EUR/USD Short-Term Outlook: Range Between 1.12s and 1.10s to Hold

Image © Adobe Images

- Recent recovery can extend

- Range seen between 1.10s and 1.12s

- Euro to be moved by CPI data this week; U.S. Dollar by trade rhetoric

The Euro-to-Dollar rate is trading at around 1.11 at the time of writing on Tuesday, having risen 0.50% in the week before.

Concerning the outlook, our studies of the charts are showing the short-term trend as being sideways in nature, and the Euro can therefore continue recovering in the short-term:

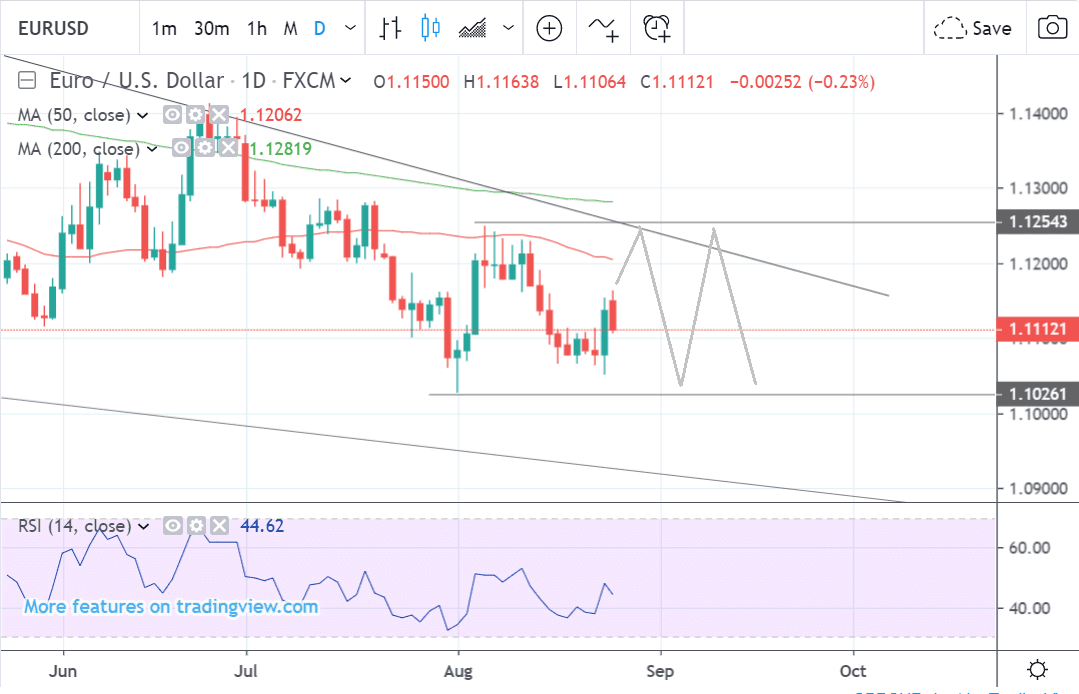

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair having recovered after making lows at around 1.1050.

It looks like the recovery should continue to go higher, to just above 1.1200 and the range highs. After that however, it could well begin declining back down again to the range lows at around 1.1050.

This sideways trend is then likely to continue unfolding within these parameters over the short-term.

The daily chart shows the pair rising and falling in a sideways trend which is likely to continue given the old adage that ‘the trend is your friend’.

The range which has been forming appears to have highs in the 1.1200s and lows in the 1.1000s and we see an extrapolation of this as probable.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

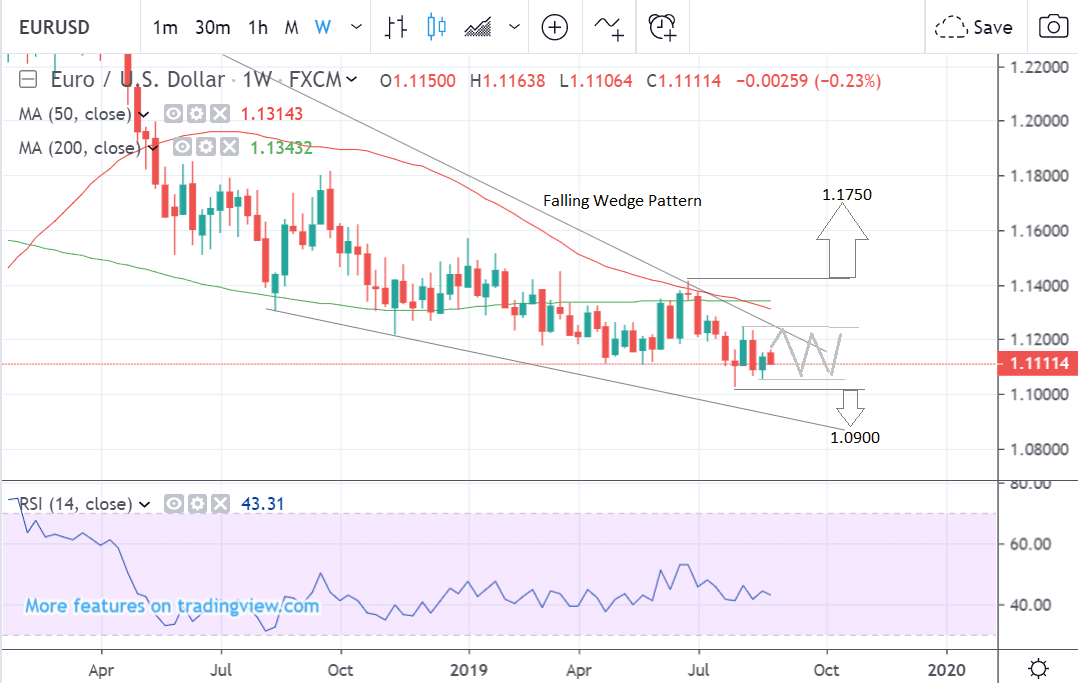

The weekly chart - used to give us an idea of the longer-term outlook, which includes the next few months - shows how the pair continues to fall within a falling wedge pattern.

If the pair managed to pierce the bottom of the 2019 lows and the wedge pattern it could fall as far as 1.0800 in the long-term.

A break above the June highs at 1.1412 would probably see the pair continue higher to a target at around 1.1750 based on the width of the current range.

A break below the July lows at 1.1027, however, would probably see a continuation down to a target at the lower border of the falling wedge pattern and a target at around 1.0900.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Euro: What to Watch

The main release for the Euro in the week ahead is likely to be inflation data out on Friday.

Eurozone core inflation is forecast to show a rise to 1.0% from 0.9% in August whilst broad inflation is forecast to remain unchanged at 1.0%, when released at 10.00 BST on Friday.

Inflation impacts on the Euro via interest rates which rise or fall in tandem with inflation. The Euro is closely correlated to interest rates because of the impact they have on capital flows. When they are high they lead to higher capital flows and vice versa when they are low.

“Attracting more attention will probably be Friday’s flash CPI stats for the Eurozone as a whole. Inflationary pressures have cooled in recent months as the economy slowed, and inflation expectations have also declined dramatically, threatening to drag actual inflation even lower. That is why investors expect the European Central Bank to act with force in September and cut rates deeper into negative territory, as well as launch another round of Quantitative Easing,” says Marios Hadjikyriakos, an investment analyst at XM.com who concludes the outlook does not bode well for the single currency.

The other key release is Eurozone unemployment in July, which is forecast to come out at 7.5% when it is released at the same time as inflation data.

German data may also be of interest. The Ifo Business climate index came out below expectations when it was released this morning. It is seen as a fairly reliable indicator of growth, suggesting the possibility of slower growth as possible a recession in Europe’s largest economy.

Consumer Confidence on Wednesday and German CPI out on Thursday may also be of interest, with the former expected to show a drop to 9.6 and the latter a slowdown of -0.1% in inflation in August.

The U.S. Dollar: What to Watch this Week

Trade tensions between the U.S. and China will probably take centre stage over coming days after the escalation seen last week, when the Chinese announced a new set of tariffs on U.S. goods.

The tariffs included an increase of between 5% and 10% to be implemented at the start of September and 25% tariffs on U.S. car imports.

In retaliation, Donald Trump threatened to slap even higher tariffs on Chinese imports, increasing existing tariffs from 25% to 30%, and threatening to increase expected tariffs of 10%, earmarked for another $300bn of Chinese imports, to 15%.

Trade issues will probably eclipse data in the week ahead as they are seen as a more significant factor for the U.S. economy, according to Marios Hadjikyriacos, an investment analyst at XM.com.

“Even if these figures are stellar, the central bank is still certain to slash rates next month, as it tries to safeguard the US economy from the negative effects of trade tensions. Indeed, the Fed has made it clear it’s not cutting rates because the economy is in trouble, but rather so it doesn’t get into trouble in the first place,” says Hadjikyriacosm, adding:

“Therefore, the most crucial factor for how aggressively the Fed will act may be whether the White House proceeds with slapping new tariffs on China on September 1. Judging by Trump’s raise-the-stakes negotiating style, further escalation is very likely,” such an outcome would force the Dollar lower, says the analyst.

The Federal Reserve (Fed) is still likely to cut interest rates in September, in an effort to insulate the economy from a potential trade-induced downturn, and lower interest rates will probably weigh on the U.S. Dollar, since they act as less of a draw on foreign capital inflows.

On the 'hard' data front, the key releases are likely to personal consumption expenditure (PCE) and personal spending also on Friday.

PCE is the Fed’s preferred gauge of inflation and it is forecast to show a 0.2% rise in July compared to the month before and a 1.6% rise compared to a year ago.

PCE impacts on interest rate expectations which could be important given the debate around how much the Fed is expected to cut interest rates in September.

A lower-than-expected PCE result, therefore, would fuel bigger rate cut expectations, driving the U.S. Dollar down in the process.

Personal spending, as well as consumer confidence, are both likely to come out relatively strongly when released next week, as all the signs are that the U.S. consumer continues to spend relatively liberally.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement