Euro-Dollar Shatters Resistance

- Written by: Gary Howes

Above: File image of Olaf Scholz (SPD), Federal Chancellor. Reichstag building, plenary hall, Berlin / Germany. Image Thomas Imo / photothek for Bundestag.de.

The Euro is powering higher on signs that European countries are to invest more in defence and infrastructure.

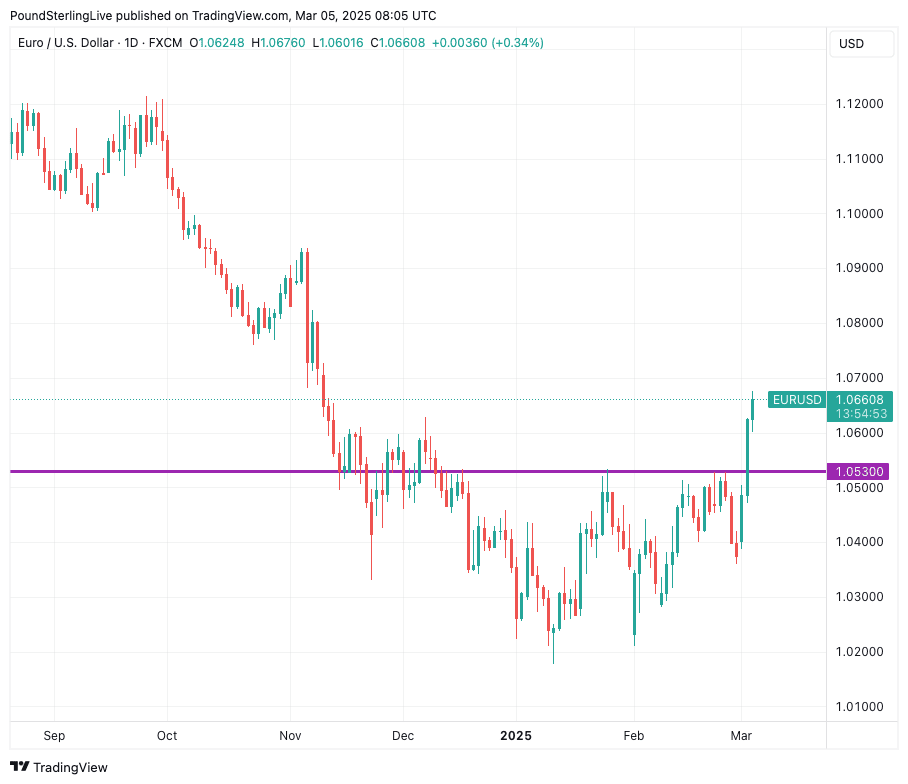

The Euro-to-Dollar exchange rate broke through a key resistance level at 1.0530 on Tuesday and is extending gains on Wednesday.

The impetus follows news that Germany is preparing to amend its constitution to allow it to invest more in defence and infrastructure.

The existing coalition of the Greens, CDU/CSU and Chancellor Olaf Scholz's SPD are looking to quickly push through a constitutional change to allow greater spending in infrastructure and defence.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

This is because the incoming government won't have the three-quarters majority in the Bundestag required to enact constitutional changes.

Currently, spending is constrained by the debt brake that says no more than 0.35% of GDP can be borrowed.

A provision would exempt defence spending above 1% of GDP from the "debt brake" that caps government borrowing, allowing Germany to raise an unlimited amount of debt to fund its armed forces and to provide military assistance to Ukraine.

Proposed changes will also allow the next government to launch a €500BN infrastructure fund to invest in priorities such as transportation, energy grids, and housing.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

All this points to a fundamental shift in Germany away from fiscal austerity to greater spending, which would boost growth.

"Fiscal austerity is out of favour. Austerity had unnecessarily burdened Europe and exacerbated the private sector's deleveraging," says Mathieu Savary, BCA Research’s Chief European Strategist.

The rally in the euro confirms that markets agree.

"European fiscal policy could all be enough to lead EUR/USD to break the critical 1.0530 level," says David S. Adams, a strategist at Morgan Stanley. "A break here would correspond with the DXY breaking the 106 level, confirming a technical downtrend and allowing other USD-crosses to break their corresponding range bottoms."

Above: EURUSD breaks above a key resistance point.

Morgan Stanley maintains a 'long' EUR/USD trade that targets a move to 1.08.

The developments come amidst an acceleration of the U.S. Dollar downtrend that is linked to fears the U.S. economy will buckle under President Trump's volatile decision-making and punitive tariffs.

The major surprise of the week so far has been the Dollars slump on confirmation that tariffs on Canada and Mexico would proceed, shattering a long-held view that tariffs are unambiguously good for the Dollar.

Investment banks are revising forecasts for the Euro vs. the Dollar, saying they no longer see it falling to parity in 2025.

Prominent names include Goldman Sachs, MUFG Bank and TD Securities.

Goldman Sachs forecasts Euro-Dollar at $1.01 in six months, weaker than current levels, but stronger than its previous call for $0.97.

MUFG Bank Ltd says, "we are no longer showing EUR/USD forecasts below parity given our view that by end-Q2 the US economic slowdown will be more apparent and by then the Fed will have possibly cut the fed funds rate again."