Pound / Euro Gripped by Ukraine Tensions as HSBC Bets on Sterling's Decline

- Written by: Gary Howes

- GBP/EUR maintains slight upside bias

- Aided by lack of clarity from Eastern Europe

- But HSBC say they are buyers of EUR/GBP

- On relative central bank policy

Above: Doorstep statement by NATO Secretary General Jens Stoltenberg in advance of the meetings of NATO Defence Ministers on January 16.

Pound Sterling looks to maintain an upside bias against the Euro as long as investors are fixated on Russia and Ukraine, but a major bank has initiated a buy on EUR/GBP as they bet the Euro will eventually win out.

The Pound to Euro exchange rate remains in the grip of messy market sentiment regarding the Ukraine-Russia situation: this week we have seen solid gains (Monday) followed by a dip (Tuesday) and a recovery (Wednesday).

Monday saw tensions over the situation in Eastern Europe reach fever-pitch highs only for the pressure to be released on Tuesday amidst reports that Russia was keen to keep talking to Western nations and that some military units were returning to base following exercises.

Wednesday saw optimism fade again as it became clear that nothing has really changed: Russia still has over 120K troops stationed on Ukraine's borders and there is no clear diplomatic progress.

"I was impressed immediately on Monday by the extent to which the FX market believes official Russian statements, as the Russian military has been renowned for Maskirovka for a long time, for its ability to camouflage, deceive and surprise. Maskirovka is a long-standing tradition of the Russian army," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

Maskirovka is quite simple by definition: Russian military deception.

"Because there is still significant risk of an escalation of the conflict those who do not have to earn a living from risk-on/risk-off moves are best served maintaining a moderately sceptical view," says Leuchtmann.

NATO Secretary General Jens Stoltenberg offered some incisive clarity when he said on Wednesday, "we have not seen any de-escalation on the ground. On the contrary, it appears that Russia continues the military build-up."

The Pound-Euro exchange rate will therefore almost certainly remain caught in a vortex of media briefings, speculation and spin with regards to the Ukraine-Russia issue.

It is simply too difficult to speculate on the outcome or next steps Russia intends to take, therefore it would be foolish to try and predict near-term moves in Sterling-Euro in light of geopolitics.

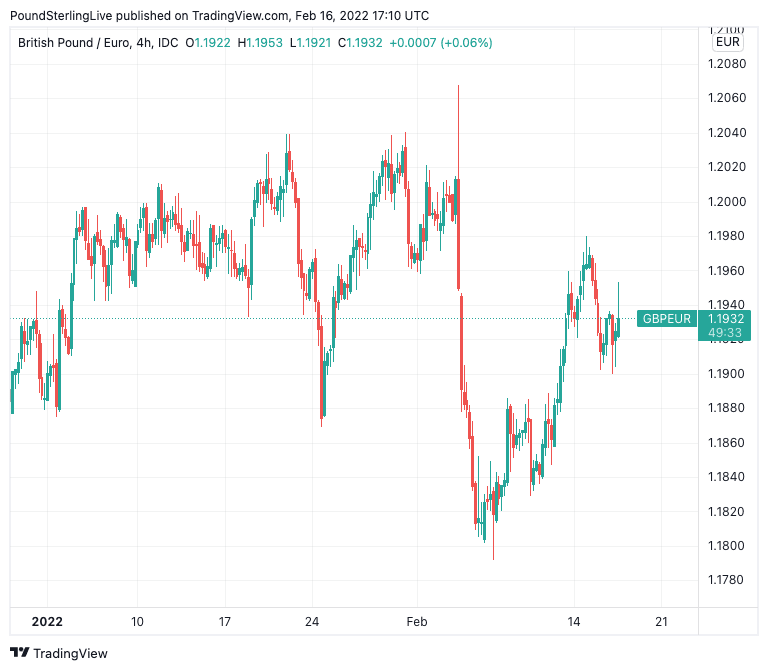

Observations of the GBP/EUR currency strength chart - see below - however confirms the pair is looking increasingly comfortable in the 1.19-1.1980 bracket and further moves within here are possible.

Above: GBP/EUR at four hour intervals, showing trade in 2022.

- Reference rates at publication:

GBP to EUR: 1.1956 - High street bank rates (indicative): 1.1640 - 1.1720

- Payment specialist rates (indicative): 1.1873- 1.1896

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

The immediate trend heading into this zone favoured Sterling, placing a greater emphasis on the upside and a potential test of the round number at 1.20 ahead of the 2022 resistance layers located just above here.

Only a complete removal of Eastern European anxieties would expose the downside again and a retest of the February 07 lows at 1.18 again.

But bear in mind too that much of the Euro's early February strength was linked to the about-turn in European Central Bank policy, announced at the February 03 policy update.

The ECB said it would no longer rule out a rate hike in 2022, prompting the market to price in a number of 10 point hikes to the Deposit Rate, that would take it back to 0% by the end of the year.

ECB Governing Council member Francois Villeroy said midweek the ECB will consider the calendar for APP purchases in March and regular bond buying under APP could end in the third quarter.

For GBP/EUR more broadly much depends on how fast the ECB moves relative to the Bank of England on tightening monetary policy from here.

Foreign exchange strategists at HSBC have this week said they are now buyers of the Euro against the Pound as they see the Bank of England disappointing against market expectations.

In a briefing note HSBC's strategy desk said the ECB seems likely to announce a faster tapering of its quantitative easing programme in March, while also releasing higher inflation forecasts.

"We think there appears to be room for the Bank of England to disappoint relative to market pricing, which has more than a 50% chance of a 50bp hike," says Dominic Bunning, Head of European FX Research at HSBC.

HSBC targets a move to 0.8530 in EUR/GBP, or 1.1723 in GBP/EUR.