Pound Sterling Weakness against Euro Can Extend say Strategists

- Written by: Gary Howes

Image © Adobe Images

Foreign exchange strategists retain a cautious stance on Pound Sterling and see the potential for further weakness against the Euro over the short- to medium-term.

The calls come amidst an ongoing decline for the Pound to Euro exchange rate that has seen it lose two-thirds of a percent already in February.

Jordan Rochester at Nomura is one such strategist; he is looking for the Pound to underperform its Eurozone counterpart for two key reasons.

Firstly, the ongoing unwind of negative interest rates in the euro area has "long-term implications" for Sterling.

UK interest rates have typically been higher than those of the Eurozone over the past decade, offering investors better returns.

This allowed investors to borrow in euros and fund pound-based assets, supporting the Pound.

But the end of the negative interest rate regime at the European Central Bank, turns this trade on its head, particularly given investors now expect the ECB to hike further than the BoE in 2023.

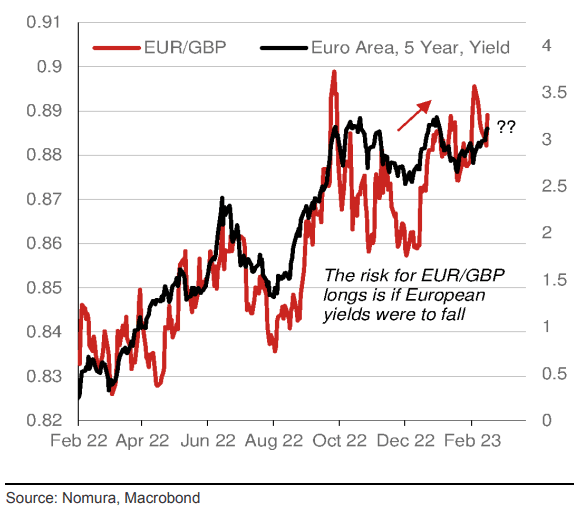

Above: "EUR/GBP is broadly following the path of higher EGB yields. Years of EUR funded carry trades being unwound, weighing on GBP" - Nomura.

As the chart above shows, as Eurozone yields rise in response to higher ECB interest rates, so too does EUR/GBP.

Secondly, the UK's economic growth and inflation momentum are expected to cool off quickly from here as UK consumers are more exposed to rate hikes than peers in Europe.

"The real problem is that the UK housing sector's fixed-rate mortgage period tends to be between 2yrs and 5yrs vs Germany and France in excess of 10yrs," says Rochester.

ONS data reveals some 1.4 million households will renew their mortgages at higher interest rates in 2023, weighing on household expenditure.

Given the above, Nomura looks for EUR/GBP to trade into a range of 0.90-0.92 by the second quarter of the year. (This gives a Pound to Euro range of 1.11-1.0870.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Thomas Flury, Strategist at UBS, has meanwhile made buying the Euro against the British Pound his trade of the week.

"We think the GBP has little upside left, given the BoE's softer language at its February meeting and the downside surprise in core inflation in January. Leading indicators are rolling over, and we are expecting to see more weakness in the economy with next week’s PMIs," says Flury in a regular weekly briefing.

Calls for Euro strength against the Pound have been a popular one amongst strategists of late, with those at both Citi and RBC Capital Markets making similar trade recommendations in the previous week.

Citi's economists still expect a 25bp interest rate hike to be delivered at the next Bank of England meeting owing to the robust wage dynamics of the UK, but they caution the likelihood of a pause in May is increasing as the peak in UK inflation has passed.

RBC Capital Markets meanwhile anticipated the faster-than-expected decline in UK inflation revealed by last week's data, anticipating the weakness in the Pound that followed.

Technicals were also a consideration:

"EUR/GBP is near the bottom of the ascending channel that has held since late last year so we go long EUR/GBP with a stop just below the rising trendline," said Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

The short-term trade was closed with a 0.2% profit.

UBS is looking for a move to EUR/GBP 0.9060 and Citi is holding out for a longer duration as they target 0.92.

In GBP/EUR terms, these targets approximate to 1.1038 and 1.0870. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes