EUR/USD Week Ahead Forecast: No Killer Blow

- Written by: Gary Howes

File image of Emmanuel Macron, Copyright: European Union.

The Euro starts the new week on a softer footing, but France's election result is no killer blow, and the single currency can extend its short-term recovery.

The Euro to Dollar exchange rate was softer on Monday after France's legislative election resulted in an unexpected win for a coalition of far-left and left-wing parties.

The left-wing New Popular Front (Left Alliance, or NFP) won 182 seats, compared with 168 for Emmanuel Macron's coalition Ensemble and 143 for the far-right Rassemblement National and its allies.

Even though the leftist bloc won, it does not have the numbers to form a majority, and it is difficult to see how this chequered group can stay united when concessions to other political parties are required.

In short, France has a 'hung' national assembly, which means the extremes of the left and right will be avoided. Nevertheless, a period of political gridlock awaits, which could be problematic for a country that must bring its debt levels down in the coming years.

"There is a risk that the hard-left Jean-Luc Mélenchon is appointed prime minister. And even if he isn’t, parliamentary gridlock will hinder efforts to get the public finances on a sustainable footing," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist at Capital Economics. "We think investors will probably judge that the election has avoided the worst possible outcomes: a majority RN or NFP government. But things still don’t look good for France."

Track EUR/USD with your own alerts, find out more here.

Euro-Dollar entered the French vote with a spring in its step, taking advantage of last week's broad-based weakness in the Dollar. The Dollar fell as market bets for Federal Reserve rate cuts rose again, owing to a string of softer-than-expected data prints.

This confirms that even the intrigue provided by French politics will ultimately be a secondary consideration for currency markets compared to the Fed.

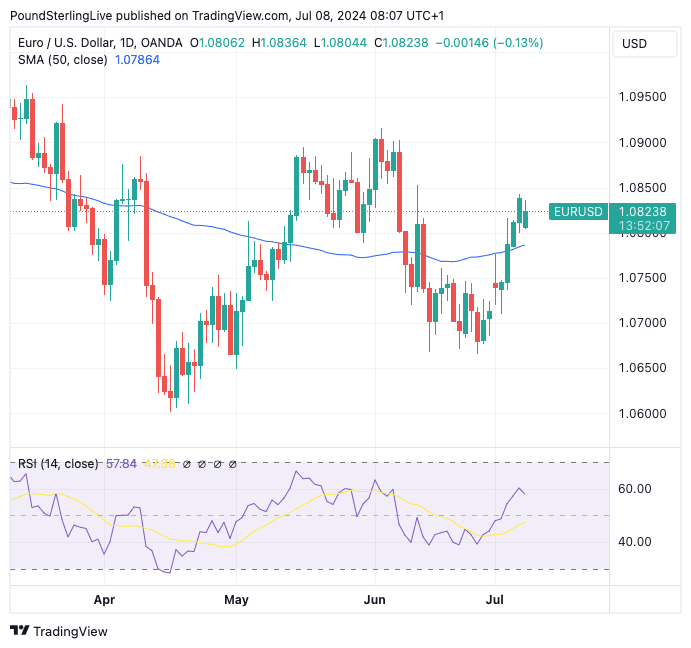

Euro-Dollar last week broke above its 50-day moving average as upside momentum began to build again. This is confirmed by the RSI, which is now positive and pointing higher again.

In the coming week, we could see a test of 1.0850, and then eyes will turn to 1.09.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

For these levels to be attained, Thursday's U.S. inflation print must undershoot expectations. Headline CPI is expected to decline to 3.1% year-on-year, down from 3.3% in May, a level last seen in January. The core inflation print is expected to be at 0.2% month-on-month.

Such readings would signal the disinflation process is underway again, having been disrupted by the price acceleration in H1. This will raise the odds that the Federal Reserve will cut interest rates in September and potentially weigh on the Dollar.

The inflation report will follow Friday's labour market report, which confirmed a trend of cooling is underway, and this will continue to bring wage pressures down. Falling wages will ultimately result in easing domestic inflation.

"This week will be a hot one for US macro, with the CPI report for June out on Thursday," says Francesco Pesole, FX Strategist at ING Bank. "There is a clear weakening trend emerging in the US jobs market and that will, in our view, push an FOMC that wants to avoid unnecessary economic pain to cut three times this year, starting in September."

A further repricing towards more rate cuts at the Fed will weigh on the Dollar.