GBP/EUR Week Ahead Forecast: Data Dominates Formative Period for Outlook

- Written by: James Skinner

- GBP/EUR supported near 1.1478 but upside uncertain

- UK GDP, inflation in focus after BoE's decision delayed

- Fiscal policy risks drawing an aggressive BoE response

- CPI & GDP could foment risk of a shock & awe rate rise

- GBP implications uncertain, but potentially quite bearish

Image © Adobe Images

The Pound to Euro exchange rate fell last week and could struggle to get far off the ground in the days ahead when the market will likely be most interested in UK inflation data that could further heighten the already-elevated risk of aggressive interest rate action from the Bank of England (BoE) next week.

Sterling traded as low as 1.1478 against the Euro during the Wednesday session last week where it found support atop of the 50% Fibonacci retracement of the September 2020 recovery from losses sustained at the height of the Brexit negotiations, a level that could continue to support the Pound in the week ahead.

However, the Pound was steadier on its feet by the Friday close after the Euro softened when the European Central Bank (ECB) announced the largest interest rate rise in the history of the monetary union and following the announcement of a large fiscal support package from new Prime Minister Liz Truss.

The new fiscal package has potentially significant implications for Bank of England (BoE) monetary policy when September's interest rate decision is announced on September 22 following a delay to accommodate the national mourning of Her Majesty Queen Elizabeth II.

Above: Pound to Euro exchange rate shown at daily intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The government's fiscal package caps energy bills to £2,500 per year, saving a typical household around £1,000, and provides support to businesses at the same time as it seeks to boost domestic production of energy over the medium-term.

"The cost of her announcements is extremely uncertain as it is likely to depend on the direction of wholesale energy prices over the next two years. Given the current level of futures prices, it could easily exceed £150bn (c. 7-8% of GDP)," say Fabrice Montagne and Abbas Khan, both economists at Barclays.

"Given that the average energy bill was previously expected to reach almost £6,000 by April 2023, the effect on headline inflation of freezing energy bills at £2,500 from October is material. Our new baseline now suggests that inflation may already have peaked in July," they both said on Friday.

The new measures will reduce inflation and help to support consumer demand but will do little to encourage better discipline of companies and consumers in price setting and consumption decisions, which means they may be an upside risk to inflation over the medium-term.

This, rising expectations of inflation and the market perception of the BoE having been too timid in raising its interest rate during prior months are all reasons for why it could be likely to respond aggressively on September 22.

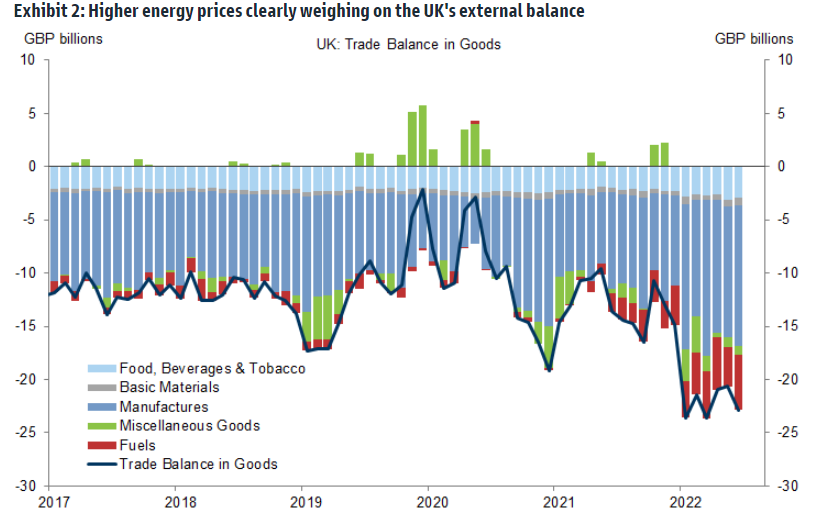

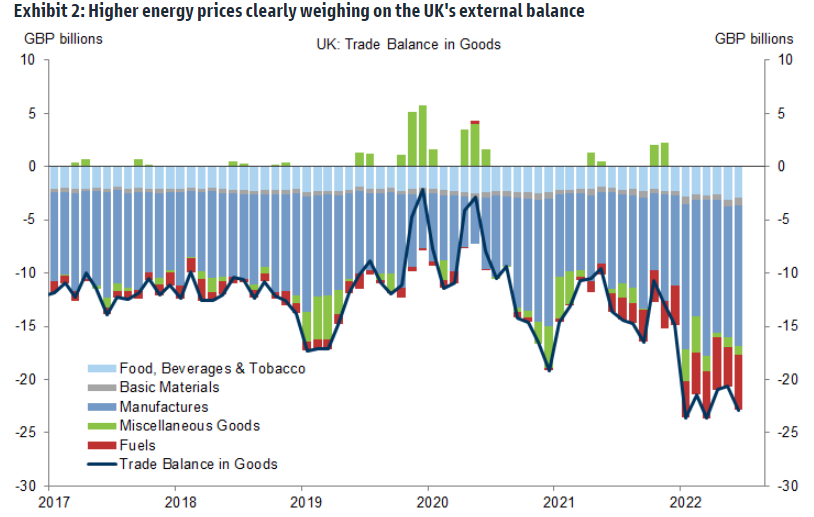

"Mocking the British economy has always been a financial market pastime, but the twin deficit does expose sterling assets to downside pressure under difficult circumstances," says Stefan Koopman, a senior macro strategist at Rabobank.

Above: Pound to Euro exchange rate shown at weekly intervals with selected moving-averages and Fibonacci retracements of September 2020 rally indicating possible areas of technical support for Sterling. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"We still favour a 50 bps increase in Bank rate to 2.25% next week; a 50 bps hike in November looks now likely too. The risks remain skewed to the upside," Koopman wrote in a Friday research briefing.

The author suspects that a decision to raise Bank Rate to 3%, 4% or perhaps even more cannot be completely ruled out for this month, although it's far from clear how the currency market would respond to that and there is surely a risk of its reaction being bearish for Sterling, at least in the immediate aftermath.

Much still likely depends, however, on the outcome of July GDP data due to be released on Monday, the latest employment figures on Tuesday and the details of the August inflation report that is set for publication on Wednesday, which is also the 20th anniversary of the infamous Black Wednesday.

These are the highlights for the Pound in what is set to be a quiet week for European economic data.

"The UK economy is suffering from a significant fundamental shock, with higher energy prices clearly weighing on the external balance. No government policy can fully offset these fundamentals, but we do not see the makings of a fiscal crisis, either," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"But with the energy price freeze also bringing about lower near-term headline consumer inflation, their expectation is that the MPC is not yet ready to deliver a 75bp hike at the upcoming meeting (now scheduled for September 22), and that is an important near-term risk to the Pound," Cahill also said on Friday.

Source: Goldman Sachs Global Investment Research.