Pound Sterling: UK Inflation Beats Expectations

- Written by: Gary Howes

Image © Adobe Images

The British Pound has made steady progress through the hours following a release of inflation numbers for September that beat analyst expectations and prompted markets to bet the odds of a further Bank of England rate hike now stand at 50%.

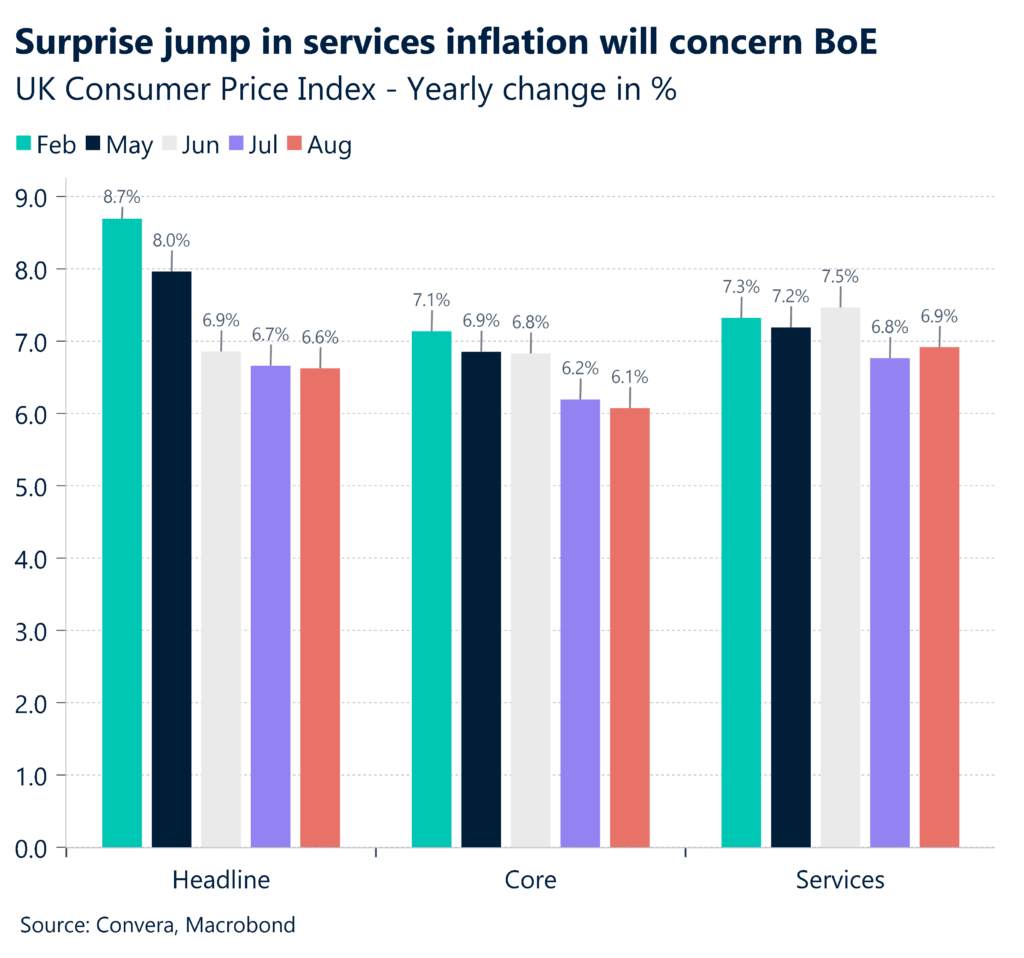

Headline UK inflation rose 6.7% year-on-year in September said the ONS, unchanged from August, but above the fall to 6.6% the market was looking for. The month-on-month figure ticked up to 0.5% from 0.3%, which was expected.

Core CPI inflation was up 6.1% y/y in September, down from 6.2%, but above analyst expectations for a drop to 6.0%.

"Sterling is trading higher after the release, as markets now price in 50% chances of another hike before year-end. EUR/GBP may correct a bit lower on the back of some hawkish BoE rate expectation repricing today but is then probably heading higher into the BoE meeting as we expect a hold," says Francesco Pesole, FX Strategist at ING Bank.

Above: Key inflation headlines from the UK, image courtesy of Convera.

The Pound to Euro exchange rate has steadily risen through the day to reach 1.1540, the Pound to Dollar exchange rate is flat at 1.2180 but had been higher at 1.22 earlier.

Although the Pound has edged higher following the release, it has not surged. Those who read Pound Sterling Live on Tuesday will have seen our coverage of research by RBC Capital Markets that shows Pound Sterling traditionally tends to react when inflation figures surprise to the downside, making today's reaction unsurprising.

The odds of a further rate hike won't disappear entirely as services inflation, which the Bank of England pays close attention to, surprisingly rose from 6.8% to 6.9%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Money markets show the chance of another BoE rate increase before year-end is little less than 50-50. However, rates are expected to stay elevated for an extended period as officials keep up their battle to bring inflation back to target," says George Vessey, Lead FX Strategist at Convera.

This latest inflation release is not decisive enough to sway the Bank into another rate hike in November, particularly following Tuesday's wage numbers that showed a cooling in wage pressures is underway, which can contribute to lower inflation rates in the future.

The Pound fell against the majority of its peers following the wage figures, which also led us to reflect that the market might have already moved ahead of the inflation release. In short, the market is hunting out and reacting to any data releases which support a narrative that the Bank of England is done hiking.

A softer Pound is the expression of this.

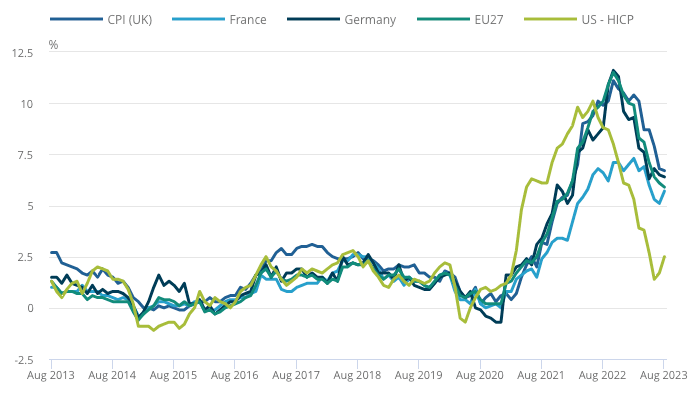

Above: CPI compared with selected G7 and EU annual inflation rates, August 2013 to August 2023. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

"Cooling labour market conditions pave the way for services-driven core CPI inflation to stay on an easing path. It has taken time, but it now looks as if we are finally starting to get there – both in absolute terms and versus other major DMs," says Konstantinos Venetis, an economist at TS Lombard.

The Bank of England could keep rates unchanged in November as a significant positive contribution to inflation is related to rising fuel costs, which are courtesy of the recent uptick in global oil prices.

With oil having fallen back, this trend can ease over the coming weeks.

The ONS reported significant downward effects from restaurants and hotels, food and non-alcoholic beverages, recreation and culture, furniture, and household goods.

"Looking ahead, the combination of falling energy costs for many businesses when they renew their contracts with suppliers and improving labour availability should ensure that services price rises continue to slow," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Pantheon Macroeconomics continues to think that consumer prices will rise slowly enough over the coming months to drag down the headline rate of CPI inflation to an average rate of 4.5% in Q4 and 4.0% in Q1.

"Then we expect the headline rate to hover between 2.0% and 3.0% for the rest of 2024. If so, then the MPC needn’t leave Bank Rate at 5.25% for very long next year," says Tombs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes