee Hardman, currency analyst at MUFG Bank Ltd.

"Tariffs are a massive near-term risk," says Bill Diviney, an economist at ABN AMRO.

On April 02 the U.S. is expected to announce new tariffs on the car and pharmaceutical sectors, which account for a significant amount of EU exports to the U.S.

However, he is almost certain to include other sectors and (bizarrely!) introduce tariffs on countries that charge VAT.

"If the administration were to go ahead with all of its threats, this would represent a much bigger growth shock than we currently have in our base case," says Diviney.

Expectations for a pullback in the Euro is why Commerzbank hold a Euro-Dollar forecast of 1.05 for June.

MUFG upgrades its forecasts from a sub-parity target to 1.02 for mid-year.