Pound-to-Euro Exchange Rate Finds Support on Heightened Political Uncertainty in Italy

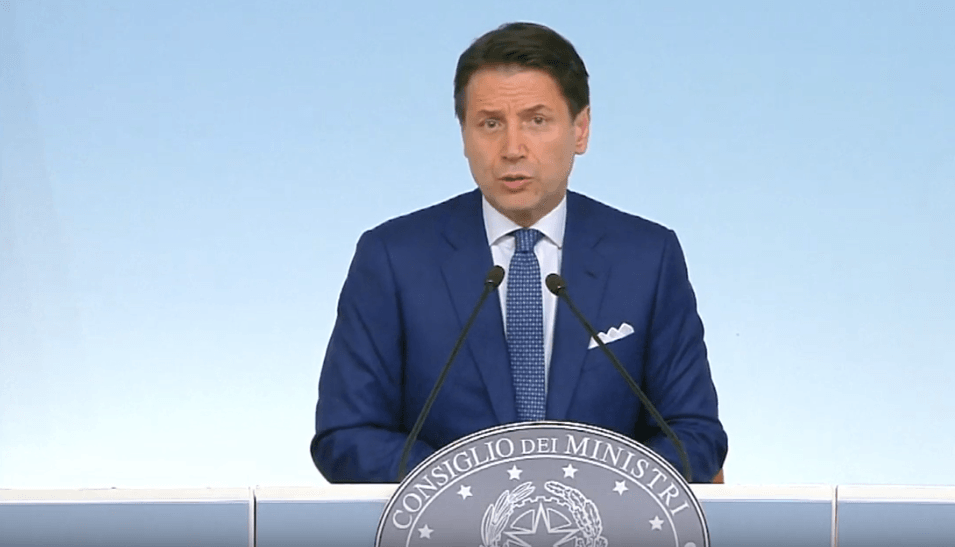

Above: Italian Prime Minister Giuseppe Conte, his administration is on the verge of collapse. © Pound Sterling Live. Still courtesy of Euro News

Pound Sterling bounced higher against the Euro at the start of the new week having recovered from the 10-year lows recorded in the late hours of the previous Friday, with the Pound-to-Euro exchange rate moving higher in response to signs of growing political instability in Italy.

The exchange rate - under heavy and sustained selling pressure since May - recovered from multi-year lows at 1.0638 to trade at 1.0779 at the time of writing on Tuesday, amidst signs the Italian governing coalition is unlikely to see out 2019.

Senate leaders met Monday to discuss a no-confidence vote in the 5-Star-League coalition government headed by Guiseppe Conte after Matteo Salvini’s League party withdrew support for the coalition in an attempt to capitalise on increasing popularity in the polls.

The meeting failed to deliver agreement and as a result the entire senate has been called back from their summer holidays to set a date to debate a motion of no-confidence in the government.

Salvini and right-wing allies are said to want a no-confidence vote this week, but factions within M5S and the opposition Democratic Party (PD) are attempting to scupper a push for immediate elections knowing that the League could seize power.

Salvini, who is deputy prime minister and interior minister, has also threatened to withdraw his seven government ministers in order to topple an administration that he says is no longer viable.

"Political uncertainty in Italy is weighing on the Euro," says Georgette Boele, Senior FX Strategist at ABN Amro. "Investors will probably continue to focus again on developments in Italy (upcoming new election) and this could result in investors shying away from the Euro."

Above: Sterling recovered from 10-year lows against the Euro.

Salvini's League party has been in government with the Five Star Movement for the past 14 months, but relations between the parties have turned sour. The government is headed by an independent prime minister, Giuseppe Conte.

However, Salvini might yet not get his way: ex-PD leader Matteo Renzi has returned to the political arena with a call to stop Salvini's "crazy" push for elections by proposing an "institutional" government backed by parliament.

"The Euro slipped, stalked by rising political risk in Italy, home to the bloc’s third-biggest economy. Political differences in Rome have markets on edge over whether leaders will aim to bridge them by holding early elections," says Joe Manimbo, a foreign exchange analyst with Western Union.

"Recent events make it highly unlikely, in our view, the Italian government will survive the vote. Having called the vote, Lega will almost certainly vote against its own government, and we see little reason why opposition parties might come to its rescue. So, in all likelihood, next week will mark the end of the Lega-Five Star Movement (5SM) coalition government," says Fabio Balboni, Senior Economist with HSBC Bank in London.

After a no-confidence vote, the Italian President Sergio Mattarella will consult with party leaders and the various parliamentary blocs to establish whether an alternative administration can be created.

However, HSBC's research on the parliamentary arithmetic suggests the only other viable majority seems to be a coalition between 5SM and centre-left Partito Democratico (PD).

However, PD's leader Nicola Zingaretti has explicitly ruled out this option and if no other 'political' government is possible, the president will have two options: dissolve parliament or push for an

'institutional' government to take over until the end of the year.

"All in all, it is a close call whether Italy will end up having fresh elections or a technocratic government, in place at least until the beginning of next year," says Balboni.

From a markets perspective, Balboni suggests investors would prefer a technocratic government being installed near-term, as it might go some way in mitigating the risks associated with a right-wing Eurosceptic party taking absolute power.

Paul Spirgel, an options analyst at Thomson Reuters says the recovery in the GBP/EUR exchange rate on the back of Italian political jitters is helping other Sterling-based exchange rates, such as GBP/USD.

Despite the recovery in Sterling, most analysts suggest any strength will likely be short-lived in nature, as the dominant narrative surrounding a 'no deal' Brexit is likely to reassert itself.

"It's a familiar pattern for Sterling: Beset by Brexit fears, markets nevertheless become transfixed by external events, this time high anxiety over Italian political uncertainty," says Spirgel. "But it's unlikely to last with a Brexit deadline of Oct. 31 and a UK prime minister set on taking the UK out – with or without a deal to smooth the transition."

Spirgel says Johnson's determination to guide Britain out of the EU, deal or no deal, "will remain a cloud over Sterling and the UK political. Sterling bulls will run into considerable technical hurdles".

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement