GBP/EUR: Final Rate Hike Can Support Sterling Say Analysts

- Written by: Gary Howes

Image © Adobe Images

The British Pound outlook is constructive as analysts say UK inflation data raise the possibility of another interest rate hike at the Bank of England by early 2024.

"Inflation data presents a bullish outlook for sterling," says Matthew Ryan, Head of Market Strategy at global financial services firm Ebury.

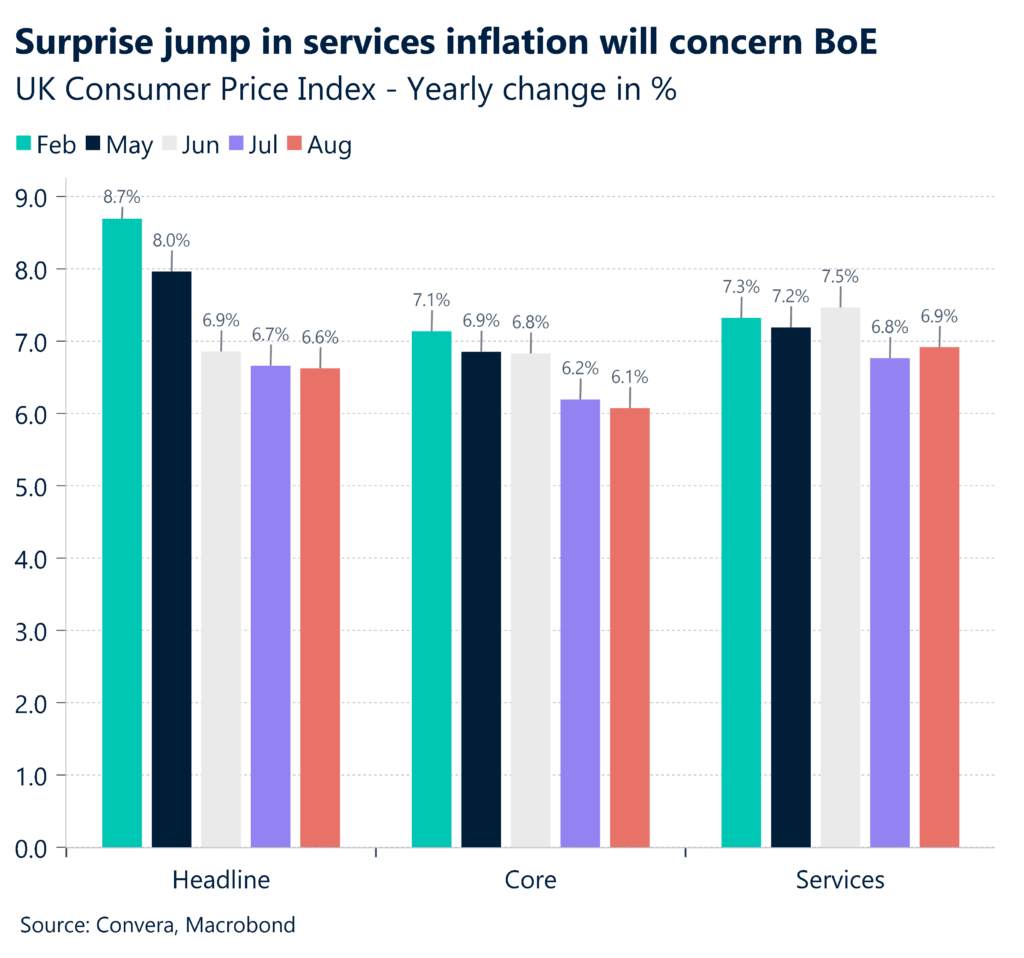

Ryan's comments come after headline UK inflation rose 6.7% year-on-year in September, unchanged from August, but above a fall to 6.6% that was expected by markets.

"Today's inflation data will undoubtedly heap pressure back on the Bank of England to continue raising interest rates at upcoming MPC meetings," says Ryan, adding that a final 25bp hike presents a bullish outlook for the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Core CPI inflation - which gives a clearer sense of domestic inflationary pressures - was up 6.1% y/y in September, down from 6.2%, but above analyst expectations for a drop to 6.0%.

However, the rise in services inflation will prove particularly concerning to the Bank of England, according to economists, given that policy makers have expressed concern about the persistence of inflation in the economy's largest sector.

"The stickiness of services inflation is a common theme across major Western economies and the reacceleration in the UK to 6.9% yoy in September gives the hawks on the BoE no reason to back down," says Kenneth Broux, Société Générale.

Image courtesy of Convera. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Money market pricing now indicates a 60% chance of another rate hike by the early part of 2024, and economists at Investec say there are notable risks the Bank of England meets these expectations.

"We still have retail sales, flash PMIs and labour market data to be published. As has been seen in past meetings, singular data points can have the power to influence a rate decision (even if they are then revised). The risks are certainly tilted towards a further hike from the Bank of England," says Ellie Henderson, an economist at Investec.

The British Pound was the top-performing G10 currency for much of 2023, mainly because of the market's elevated expectations for how high the Bank of England would take interest rates.

Such expectations pushed UK bond yields higher, in turn generating international investor demand for UK bonds as investors sought higher returns, naturally creating a bid for Pound Sterling.

But expectations rapidly declined as investors grasped the UK's inflation problem was not as exceptional as it once appeared, culminating in the Bank's decision in September to keep interest rates on hold.

This has been a drag on the Pound since August, and markets will question how much further this trade can persist.

If the Bank does hike interest rates in November, or at least set the market up for a December rate hike, the Pound could stabilise.

"We continue to see very little chance of any change in rates when the BoE next convenes early next month, as officials will likely wish to wait for additional data before deciding on the next policy move," says Ebury's Ryan. "That said, we are increasingly of the opinion that a final 25 basis point hike may be required at a subsequent MPC meeting."

"UK inflation continues to run far too hot for comfort, and until we see a clearer move lower in both prices and wages, rates will likely need to remain higher, for longer. This presents a bullish outlook for sterling," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes